- Mexico

- /

- Household Products

- /

- BMV:KIMBER A

3 Reliable Dividend Stocks Offering Up To 6.3% Yield

Reviewed by Simply Wall St

As global markets navigate a landscape marked by resilient labor markets, inflation concerns, and political uncertainties, investors are increasingly seeking stability amidst volatility. With U.S. equities experiencing declines and choppy trading conditions expected to persist, dividend stocks emerge as a compelling option for those looking to achieve steady income streams. In this environment, reliable dividend stocks can offer attractive yields while providing some insulation against market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.36% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.00% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.66% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.64% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.89% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.21% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.17% | ★★★★★★ |

Click here to see the full list of 2007 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

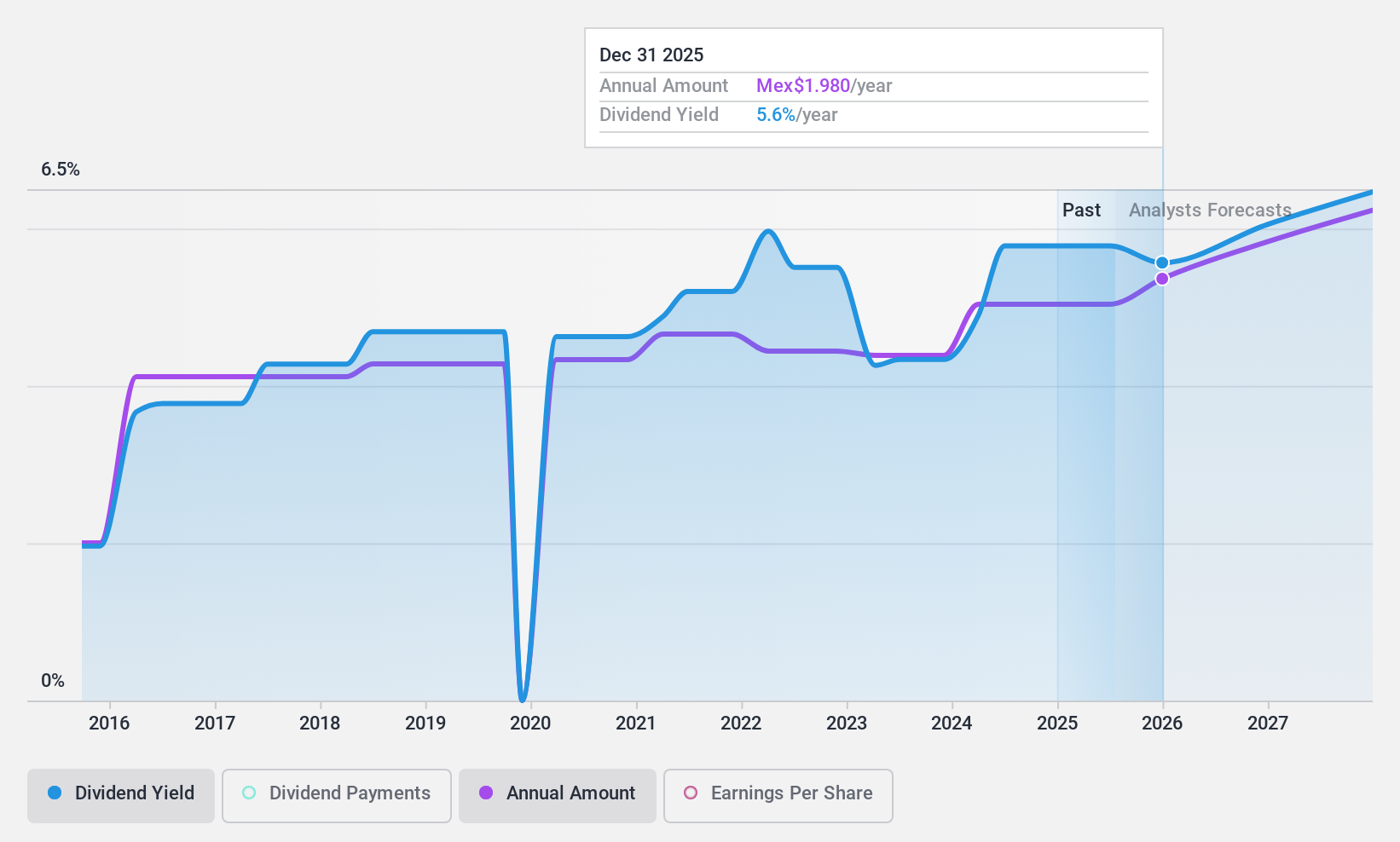

Kimberly-Clark de México S. A. B. de C. V (BMV:KIMBER A)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kimberly-Clark de México S. A. B. de C. V., along with its subsidiaries, focuses on the manufacturing, distribution, and sale of disposable products in Mexico, with a market capitalization of MX$88.12 billion.

Operations: Kimberly-Clark de México S. A. B. de C. V.'s revenue is segmented into Export at MX$4.83 billion, Professional at MX$5.55 billion, and Consumer Products at MX$44 billion.

Dividend Yield: 6.4%

Kimberly-Clark de México's dividend payments, while covered by earnings and cash flows with payout ratios of 71.8% and 64.1% respectively, have been volatile over the past decade. Recent financial results show growth in sales and net income for Q3 2024, indicating potential stability in future dividends despite a high level of debt. The stock trades below estimated fair value but offers a lower yield compared to top-tier MX market dividend payers.

- Get an in-depth perspective on Kimberly-Clark de México S. A. B. de C. V's performance by reading our dividend report here.

- The analysis detailed in our Kimberly-Clark de México S. A. B. de C. V valuation report hints at an deflated share price compared to its estimated value.

