- Mexico

- /

- Metals and Mining

- /

- BMV:GMEXICO B

Grupo México. de And 2 More Top Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a volatile landscape marked by fluctuating corporate earnings and geopolitical tensions, investors are keeping a close eye on central bank policies and inflation trends. Amid these developments, dividend stocks often attract attention for their potential to provide steady income streams, particularly in uncertain economic climates. In this context, understanding what makes a good dividend stock is crucial—factors such as financial stability, consistent payout history, and resilience in challenging market conditions are key considerations for investors seeking reliable returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.97% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.85% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.29% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.95% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.45% | ★★★★★☆ |

Click here to see the full list of 1972 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Grupo México. de (BMV:GMEXICO B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Grupo México, S.A.B. de C.V. operates in copper production, cargo transportation, and infrastructure sectors globally with a market cap of MX$790.88 billion.

Operations: Grupo México's revenue segments include $0.24 billion from the Infrastructure Division and $3.24 billion from the Transportation Division.

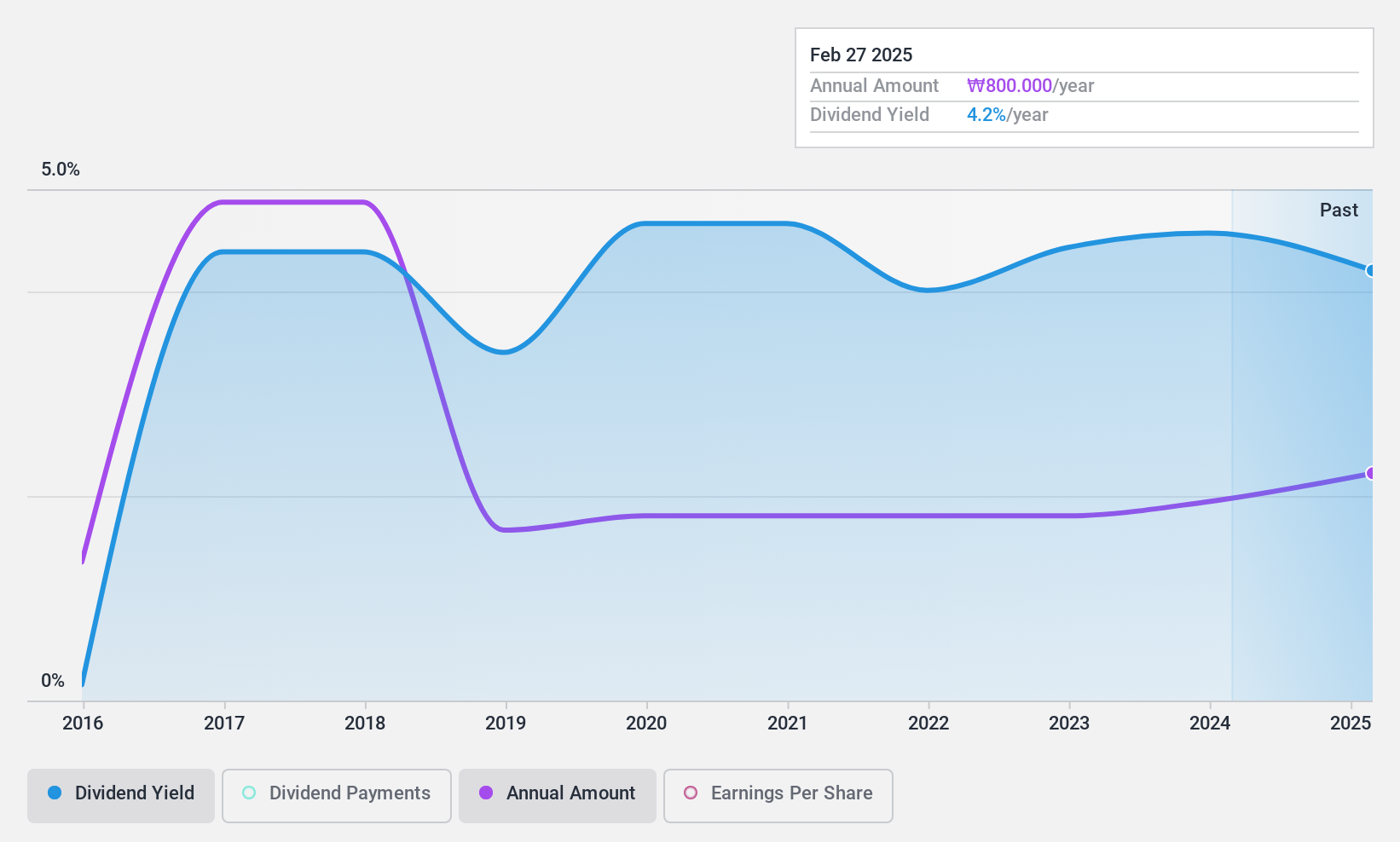

Dividend Yield: 3.4%

Grupo México's dividend profile shows a mixed picture for investors. While the company's dividends are well-covered by both earnings and cash flows, with payout ratios of 49.8% and 40.6% respectively, its dividend yield of 3.41% is lower than the top payers in the Mexican market. The dividends have been volatile over the past decade despite recent growth trends, making them less reliable for those seeking stable income streams.

- Dive into the specifics of Grupo México. de here with our thorough dividend report.

- Our valuation report here indicates Grupo México. de may be undervalued.

ORION Holdings (KOSE:A001800)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ORION Holdings Corp. is a company that manufactures and sells confectioneries in South Korea, China, and internationally with a market cap of ₩914.38 billion.

Operations: ORION Holdings Corp.'s revenue segments include Confectionery at ₩4.01 trillion, Video at ₩92.79 million, and Landlord at ₩38.77 million.

