- South Korea

- /

- Entertainment

- /

- KOSE:A352820

South Korea's High Growth Tech Stocks To Watch

Reviewed by Simply Wall St

The South Korea stock market has recently shown signs of recovery, finishing higher in two out of three trading days following a brief slump, with the KOSPI index now hovering just below the 2,600-point mark. In this environment marked by fluctuating indices and global economic pressures such as rising treasury yields and interest rate concerns, identifying high-growth tech stocks requires careful consideration of their resilience and potential to thrive amidst broader market volatility.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| NEXON Games | 27.44% | 69.62% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 23.21% | 34.63% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 47 stocks from our KRX High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

UTI (KOSDAQ:A179900)

Simply Wall St Growth Rating: ★★★★★★

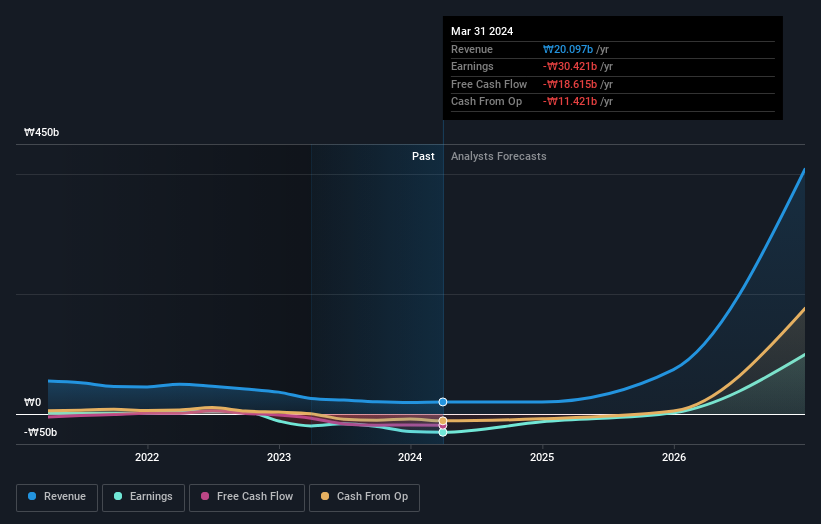

Overview: UTI Inc. focuses on the research, development, manufacture, and sale of smartphone camera windows and sensor glasses both in South Korea and internationally, with a market cap of ₩346.49 billion.

Operations: The company generates revenue primarily from the sale of electronic components and parts, amounting to ₩19.97 billion. It operates in both domestic and international markets, focusing on smartphone camera windows and sensor glasses.

UTI, a South Korean tech firm, is navigating the competitive landscape with a robust R&D focus, allocating significant resources to innovation—evidenced by its R&D expenses rising to 134.6% annually. This investment is propelling anticipated revenue growth of 115% per year, outpacing the broader KR market's growth rate of 10.2%. Despite current unprofitability, UTI is poised for a turnaround with earnings expected to surge by 134.6% annually over the next three years, reflecting potential in both domestic and global tech sectors. The company's commitment to advancing technology positions it well for future industry leadership and client acquisition.

- Take a closer look at UTI's potential here in our health report.

Explore historical data to track UTI's performance over time in our Past section.

ISU Petasys (KOSE:A007660)

