- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A020150

Shareholders Can Be Confident That Lotte Energy Materials' (KRX:020150) Earnings Are High Quality

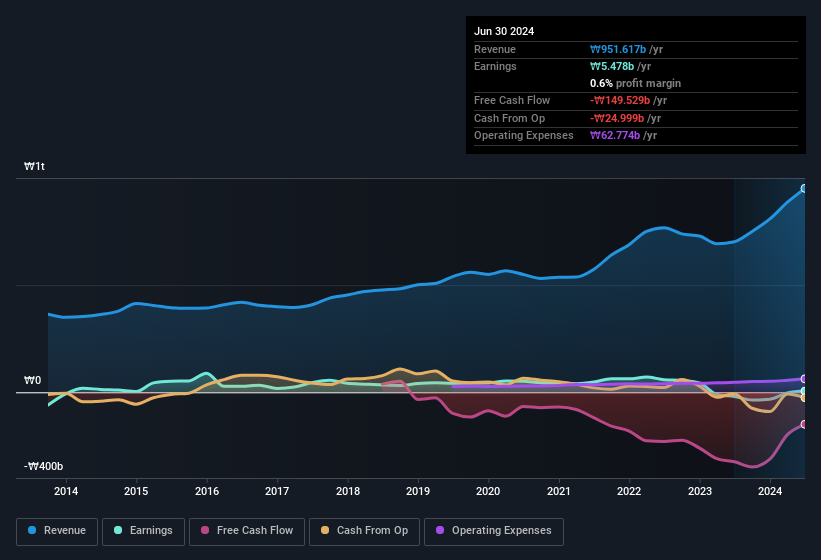

Lotte Energy Materials Corporation's (KRX:020150) strong earnings report was rewarded with a positive stock price move. We did some digging and found some further encouraging factors that investors will like.

See our latest analysis for Lotte Energy Materials

How Do Unusual Items Influence Profit?

To properly understand Lotte Energy Materials' profit results, we need to consider the ₩37b expense attributed to unusual items. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's hardly a surprise given these line items are considered unusual. Lotte Energy Materials took a rather significant hit from unusual items in the year to June 2024. All else being equal, this would likely have the effect of making the statutory profit look worse than its underlying earnings power.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Lotte Energy Materials' Profit Performance

As we mentioned previously, the Lotte Energy Materials' profit was hampered by unusual items in the last year. Because of this, we think Lotte Energy Materials' underlying earnings potential is as good as, or possibly even better, than the statutory profit makes it seem! And it's also positive that the company showed enough improvement to book a profit this year, after losing money last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. So while earnings quality is important, it's equally important to consider the risks facing Lotte Energy Materials at this point in time. Case in point: We've spotted 1 warning sign for Lotte Energy Materials you should be aware of.

This note has only looked at a single factor that sheds light on the nature of Lotte Energy Materials' profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A020150

Lotte Energy Materials

Produces and sells elecfoils in Korea and internationally.

High growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)