Dividend Yield: 4.9%

ORION Holdings' dividend profile is characterized by a high yield of 4.93%, placing it in the top 25% of payers in the KR market. Despite its volatile and unreliable dividend history over the past decade, recent growth trends are evident. Dividends are well-covered by earnings and cash flows, with payout ratios at 38.4% and 10.1%, respectively. Recent earnings reports show significant net income growth, suggesting improved financial health despite declining sales figures year-on-year.

- Unlock comprehensive insights into our analysis of ORION Holdings stock in this dividend report.

- Our comprehensive valuation report raises the possibility that ORION Holdings is priced lower than what may be justified by its financials.

Shinhan Financial Group (KOSE:A055550)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shinhan Financial Group Co., Ltd. offers a range of financial products and services both in South Korea and internationally, with a market cap of approximately ₩25.29 trillion.

Operations: Shinhan Financial Group's revenue primarily comes from its Banking segment at ₩9.17 trillion, followed by the Credit Card segment at ₩2.13 trillion and Securities at ₩830.17 billion.

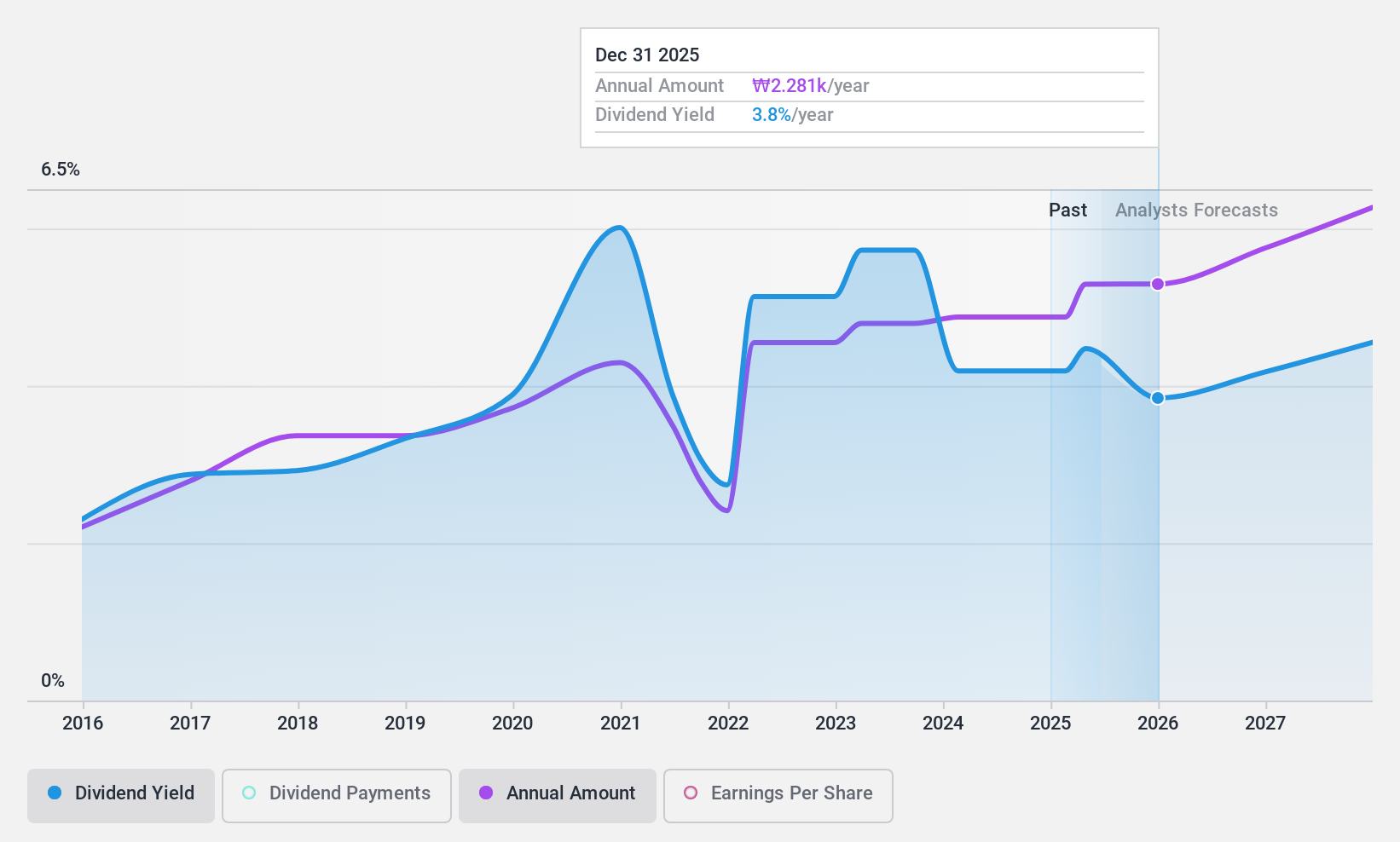

Dividend Yield: 4.1%

Shinhan Financial Group offers a dividend yield of 4.12%, ranking it among the top 25% in the Korean market. Despite its dividends being well-covered by earnings with a low payout ratio of 24.7%, the company's dividend history has been volatile and unreliable over the past decade. Recent share buybacks totaling KRW 250 billion may indicate confidence in financial stability, although analysts forecast continued coverage with a similar payout ratio in three years.

- Navigate through the intricacies of Shinhan Financial Group with our comprehensive dividend report here.

- According our valuation report, there's an indication that Shinhan Financial Group's share price might be on the cheaper side.

Summing It All Up

- Discover the full array of 1972 Top Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BMV:GMEXICO B

Grupo México. de

Engages in copper production, cargo transportation, and infrastructure businesses worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success