Simply Wall St Growth Rating: ★★★★★☆

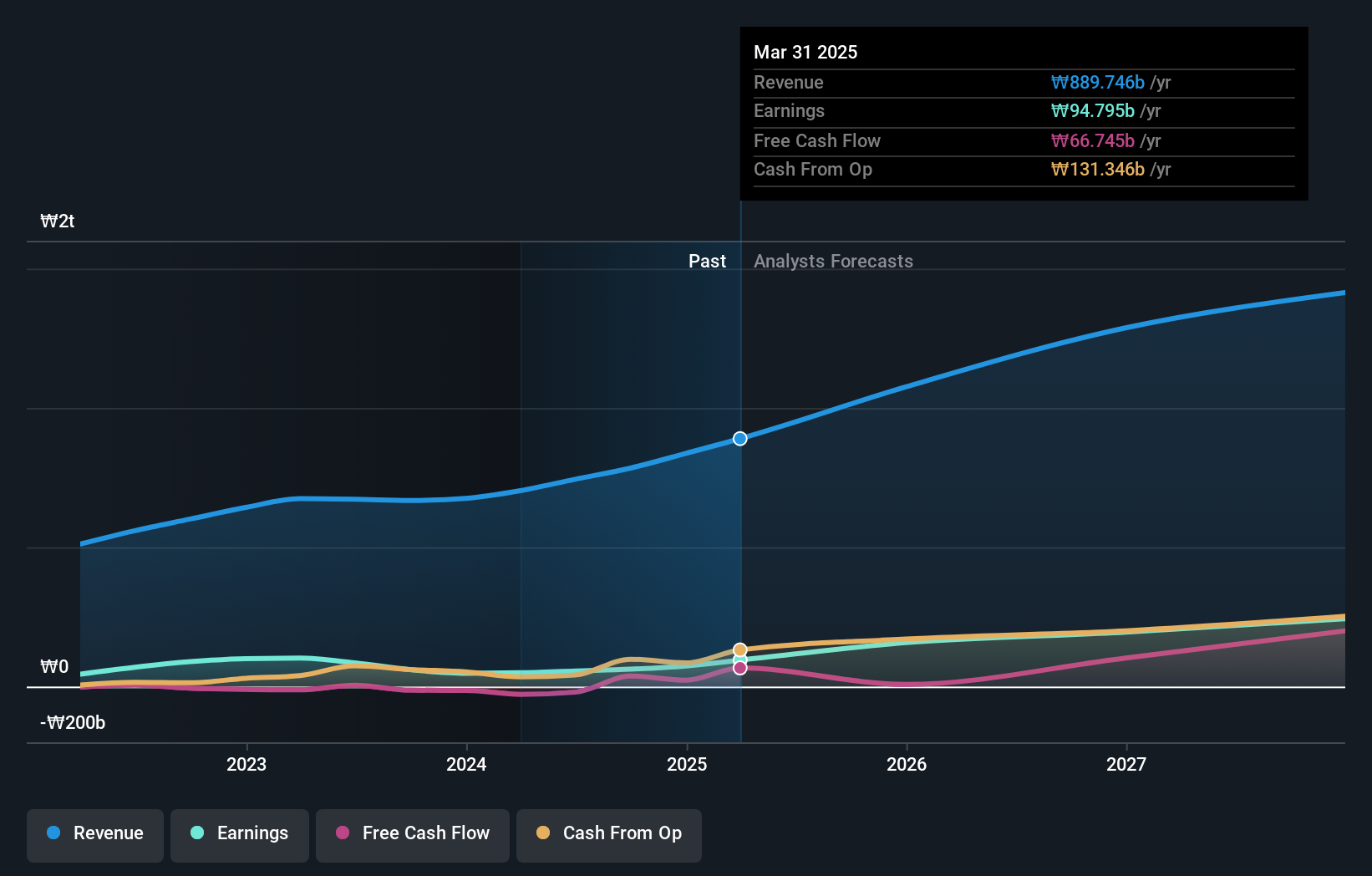

Overview: ISU Petasys Co., Ltd. is a global manufacturer and seller of printed circuit boards (PCBs) with a market capitalization of approximately ₩2.89 trillion.

Operations: ISU Petasys generates revenue primarily through the manufacture and sale of printed circuit boards, with this segment contributing ₩743.88 billion. The company's market capitalization stands at approximately ₩2.89 trillion.

ISU Petasys, a South Korean tech entity, is charting a path through the competitive electronic sector with its strategic focus on R&D, which has seen a significant uptick in expenses. This proactive investment in innovation is mirrored in its revenue projections, expected to climb by 18.6% annually. Despite this growth being slightly below the high-growth threshold of 20%, it surpasses the broader KR market's average of 10.2%. On the profitability front, ISU Petasys shines with anticipated earnings surging by an impressive 44.4% per year—well above the market average of 29.3%. This robust profit outlook is underpinned by a strong forecasted return on equity of 34.3%, positioning ISU Petasys favorably for future financial health and market competitiveness despite current challenges like high volatility in share price and a dip in profit margins from last year’s figures.

- Delve into the full analysis health report here for a deeper understanding of ISU Petasys.

Assess ISU Petasys' past performance with our detailed historical performance reports.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

