- South Korea

- /

- Electric Utilities

- /

- KOSE:A071320

Investors Appear Satisfied With Korea District Heating Corp.'s (KRX:071320) Prospects As Shares Rocket 29%

Korea District Heating Corp. (KRX:071320) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. The last month tops off a massive increase of 141% in the last year.

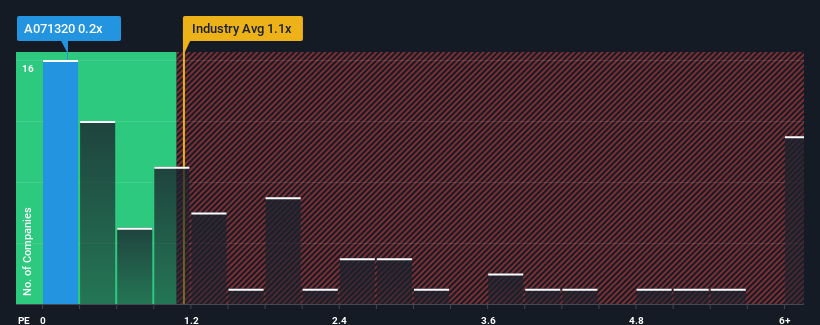

Although its price has surged higher, there still wouldn't be many who think Korea District Heating's price-to-sales (or "P/S") ratio of 0.2x is worth a mention when it essentially matches the median P/S in Korea's Electric Utilities industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Korea District Heating

How Korea District Heating Has Been Performing

Korea District Heating hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Korea District Heating's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Korea District Heating would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 21%. Still, the latest three year period has seen an excellent 58% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 8.3% over the next year. Meanwhile, the rest of the industry is forecast to expand by 7.2%, which is not materially different.

With this information, we can see why Korea District Heating is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Its shares have lifted substantially and now Korea District Heating's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A Korea District Heating's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Electric Utilities industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Korea District Heating that you should be aware of.

If you're unsure about the strength of Korea District Heating's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Korea District Heating might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A071320

Korea District Heating

Engages in the district cooling and heating businesses in South Korea.

Slight risk second-rate dividend payer.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026