- Malaysia

- /

- Construction

- /

- KLSE:GBGAQRS

Gabungan AQRS Berhad Reported A Surprise Loss, And Analysts Have Updated Their Forecasts

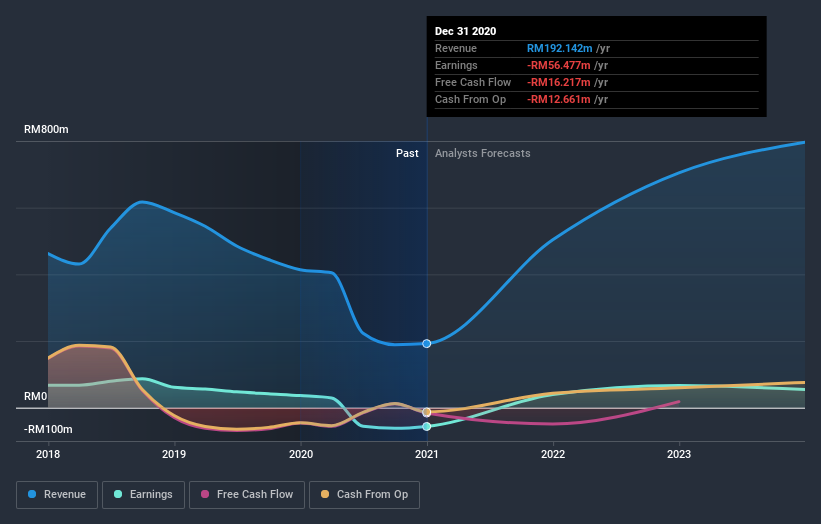

Investors in Gabungan AQRS Berhad (KLSE:GBGAQRS) had a good week, as its shares rose 2.5% to close at RM0.61 following the release of its annual results. Revenues fell badly short of expectations, with sales of RM192m missing analyst predictions by 36%. Unsurprisingly, the statutory profit the analysts had been forecasting evaporated, turning into a loss of RM0.11 per share. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

View our latest analysis for Gabungan AQRS Berhad

Taking into account the latest results, the consensus forecast from Gabungan AQRS Berhad's six analysts is for revenues of RM503.7m in 2021, which would reflect a sizeable 162% improvement in sales compared to the last 12 months. Gabungan AQRS Berhad is also expected to turn profitable, with statutory earnings of RM0.08 per share. In the lead-up to this report, the analysts had been modelling revenues of RM531.1m and earnings per share (EPS) of RM0.083 in 2021. It's pretty clear that pessimism has reared its head after the latest results, leading to a weaker revenue outlook and a small dip in earnings per share estimates.

The analysts made no major changes to their price target of RM0.91, suggesting the downgrades are not expected to have a long-term impact on Gabungan AQRS Berhad's valuation. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic Gabungan AQRS Berhad analyst has a price target of RM1.04 per share, while the most pessimistic values it at RM0.77. The narrow spread of estimates could suggest that the business' future is relatively easy to value, or thatthe analysts have a strong view on its prospects.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. The analysts are definitely expecting Gabungan AQRS Berhad's growth to accelerate, with the forecast 162% growth ranking favourably alongside historical growth of 1.5% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 10% next year. Factoring in the forecast acceleration in revenue, it's pretty clear that Gabungan AQRS Berhad is expected to grow much faster than its industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Gabungan AQRS Berhad. They also downgraded their revenue estimates, although industry data suggests that Gabungan AQRS Berhad's revenues are expected to grow faster than the wider industry. The consensus price target held steady at RM0.91, with the latest estimates not enough to have an impact on their price targets.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. At Simply Wall St, we have a full range of analyst estimates for Gabungan AQRS Berhad going out to 2023, and you can see them free on our platform here..

You still need to take note of risks, for example - Gabungan AQRS Berhad has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

When trading Gabungan AQRS Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:GBGAQRS

Gabungan AQRS Berhad

An investment holding company, engages in development and construction of property in Malaysia.

Reasonable growth potential and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)