Do These 3 Checks Before Buying Megacable Holdings, S. A. B. de C. V. (BMV:MEGACPO) For Its Upcoming Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Megacable Holdings, S. A. B. de C. V. (BMV:MEGACPO) is about to go ex-dividend in just four days. The ex-dividend date generally occurs two days before the record date, which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade can take two business days or more to settle. In other words, investors can purchase Megacable Holdings S. A. B. de C. V's shares before the 21st of May in order to be eligible for the dividend, which will be paid on the 22nd of May.

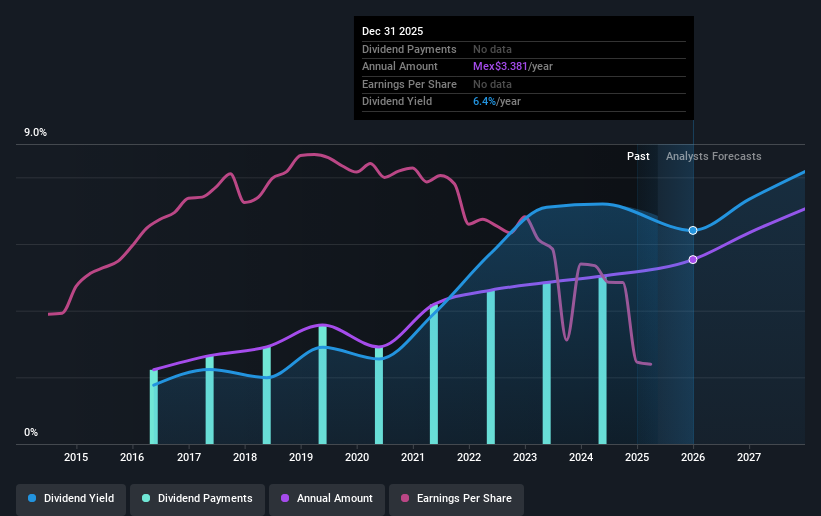

The company's upcoming dividend is Mex$3.34 a share, following on from the last 12 months, when the company distributed a total of Mex$3.08 per share to shareholders. Last year's total dividend payments show that Megacable Holdings S. A. B. de C. V has a trailing yield of 5.8% on the current share price of Mex$52.76. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to investigate whether Megacable Holdings S. A. B. de C. V can afford its dividend, and if the dividend could grow.

Our free stock report includes 3 warning signs investors should be aware of before investing in Megacable Holdings S. A. B. de C. V. Read for free now.Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Megacable Holdings S. A. B. de C. V paid out 104% of its earnings, which is more than we're comfortable with, unless there are mitigating circumstances. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. Over the last year it paid out 72% of its free cash flow as dividends, within the usual range for most companies.

It's good to see that while Megacable Holdings S. A. B. de C. V's dividends were not covered by profits, at least they are affordable from a cash perspective. Still, if the company repeatedly paid a dividend greater than its profits, we'd be concerned. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits.

See our latest analysis for Megacable Holdings S. A. B. de C. V

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. With that in mind, we're discomforted by Megacable Holdings S. A. B. de C. V's 12% per annum decline in earnings in the past five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. In the past 10 years, Megacable Holdings S. A. B. de C. V has increased its dividend at approximately 10% a year on average. The only way to pay higher dividends when earnings are shrinking is either to pay out a larger percentage of profits, spend cash from the balance sheet, or borrow the money. Megacable Holdings S. A. B. de C. V is already paying out a high percentage of its income, so without earnings growth, we're doubtful of whether this dividend will grow much in the future.

The Bottom Line

Should investors buy Megacable Holdings S. A. B. de C. V for the upcoming dividend? Earnings per share have been shrinking in recent times. Additionally, Megacable Holdings S. A. B. de C. V is paying out quite a high percentage of its earnings, and more than half its cash flow, so it's hard to evaluate whether the company is reinvesting enough in its business to improve its situation. With the way things are shaping up from a dividend perspective, we'd be inclined to steer clear of Megacable Holdings S. A. B. de C. V.

With that in mind though, if the poor dividend characteristics of Megacable Holdings S. A. B. de C. V don't faze you, it's worth being mindful of the risks involved with this business. Every company has risks, and we've spotted 3 warning signs for Megacable Holdings S. A. B. de C. V (of which 1 is concerning!) you should know about.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:MEGA CPO

Megacable Holdings S. A. B. de C. V

Engages in the installation, operation, and maintenance of cable television, internet, and telephone signal distribution systems.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)