- Mexico

- /

- Basic Materials

- /

- BMV:CMOCTEZ *

3 Dividend Stock Picks Yielding Up To 6.6%

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by inflation concerns, political uncertainties, and fluctuating interest rates, investors are increasingly seeking stability in their portfolios. Amidst this backdrop, dividend stocks offer a compelling option for those looking to generate income while potentially benefiting from capital appreciation. A good dividend stock typically combines a reliable payout history with strong fundamentals, making it an attractive choice in today's unpredictable market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.27% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.36% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.77% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.00% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.64% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.89% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.17% | ★★★★★★ |

Click here to see the full list of 2017 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

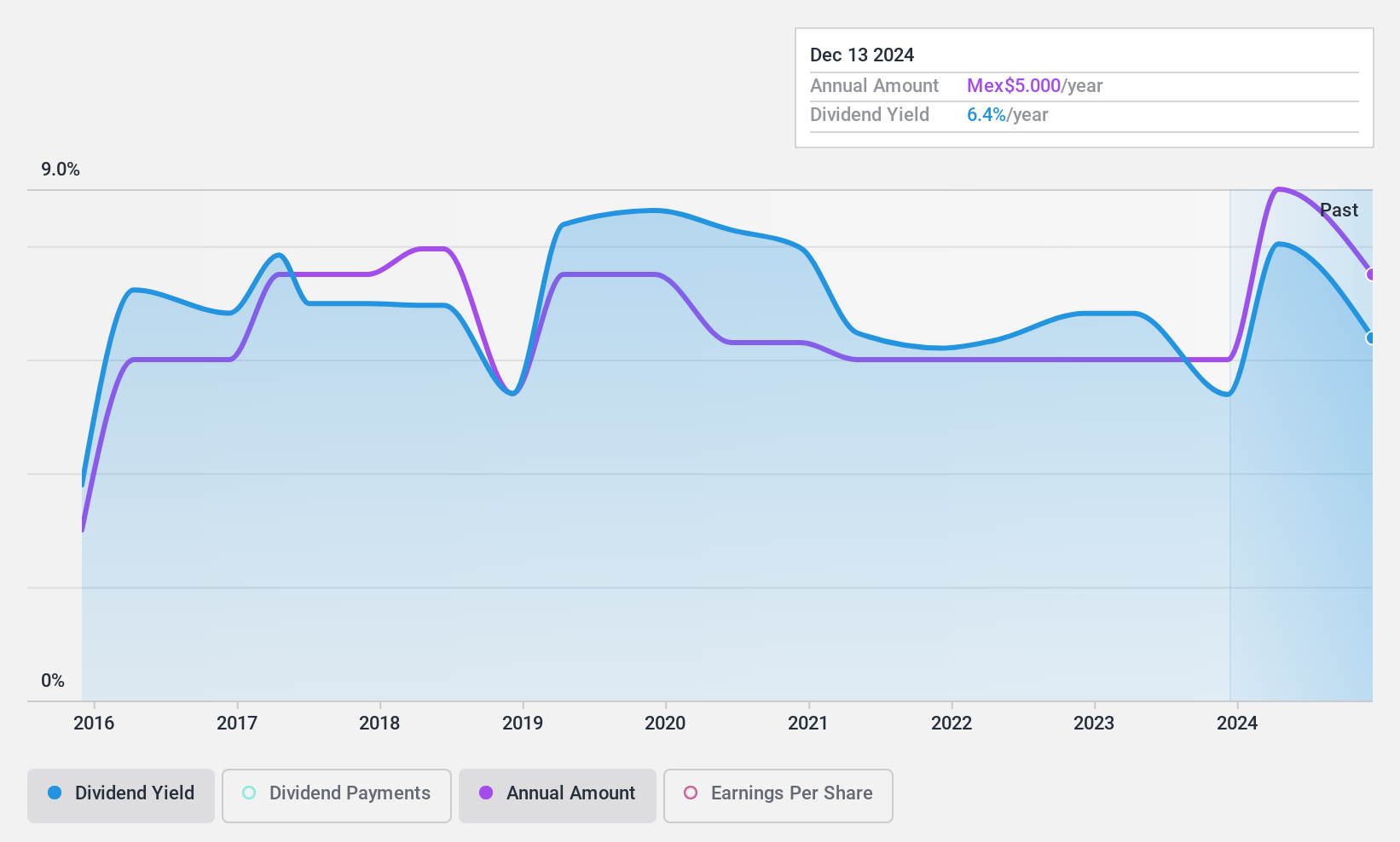

Corporación Moctezuma. de (BMV:CMOCTEZ *)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Corporación Moctezuma, S.A.B. de C.V. operates in Mexico's construction industry by producing, distributing, and selling portland cement, ready-mix concrete, sand, gravel, and pavements with a market cap of MX$60.03 billion.

