- Taiwan

- /

- Semiconductors

- /

- TWSE:8016

3 High-Yield Dividend Stocks Offering Up To 6.8% Yield

Reviewed by Simply Wall St

As global markets navigate a landscape of fluctuating interest rates and mixed economic signals, investors are increasingly seeking stability through high-yield dividend stocks. In this environment, a good stock is often characterized by its ability to provide consistent income while weathering market volatility, making dividend yield an attractive feature for many portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.99% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.43% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.76% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.12% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.43% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.95% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.77% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.23% | ★★★★★★ |

Click here to see the full list of 1967 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

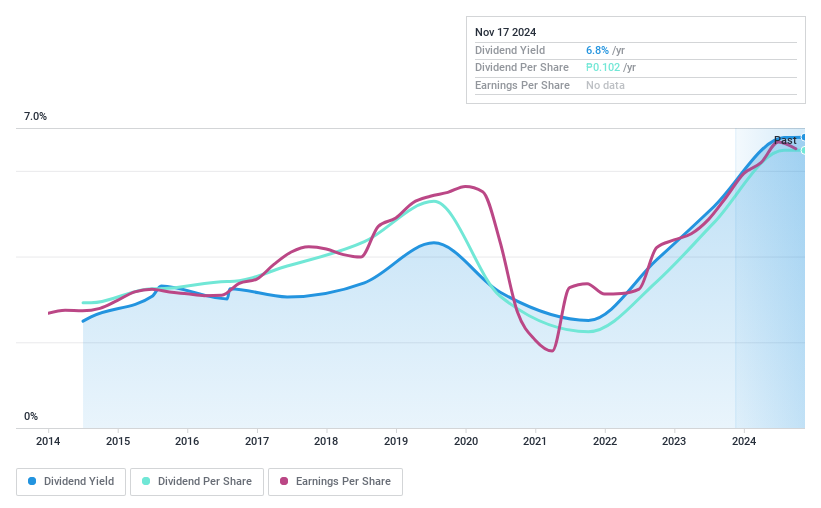

Rockwell Land (PSE:ROCK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rockwell Land Corporation is a property developer focusing on high-end and upper-mid markets primarily in Metro Manila, the Philippines, with a market capitalization of approximately ₱9.24 billion.

Operations: Rockwell Land Corporation generates revenue from two main segments: Commercial Development, contributing ₱4.28 billion, and Residential Development, with ₱14.92 billion.

Dividend Yield: 6.9%

Rockwell Land's dividend yield of 6.88% ranks in the top 25% of PH market payers, but it's not well covered by free cash flows or earnings, with a high cash payout ratio of 213.6%. Despite a low payout ratio of 18.4%, dividends have been volatile over the past decade. Recent earnings growth and improved revenue figures suggest potential for stability, yet debt coverage remains weak, challenging long-term dividend sustainability.

- Dive into the specifics of Rockwell Land here with our thorough dividend report.

- The valuation report we've compiled suggests that Rockwell Land's current price could be inflated.

