- Mexico

- /

- Metals and Mining

- /

- BMV:AUTLAN B

Should We Be Excited About The Trends Of Returns At Compañía Minera Autlán. de (BMV:AUTLANB)?

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. However, after investigating Compañía Minera Autlán. de (BMV:AUTLANB), we don't think it's current trends fit the mold of a multi-bagger.

What is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Compañía Minera Autlán. de:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.02 = US$12m ÷ (US$834m - US$217m) (Based on the trailing twelve months to September 2020).

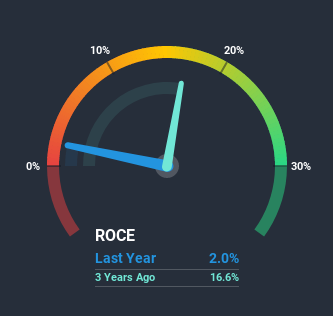

Therefore, Compañía Minera Autlán. de has an ROCE of 2.0%. Ultimately, that's a low return and it under-performs the Metals and Mining industry average of 8.2%.

View our latest analysis for Compañía Minera Autlán. de

Above you can see how the current ROCE for Compañía Minera Autlán. de compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Compañía Minera Autlán. de.

What Can We Tell From Compañía Minera Autlán. de's ROCE Trend?

When we looked at the ROCE trend at Compañía Minera Autlán. de, we didn't gain much confidence. Around five years ago the returns on capital were 3.6%, but since then they've fallen to 2.0%. And considering revenue has dropped while employing more capital, we'd be cautious. If this were to continue, you might be looking at a company that is trying to reinvest for growth but is actually losing market share since sales haven't increased.

On a side note, Compañía Minera Autlán. de's current liabilities have increased over the last five years to 26% of total assets, effectively distorting the ROCE to some degree. If current liabilities hadn't increased as much as they did, the ROCE could actually be even lower. While the ratio isn't currently too high, it's worth keeping an eye on this because if it gets particularly high, the business could then face some new elements of risk.In Conclusion...

From the above analysis, we find it rather worrisome that returns on capital and sales for Compañía Minera Autlán. de have fallen, meanwhile the business is employing more capital than it was five years ago. Yet despite these concerning fundamentals, the stock has performed strongly with a 74% return over the last five years, so investors appear very optimistic. In any case, the current underlying trends don't bode well for long term performance so unless they reverse, we'd start looking elsewhere.

One more thing: We've identified 3 warning signs with Compañía Minera Autlán. de (at least 2 which are a bit unpleasant) , and understanding them would certainly be useful.

While Compañía Minera Autlán. de may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

When trading Compañía Minera Autlán. de or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BMV:AUTLAN B

Compañía Minera Autlán. de

Engages in the production and marketing of manganese minerals and ferroalloys in Mexico and internationally.

Moderate growth potential and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.