Operations: Corporación Moctezuma's revenue primarily comes from its Concrete and Cement segment, which generated MX$20.06 billion.

Dividend Yield: 6.7%

Corporación Moctezuma's dividend is covered by earnings with a payout ratio of 63.9% and cash flows at 88%, though its dividend track record has been volatile over the past decade. Trading at 31% below estimated fair value, it offers potential value but remains highly illiquid. Recent earnings growth of 17.9% supports its dividend sustainability despite an unstable history. The company's recent ex-dividend date was December 13, 2024, for a MX$2 cash dividend.

- Take a closer look at Corporación Moctezuma. de's potential here in our dividend report.

- According our valuation report, there's an indication that Corporación Moctezuma. de's share price might be on the cheaper side.

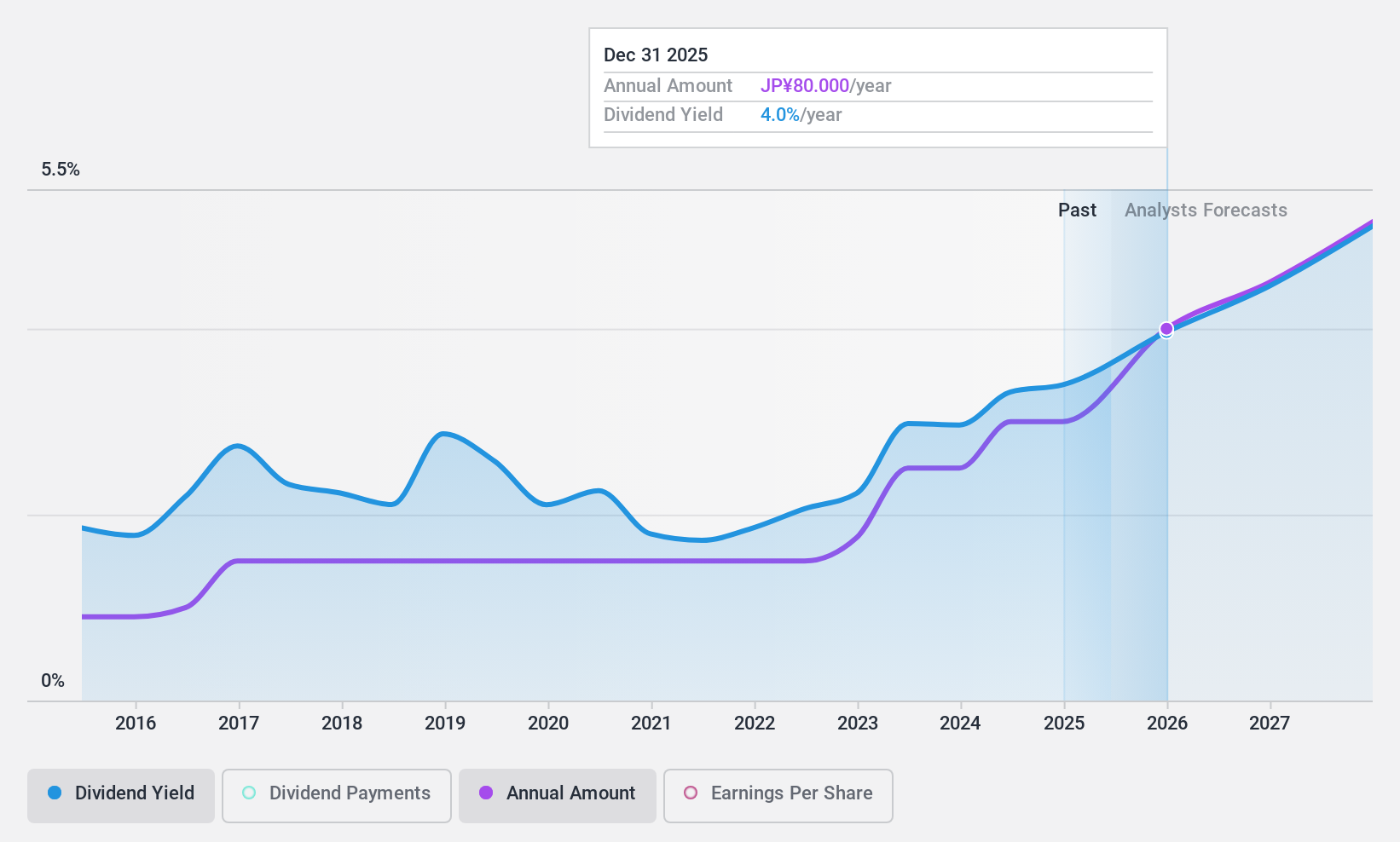

Nippon Concept (TSE:9386)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nippon Concept Corporation offers transportation services for various liquid cargoes and gases both in Japan and internationally, with a market cap of ¥24.96 billion.

Operations: Nippon Concept Corporation's revenue segment includes International Multimodal Transportation, generating ¥17.65 billion.

Dividend Yield: 3.3%

Nippon Concept's dividend yield of 3.33% is lower than the top quartile in Japan, yet its dividends have been stable and growing over the past decade. The payout ratios are sustainable, with earnings covering 41.7% and cash flows at 39.9%. Trading significantly below estimated fair value, it suggests potential undervaluation. With forecasted earnings growth of 13.86% per year, Nippon Concept maintains a reliable dividend track record supported by solid financial coverage.