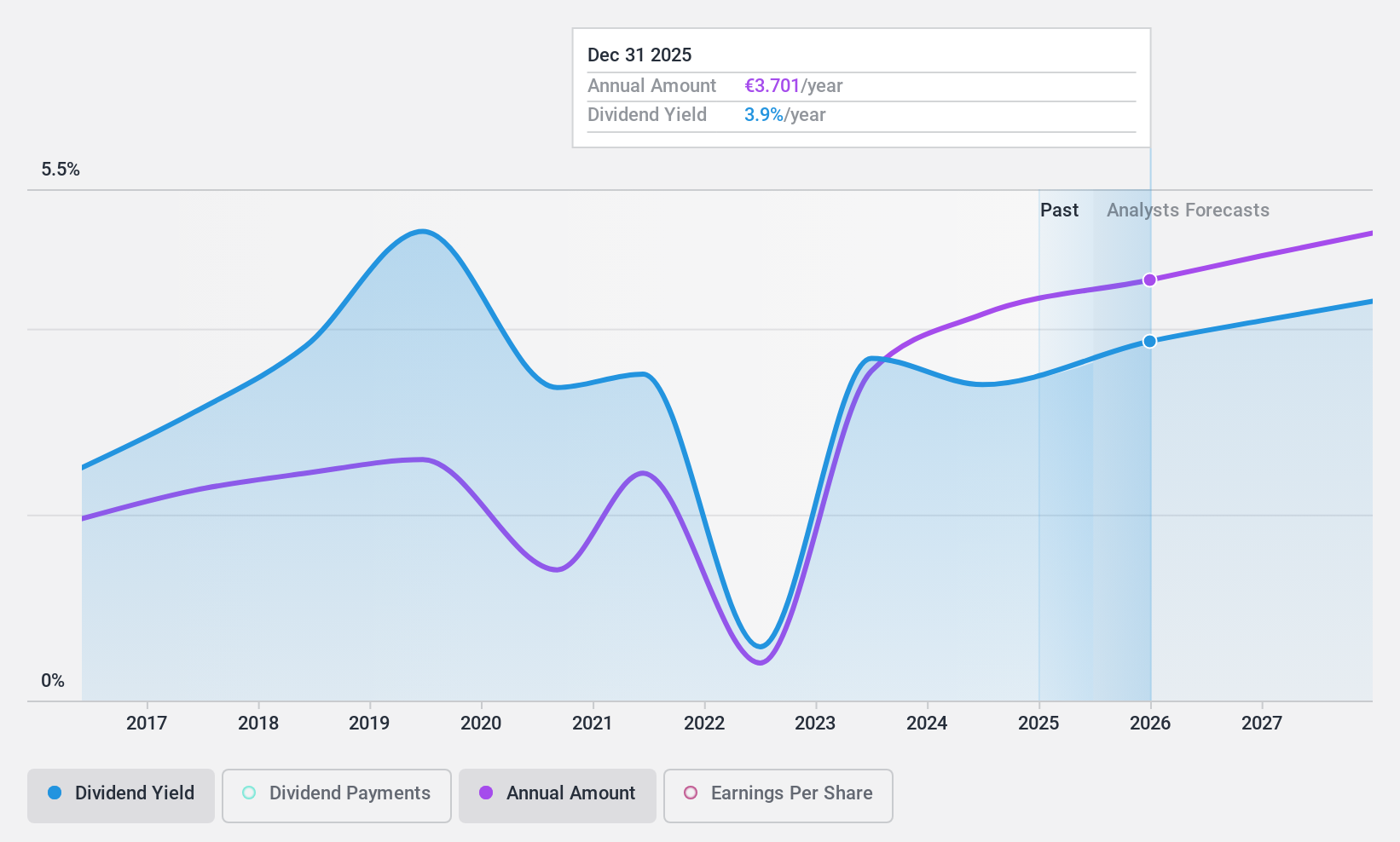

Publicis Groupe (ENXTPA:PUB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Publicis Groupe S.A. is a global company offering marketing, communications, and digital business transformation services across various regions including North America, Europe, the Asia Pacific, Latin America, Africa, and the Middle East with a market cap of €25.20 billion.

Operations: Publicis Groupe's revenue from Advertising and Communication Services is €15.35 billion.

Dividend Yield: 3.4%

Publicis Groupe's dividend payments, despite being covered by earnings and cash flows with payout ratios of 54.7% and 64.2%, have been volatile over the past decade. The dividend yield of 3.39% lags behind top-tier French market payers. Recent business expansions, including LePub’s global growth and upgraded earnings guidance for 2024, indicate strategic initiatives that might impact future financial performance without directly stabilizing dividends yet.

- Delve into the full analysis dividend report here for a deeper understanding of Publicis Groupe.

- Our valuation report unveils the possibility Publicis Groupe's shares may be trading at a discount.

