- Mexico

- /

- Food and Staples Retail

- /

- BMV:WALMEX *

Wal-Mart de México. de (BMV:WALMEX) Is Increasing Its Dividend To Mex$0.81

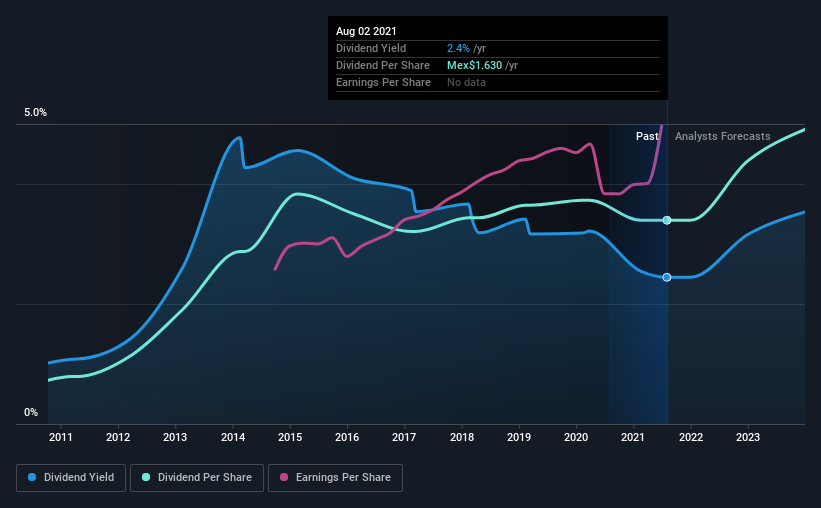

The board of Wal-Mart de México, S.A.B. de C.V. (BMV:WALMEX) has announced that it will be increasing its dividend on the 24th of November to Mex$0.81. This makes the dividend yield 2.4%, which is above the industry average.

View our latest analysis for Wal-Mart de México. de

Wal-Mart de México. de's Earnings Easily Cover the Distributions

A big dividend yield for a few years doesn't mean much if it can't be sustained. However, prior to this announcement, Wal-Mart de México. de's dividend was comfortably covered by both cash flow and earnings. This means that most of what the business earns is being used to help it grow.

Over the next year, EPS is forecast to expand by 8.8%. If the dividend continues on this path, the payout ratio could be 66% by next year, which we think can be pretty sustainable going forward.

Wal-Mart de México. de Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. Since 2011, the first annual payment was Mex$0.35, compared to the most recent full-year payment of Mex$1.63. This works out to be a compound annual growth rate (CAGR) of approximately 17% a year over that time. Rapidly growing dividends for a long time is a very valuable feature for an income stock.

The Dividend Looks Likely To Grow

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. We are encouraged to see that Wal-Mart de México. de has grown earnings per share at 10% per year over the past five years. Growth in EPS bodes well for the dividend, as does the low payout ratio that the company is currently reporting.

Wal-Mart de México. de Looks Like A Great Dividend Stock

Overall, we think this could be an attractive income stock, and it is only getting better by paying a higher dividend this year. The company is easily earning enough to cover its dividend payments and it is great to see that these earnings are being translated into cash flow. All of these factors considered, we think this has solid potential as a dividend stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Earnings growth generally bodes well for the future value of company dividend payments. See if the 14 Wal-Mart de México. de analysts we track are forecasting continued growth with our free report on analyst estimates for the company. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

If you decide to trade Wal-Mart de México. de, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wal-Mart de México. de might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BMV:WALMEX *

Wal-Mart de México. de

Owns and operates self-service stores in Mexico and Central America.

Excellent balance sheet and good value.