- South Korea

- /

- Marine and Shipping

- /

- KOSE:A005880

Little Excitement Around Korea Line Corporation's (KRX:005880) Earnings As Shares Take 26% Pounding

The Korea Line Corporation (KRX:005880) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. The recent drop has obliterated the annual return, with the share price now down 3.5% over that longer period.

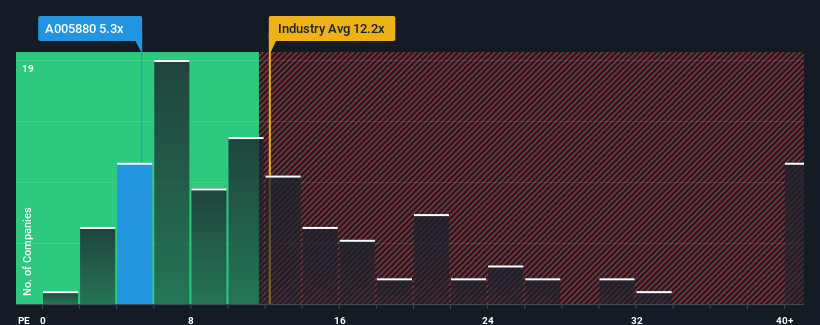

Even after such a large drop in price, given about half the companies in Korea have price-to-earnings ratios (or "P/E's") above 12x, you may still consider Korea Line as a highly attractive investment with its 5.3x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With earnings that are retreating more than the market's of late, Korea Line has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for Korea Line

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as Korea Line's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 439% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Looking ahead now, EPS is anticipated to climb by 6.6% per annum during the coming three years according to the three analysts following the company. With the market predicted to deliver 20% growth per annum, the company is positioned for a weaker earnings result.

In light of this, it's understandable that Korea Line's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Korea Line's P/E

Korea Line's P/E looks about as weak as its stock price lately. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Korea Line's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Korea Line (at least 2 which are a bit unpleasant), and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Korea Line might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A005880

Korea Line

Engages in the provision of merchant carrier services for energy resources in marine transportation industry worldwide.

Undervalued with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)