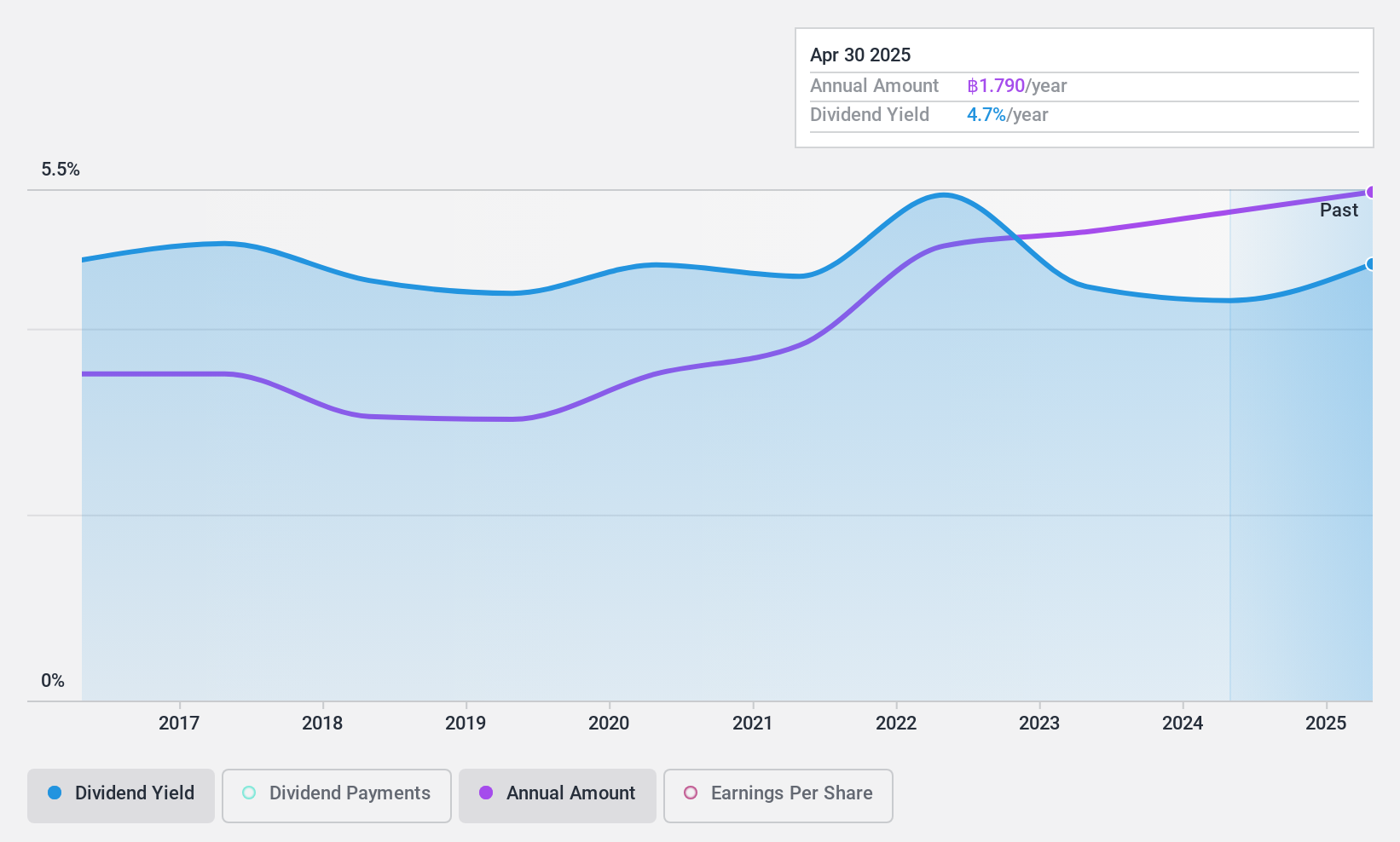

Thaitheparos (SET:SAUCE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Thaitheparos Public Company Limited manufactures and distributes sauces and condiments both in Thailand and internationally, with a market cap of THB13.68 billion.

Operations: The company's revenue is primarily derived from its Sauce Segment, which generated THB3.55 billion.

Dividend Yield: 4.5%

Thaitheparos' dividend payments, while covered by earnings and cash flows with payout ratios of 83.1% and 77.2%, have been volatile over the past decade, showing annual drops over 20%. The dividend yield of 4.53% is below Thailand's top-tier payers. Recent earnings show a slight revenue increase to THB 871.06 million for Q3 but a dip in net income to THB 169.78 million, reflecting potential challenges in maintaining consistent dividend growth despite stable coverage ratios.

- Click here to discover the nuances of Thaitheparos with our detailed analytical dividend report.

- The analysis detailed in our Thaitheparos valuation report hints at an inflated share price compared to its estimated value.

Where To Now?

- Take a closer look at our Top Dividend Stocks list of 2007 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kimberly-Clark de México S. A. B. de C. V might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BMV:KIMBER A

Kimberly-Clark de México S. A. B. de C. V

Manufactures, distributes, and sells disposable products in Mexico.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026