- Get an in-depth perspective on Nippon Concept's performance by reading our dividend report here.

- The analysis detailed in our Nippon Concept valuation report hints at an inflated share price compared to its estimated value.

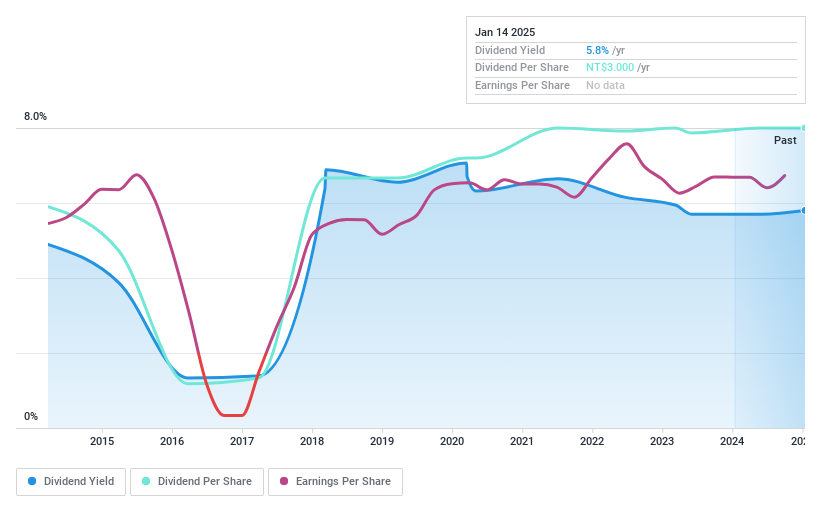

Dafeng TV (TWSE:6184)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dafeng TV Ltd., along with its subsidiaries, operates in the cable television system and broadband sector in Taiwan, with a market cap of NT$7.67 billion.

Operations: Dafeng TV Ltd.'s revenue is derived from its Cable TV System Department, which generated NT$1.44 billion, and its Broadband Service Department, contributing NT$799.30 million.

Dividend Yield: 5.8%

Dafeng TV's dividend yield of 5.8% ranks within the top quartile in Taiwan, yet its payments have been volatile over the past decade. Despite this instability, dividends are currently covered by earnings and cash flows with payout ratios at 84.6% and 88.5%, respectively. Recent earnings growth supports coverage; however, past unreliability may concern investors seeking stable income. Trading below fair value suggests potential undervaluation despite limited revenue growth at TWD 526.8 million for Q3 2024.

- Navigate through the intricacies of Dafeng TV with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Dafeng TV's current price could be quite moderate.

Make It Happen

- Click this link to deep-dive into the 2017 companies within our Top Dividend Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BMV:CMOCTEZ *

Corporación Moctezuma. de

Engages in the production, distribution, and sale of portland cement, ready-mix concrete, sand, gravel, and pavements for construction industry in Mexico.

Flawless balance sheet with solid track record and pays a dividend.