- Malaysia

- /

- Construction

- /

- KLSE:GDB

Does GDB Holdings Berhad (KLSE:GDB) Have A Place In Your Dividend Portfolio?

Is GDB Holdings Berhad (KLSE:GDB) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. If you are hoping to live on your dividends, it's important to be more stringent with your investments than the average punter. Regular readers know we like to apply the same approach to each dividend stock, and we hope you'll find our analysis useful.

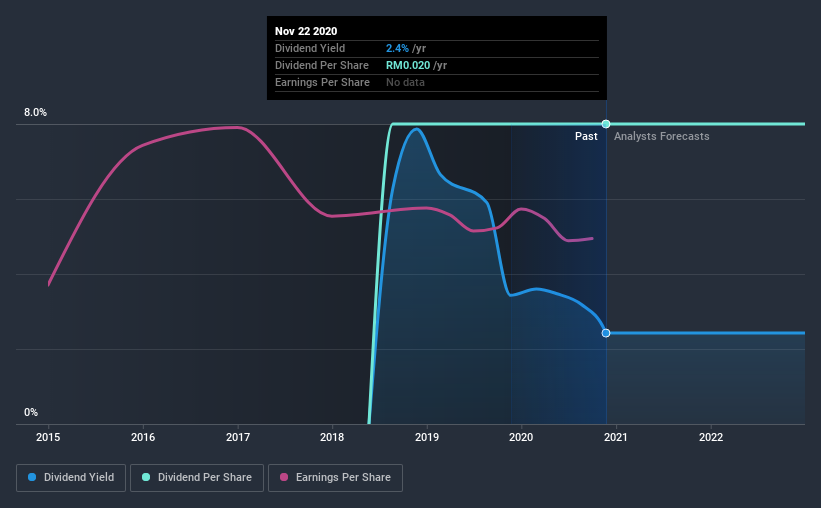

With only a two-year payment history, and a 2.4% yield, investors probably think GDB Holdings Berhad is not much of a dividend stock. While it may not look like much, if earnings are growing it could become quite interesting. Remember though, due to the recent spike in its share price, GDB Holdings Berhad's yield will look lower, even though the market may now be factoring in an improvement in its long-term prospects. When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. In the last year, GDB Holdings Berhad paid out 50% of its profit as dividends. This is a medium payout level that leaves enough capital in the business to fund opportunities that might arise, while also rewarding shareholders. Plus, there is room to increase the payout ratio over time.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. GDB Holdings Berhad paid out 65% of its cash flow as dividends last year, which is within a reasonable range for the average corporation. It's positive to see that GDB Holdings Berhad's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

With a strong net cash balance, GDB Holdings Berhad investors may not have much to worry about in the near term from a dividend perspective.

We update our data on GDB Holdings Berhad every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. The company has been paying a stable dividend for a few years now, but we'd like to see more evidence of consistency over a longer period. Its most recent annual dividend was RM0.02 per share, effectively flat on its first payment two years ago.

We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. Earnings have grown at around 5.9% a year for the past five years, which is better than seeing them shrink! It's good to see decent earnings growth and a low payout ratio. Companies with these characteristics often display the fastest dividend growth over the long term - assuming earnings can be maintained, of course.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. GDB Holdings Berhad's dividend payout ratios are within normal bounds, although we note its cash flow is not as strong as the income statement would suggest. Unfortunately, earnings growth has also been mediocre, and we think it has not been paying dividends long enough to demonstrate resilience across economic cycles. While we're not hugely bearish on it, overall we think there are potentially better dividend stocks than GDB Holdings Berhad out there.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. For example, we've picked out 2 warning signs for GDB Holdings Berhad that investors should know about before committing capital to this stock.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you decide to trade GDB Holdings Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:GDB

GDB Holdings Berhad

An investment holding company, engages in the provision of construction services in Malaysia.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)