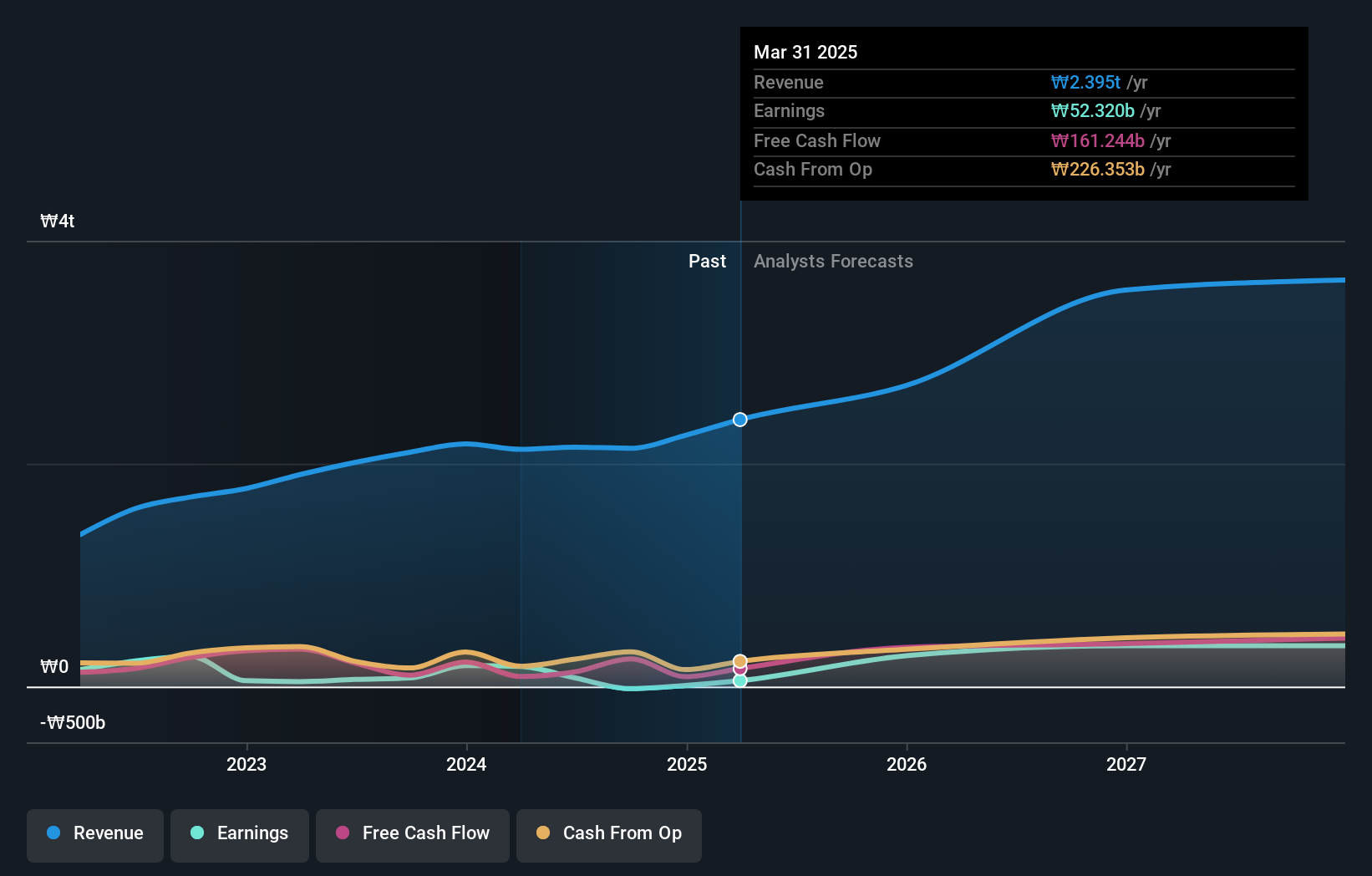

Overview: HYBE Co., Ltd. is involved in music production, publishing, and artist development and management, with a market cap of ₩8.07 trillion.

Operations: HYBE generates revenue primarily from three segments: Label, Platform, and Solution. The Label segment contributes the highest revenue at ₩1.28 trillion, followed by the Solution segment at ₩1.24 trillion. The Platform segment adds ₩361.12 billion to the overall revenue stream.

HYBE, navigating the dynamic Entertainment sector in South Korea, has demonstrated a robust financial trajectory with its earnings growing by 21.6% over the past year, outpacing the industry's average of 7.3%. This growth is underpinned by a substantial forecast in earnings growth at an annual rate of 42.5%, significantly ahead of the broader market projection of 29.3%. Despite these strong performance indicators, revenue growth projections stand at 13.7% annually, slightly below the high-growth benchmark but still surpassing the market average of 10.2%. Recent strategic moves include a notable share repurchase program and private placements aimed at bolstering financial flexibility and shareholder value, reflecting HYBE's proactive approach to capital management and growth strategy in a competitive landscape.

Key Takeaways

- Click through to start exploring the rest of the 44 KRX High Growth Tech and AI Stocks now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HYBE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A352820

HYBE

Engages in the music production, publishing, and artist development and management businesses.

Excellent balance sheet with reasonable growth potential.