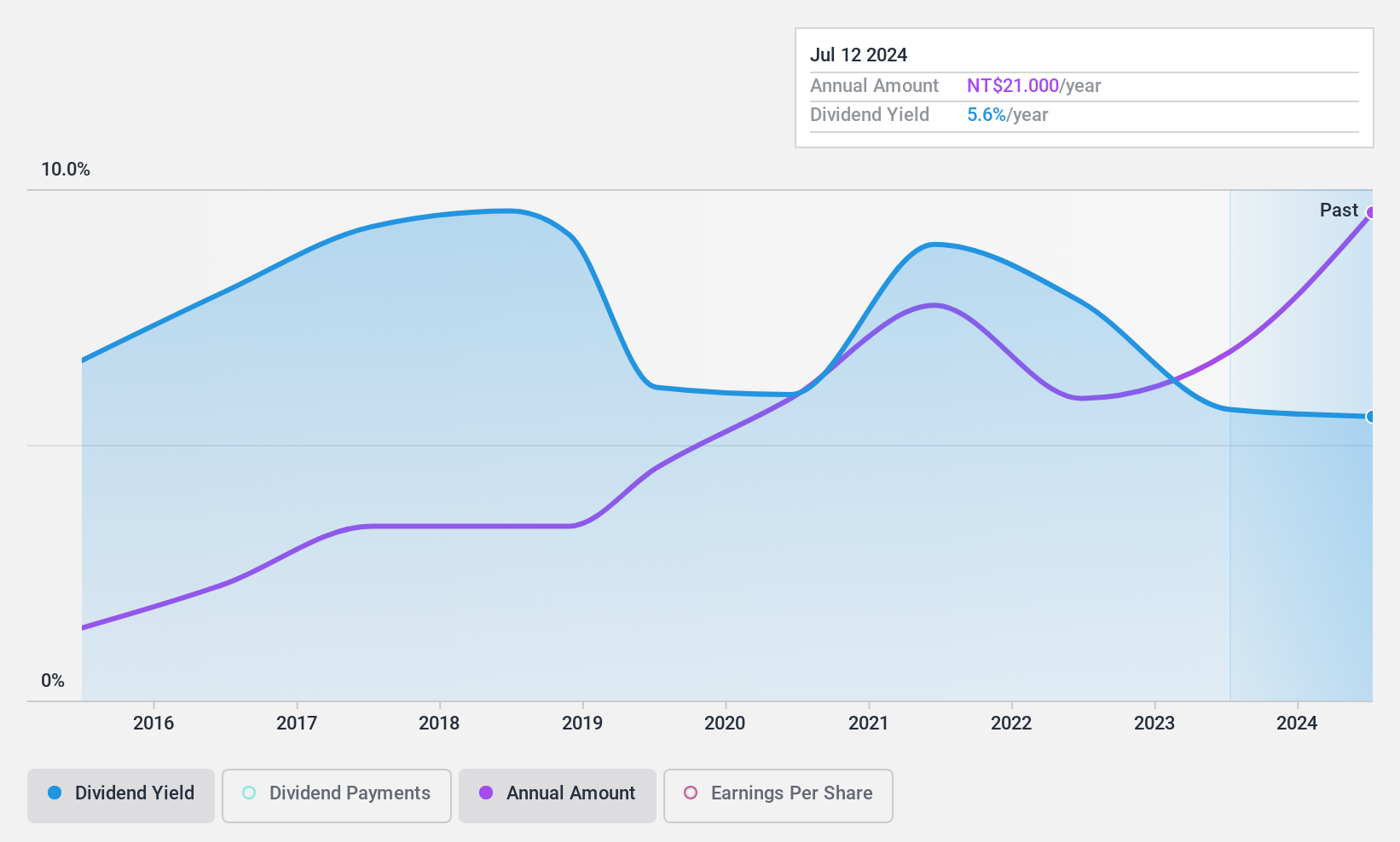

United Integrated Services (TWSE:2404)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Integrated Services Co., Ltd. offers engineering construction services across Taiwan, Mainland China, Singapore, the United States, and Japan with a market cap of NT$89.96 billion.

Operations: United Integrated Services Co., Ltd. generates revenue primarily from its Engineering and Integration segment, which accounts for NT$53.25 billion, followed by Maintenance and Design services contributing NT$89.79 million.

Dividend Yield: 4.4%

United Integrated Services has shown earnings growth of 11.2% over the past year, with dividends covered by both earnings (payout ratio: 75.8%) and cash flows (cash payout ratio: 33.8%). However, its dividend track record is unstable and volatile over the past decade. Recent Q3 results indicate improved net income at TWD 1,750.13 million compared to TWD 1,306.99 million a year ago, despite a drop in revenue from TWD 17.55 billion to TWD 11.15 billion.

- Take a closer look at United Integrated Services' potential here in our dividend report.

- The analysis detailed in our United Integrated Services valuation report hints at an deflated share price compared to its estimated value.

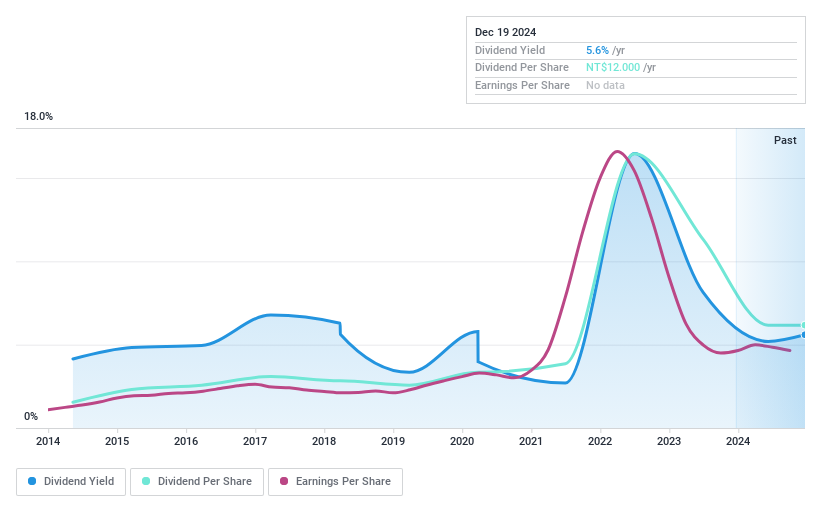

Sitronix Technology (TWSE:8016)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sitronix Technology Corporation designs, manufactures, and supplies integrated circuits and memory chips across various regions including Hong Kong, Vietnam, South Korea, Taiwan, India, and internationally with a market cap of NT$25.58 billion.

Operations: Sitronix Technology Corporation generates its revenue from the semiconductor segment, amounting to NT$17.72 billion.

Dividend Yield: 5.6%

Sitronix Technology's dividends are covered by earnings (payout ratio: 77.4%) and cash flows (cash payout ratio: 57%), but its dividend history is unstable and volatile. Despite a top-tier yield of 5.59% in the TW market, past payments have been unreliable. Recent Q3 results show increased sales at TWD 4.68 billion, though net income decreased to TWD 463.49 million from TWD 539.98 million last year, reflecting potential challenges in sustaining payouts consistently.

- Click here to discover the nuances of Sitronix Technology with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Sitronix Technology is priced higher than what may be justified by its financials.

Next Steps

- Access the full spectrum of 1967 Top Dividend Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:8016

Sitronix Technology

Designs, manufactures, and supplies integrated circuits (ICs) and memory chips in Hong Kong, Vietnam, South Korea, Taiwan, India, and internationally.

Flawless balance sheet established dividend payer.