- Malaysia

- /

- Trade Distributors

- /

- KLSE:CHUAN

Does Chuan Huat Resources Berhad (KLSE:CHUAN) Have A Healthy Balance Sheet?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Chuan Huat Resources Berhad (KLSE:CHUAN) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

What Is Chuan Huat Resources Berhad's Debt?

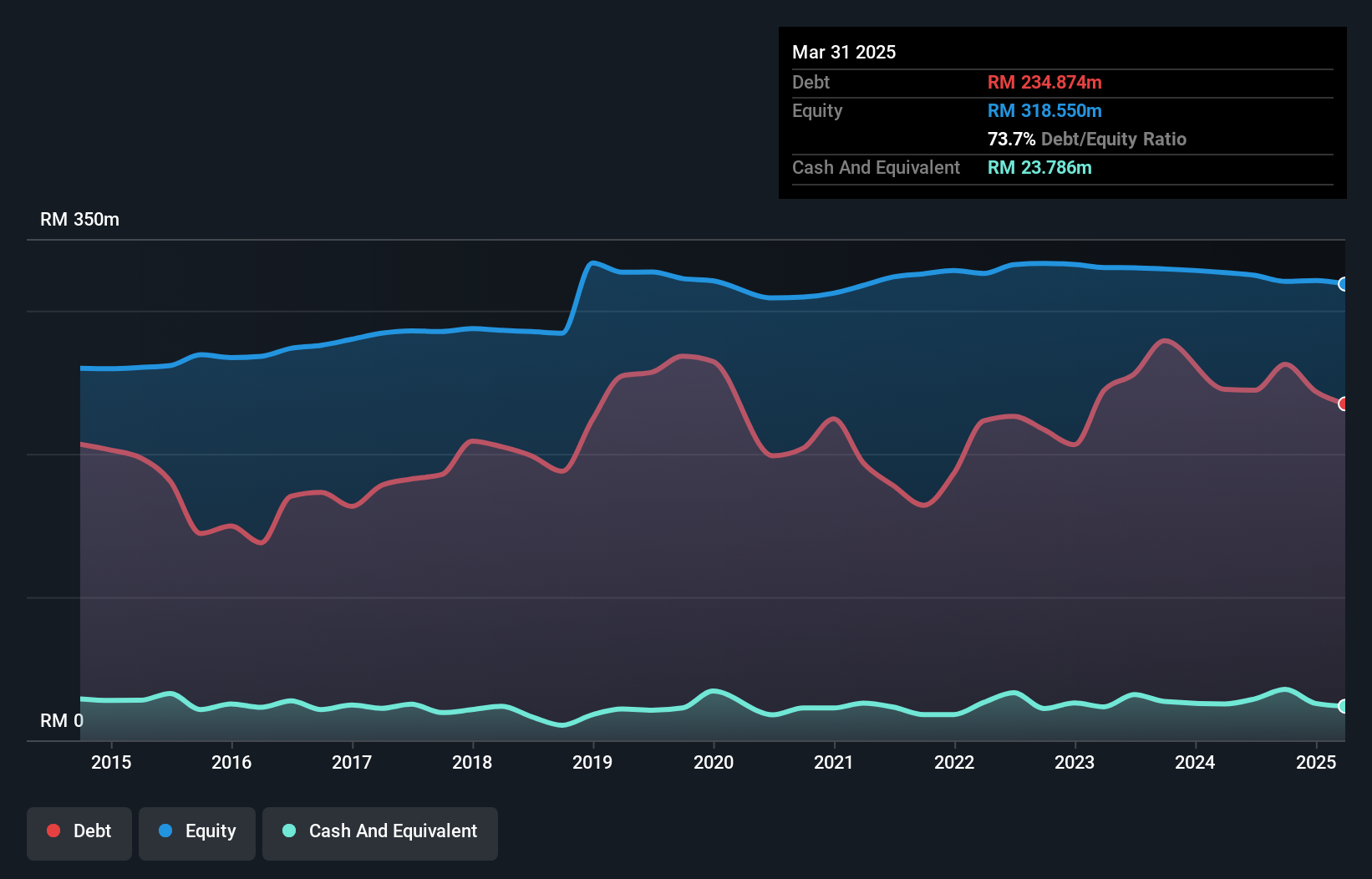

You can click the graphic below for the historical numbers, but it shows that Chuan Huat Resources Berhad had RM234.9m of debt in March 2025, down from RM244.9m, one year before. However, because it has a cash reserve of RM23.8m, its net debt is less, at about RM211.1m.

How Strong Is Chuan Huat Resources Berhad's Balance Sheet?

According to the last reported balance sheet, Chuan Huat Resources Berhad had liabilities of RM242.4m due within 12 months, and liabilities of RM51.2m due beyond 12 months. Offsetting these obligations, it had cash of RM23.8m as well as receivables valued at RM176.1m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM93.7m.

This deficit casts a shadow over the RM51.4m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Chuan Huat Resources Berhad would probably need a major re-capitalization if its creditors were to demand repayment.

See our latest analysis for Chuan Huat Resources Berhad

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Chuan Huat Resources Berhad shareholders face the double whammy of a high net debt to EBITDA ratio (29.8), and fairly weak interest coverage, since EBIT is just 0.32 times the interest expense. This means we'd consider it to have a heavy debt load. Worse, Chuan Huat Resources Berhad's EBIT was down 61% over the last year. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Chuan Huat Resources Berhad will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the most recent three years, Chuan Huat Resources Berhad recorded free cash flow worth 53% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

To be frank both Chuan Huat Resources Berhad's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. After considering the datapoints discussed, we think Chuan Huat Resources Berhad has too much debt. While some investors love that sort of risky play, it's certainly not our cup of tea. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 4 warning signs we've spotted with Chuan Huat Resources Berhad (including 3 which don't sit too well with us) .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CHUAN

Chuan Huat Resources Berhad

An investment holding company, trades in hardware and building materials in Malaysia.

Low risk and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)