- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2383

3 Stocks With Estimated Discounts Up To 44.7% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate a period marked by rate cuts from the ECB and SNB, alongside the Nasdaq hitting record highs, investors are keenly observing shifts in economic indicators such as inflation and labor market data. Amid this landscape of fluctuating indices and monetary policy adjustments, identifying undervalued stocks becomes crucial for those looking to capitalize on potential discounts relative to intrinsic value. A good stock in this context is one that not only offers a significant discount but also demonstrates resilience amidst broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sudarshan Chemical Industries (BSE:506655) | ₹1129.35 | ₹2251.04 | 49.8% |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.8% |

| Wuhan Keqian BiologyLtd (SHSE:688526) | CN¥14.62 | CN¥29.09 | 49.7% |

| Decisive Dividend (TSXV:DE) | CA$5.92 | CA$11.83 | 50% |

| Management SolutionsLtd (TSE:7033) | ¥1717.00 | ¥3419.48 | 49.8% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP290.00 | CLP579.00 | 49.9% |

| Wetteri Oyj (HLSE:WETTERI) | €0.297 | €0.59 | 49.9% |

| Compagnia dei Caraibi (BIT:TIME) | €0.542 | €1.08 | 50% |

| Fnac Darty (ENXTPA:FNAC) | €29.45 | €58.67 | 49.8% |

| Hanall Biopharma (KOSE:A009420) | ₩32600.00 | ₩65043.15 | 49.9% |

Let's uncover some gems from our specialized screener.

Samsung Electro-Mechanics (KOSE:A009150)

Overview: Samsung Electro-Mechanics Co., Ltd. manufactures and sells electronic components across multiple regions including Korea, China, Southeast Asia, Japan, the Americas, and Europe with a market cap of approximately ₩9.33 trillion.

Operations: The company's revenue segments include Package Solution at ₩1.93 trillion, Component Solution at ₩4.36 trillion, and Optical Communication Solution at ₩3.84 trillion.

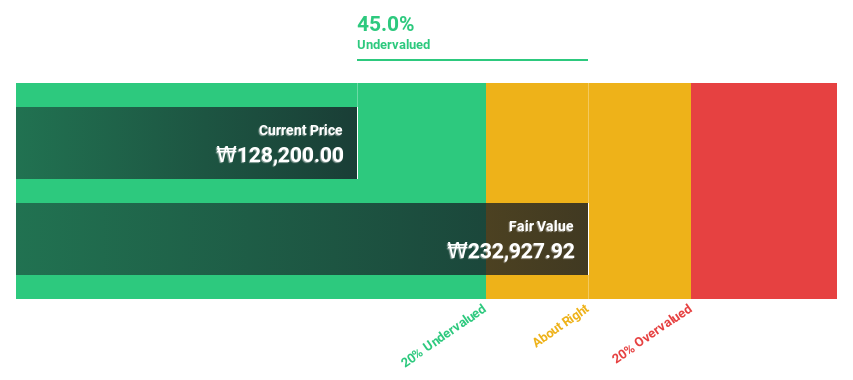

Estimated Discount To Fair Value: 44.7%

Samsung Electro-Mechanics is trading at ₩128,800, significantly below its estimated fair value of ₩232,764.16, indicating it may be undervalued based on cash flows. Despite a decline in third-quarter net income to KRW 115.20 billion from KRW 155.53 billion last year, nine-month net income rose to KRW 470.74 billion from KRW 379.53 billion previously. Earnings are forecasted to grow significantly over the next three years, outpacing market expectations with a projected annual growth rate of over 20%.

- Our growth report here indicates Samsung Electro-Mechanics may be poised for an improving outlook.

- Navigate through the intricacies of Samsung Electro-Mechanics with our comprehensive financial health report here.

Elite Material (TWSE:2383)

Overview: Elite Material Co., Ltd. produces and sells copper clad laminates, electronic-industrial specialty chemicals and raw materials, as well as electronic components across Taiwan, China, and internationally, with a market cap of NT$212.31 billion.

Operations: The company's revenue is derived from NT$14.61 billion in domestic sales and NT$54.56 billion from foreign operations.

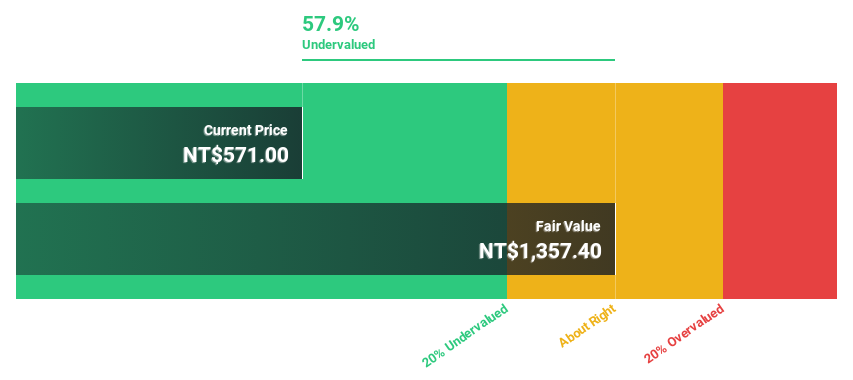

Estimated Discount To Fair Value: 13.1%

Elite Material is trading at NT$613, below its estimated fair value of NT$705.43, suggesting potential undervaluation based on cash flows. Third-quarter earnings showed strong growth with sales reaching TWD 17.46 billion compared to TWD 11.87 billion last year, and net income rising to TWD 2.52 billion from TWD 2.02 billion previously. Earnings are forecasted to grow at an annual rate of 14.6%, surpassing the broader market's expected growth rate of 6.6%.

- Our earnings growth report unveils the potential for significant increases in Elite Material's future results.

- Dive into the specifics of Elite Material here with our thorough financial health report.

ASE Technology Holding (TWSE:3711)

Overview: ASE Technology Holding Co., Ltd. offers semiconductor packaging and testing services, as well as electronic manufacturing services globally, with a market cap of approximately NT$698.60 billion.

Operations: The company's revenue segments consist of NT$52.60 billion from testing, NT$263.44 billion from packaging, and NT$308.95 billion from electronic manufacturing services (EMS).

Estimated Discount To Fair Value: 23.7%

ASE Technology Holding is trading at NT$161, below its estimated fair value of NT$211.02, indicating potential undervaluation based on cash flows. Earnings are projected to grow 32.9% annually, outpacing the TW market's 6.6%. Recent revenue reports show slight fluctuations but overall growth from last year, with November revenues at TWD 52.93 billion compared to TWD 54.51 billion a year ago and Q3 net income rising to TWD 9.67 billion from TWD 8.78 billion previously.

- According our earnings growth report, there's an indication that ASE Technology Holding might be ready to expand.

- Click to explore a detailed breakdown of our findings in ASE Technology Holding's balance sheet health report.

Make It Happen

- Take a closer look at our Undervalued Stocks Based On Cash Flows list of 903 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elite Material might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2383

Elite Material

Engages in the production and sale of copper clad laminates, electronic-industrial specialty chemical and raw materials, and electronic components in Taiwan, China, and internationally.

Solid track record with excellent balance sheet.