How Does TAS Offshore Berhad's (KLSE:TAS) P/E Compare To Its Industry, After Its Big Share Price Gain?

TAS Offshore Berhad (KLSE:TAS) shareholders are no doubt pleased to see that the share price has bounced 41% in the last month alone, although it is still down 38% over the last quarter. But shareholders may not all be feeling jubilant, since the share price is still down 16% in the last year.

Assuming no other changes, a sharply higher share price makes a stock less attractive to potential buyers. In the long term, share prices tend to follow earnings per share, but in the short term prices bounce around in response to short term factors (which are not always obvious). The implication here is that deep value investors might steer clear when expectations of a company are too high. Perhaps the simplest way to get a read on investors' expectations of a business is to look at its Price to Earnings Ratio (PE Ratio). A high P/E implies that investors have high expectations of what a company can achieve compared to a company with a low P/E ratio.

View our latest analysis for TAS Offshore Berhad

Does TAS Offshore Berhad Have A Relatively High Or Low P/E For Its Industry?

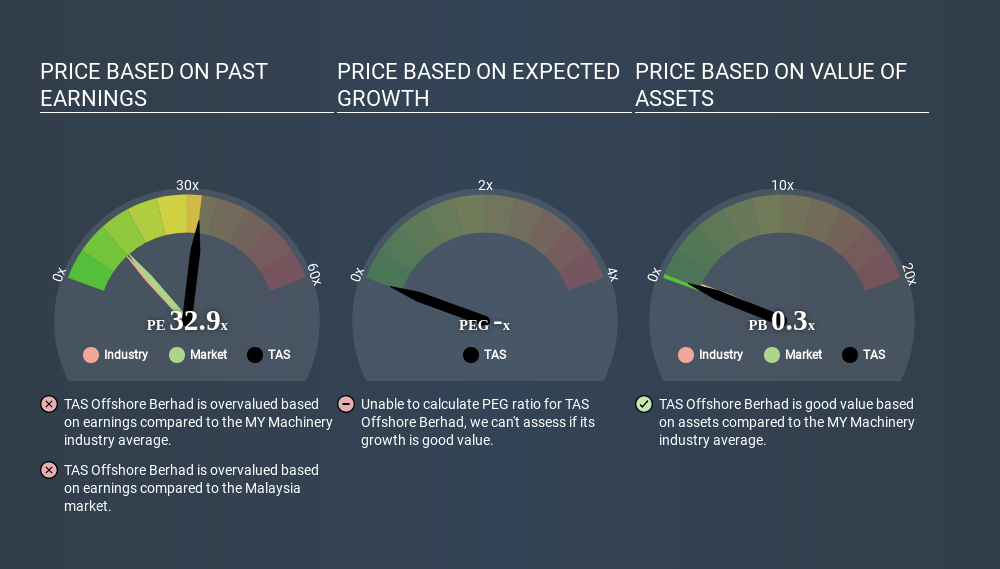

TAS Offshore Berhad's P/E of 32.91 indicates some degree of optimism towards the stock. You can see in the image below that the average P/E (11.7) for companies in the machinery industry is lower than TAS Offshore Berhad's P/E.

Its relatively high P/E ratio indicates that TAS Offshore Berhad shareholders think it will perform better than other companies in its industry classification. The market is optimistic about the future, but that doesn't guarantee future growth. So investors should always consider the P/E ratio alongside other factors, such as whether company directors have been buying shares.

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. That's because companies that grow earnings per share quickly will rapidly increase the 'E' in the equation. Therefore, even if you pay a high multiple of earnings now, that multiple will become lower in the future. A lower P/E should indicate the stock is cheap relative to others -- and that may attract buyers.

TAS Offshore Berhad shrunk earnings per share by 46% over the last year. And over the longer term (5 years) earnings per share have decreased 44% annually. This growth rate might warrant a below average P/E ratio.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

The 'Price' in P/E reflects the market capitalization of the company. Thus, the metric does not reflect cash or debt held by the company. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

How Does TAS Offshore Berhad's Debt Impact Its P/E Ratio?

TAS Offshore Berhad's net debt is 12% of its market cap. It would probably deserve a higher P/E ratio if it was net cash, since it would have more options for growth.

The Verdict On TAS Offshore Berhad's P/E Ratio

TAS Offshore Berhad's P/E is 32.9 which is above average (12.4) in its market. With modest debt but no EPS growth in the last year, it's fair to say the P/E implies some optimism about future earnings, from the market. What we know for sure is that investors have become much more excited about TAS Offshore Berhad recently, since they have pushed its P/E ratio from 23.3 to 32.9 over the last month. If you like to buy stocks that have recently impressed the market, then this one might be a candidate; but if you prefer to invest when there is 'blood in the streets', then you may feel the opportunity has passed.

Investors should be looking to buy stocks that the market is wrong about. People often underestimate remarkable growth -- so investors can make money when fast growth is not fully appreciated. We don't have analyst forecasts, but shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with modest (or no) debt, trading on a P/E below 20.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About KLSE:TAS

TAS Offshore Berhad

Engages in the ship building and repairing businesses in Malaysia, Indonesia, and Singapore.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion