- Malaysia

- /

- Construction

- /

- KLSE:CRESBLD

Crest Builder Holdings Berhad Reported A Surprise Loss, And Analysts Have Updated Their Forecasts

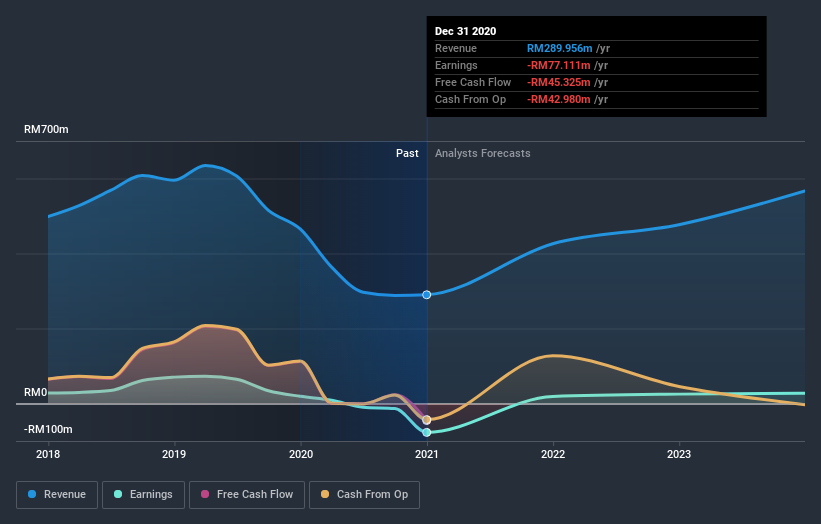

Crest Builder Holdings Berhad (KLSE:CRESBLD) came out with its full-year results last week, and we wanted to see how the business is performing and what industry forecasts think of the company following this report. Revenues of RM290m beat expectations by 5.9%. Unfortunately statutory earnings per share (EPS) fell well short of the mark, turning in a loss of RM0.47 compared to previous analyst expectations of a profit. Following the result, the analyst has updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. We thought readers would find it interesting to see the analyst latest (statutory) post-earnings forecasts for next year.

View our latest analysis for Crest Builder Holdings Berhad

After the latest results, the lone analyst covering Crest Builder Holdings Berhad are now predicting revenues of RM426.0m in 2021. If met, this would reflect a major 47% improvement in sales compared to the last 12 months. Crest Builder Holdings Berhad is also expected to turn profitable, with statutory earnings of RM0.11 per share. Before this earnings report, the analyst had been forecasting revenues of RM509.7m and earnings per share (EPS) of RM0.13 in 2021. It looks like sentiment has declined substantially in the aftermath of these results, with a substantial drop in revenue estimates and a substantial drop in earnings per share numbers as well.

It'll come as no surprise then, to learn that the analyst has cut their price target 11% to RM1.56.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. The analyst is definitely expecting Crest Builder Holdings Berhad's growth to accelerate, with the forecast 47% growth ranking favourably alongside historical growth of 6.4% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 9.2% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that Crest Builder Holdings Berhad is expected to grow much faster than its industry.

The Bottom Line

The most important thing to take away is that the analyst downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Regrettably, they also downgraded their revenue estimates, but the latest forecasts still imply the business will grow faster than the wider industry. The consensus price target fell measurably, with the analyst seemingly not reassured by the latest results, leading to a lower estimate of Crest Builder Holdings Berhad's future valuation.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have analyst estimates for Crest Builder Holdings Berhad going out as far as 2023, and you can see them free on our platform here.

It is also worth noting that we have found 4 warning signs for Crest Builder Holdings Berhad (1 is a bit concerning!) that you need to take into consideration.

If you decide to trade Crest Builder Holdings Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:CRESBLD

Crest Builder Holdings Berhad

An investment holding company, operates as a construction, and mechanical and electrical (M&E) engineering contractor in Malaysia.

Good value with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.