- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A371950

What You Can Learn From POONGWON PRECISION CO.,Ltd.'s (KOSDAQ:371950) P/S After Its 28% Share Price Crash

POONGWON PRECISION CO.,Ltd. (KOSDAQ:371950) shares have had a horrible month, losing 28% after a relatively good period beforehand. Looking at the bigger picture, even after this poor month the stock is up 31% in the last year.

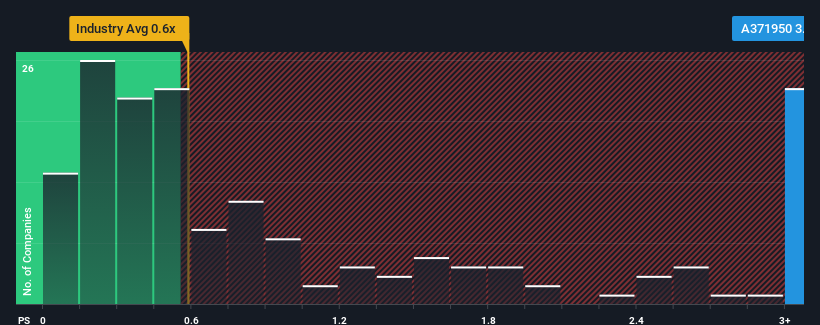

Even after such a large drop in price, you could still be forgiven for thinking POONGWON PRECISIONLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3.5x, considering almost half the companies in Korea's Electronic industry have P/S ratios below 0.6x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for POONGWON PRECISIONLtd

How Has POONGWON PRECISIONLtd Performed Recently?

The revenue growth achieved at POONGWON PRECISIONLtd over the last year would be more than acceptable for most companies. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on POONGWON PRECISIONLtd's earnings, revenue and cash flow.How Is POONGWON PRECISIONLtd's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like POONGWON PRECISIONLtd's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 18% gain to the company's top line. The latest three year period has also seen an excellent 37% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 7.0% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that POONGWON PRECISIONLtd's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Bottom Line On POONGWON PRECISIONLtd's P/S

Even after such a strong price drop, POONGWON PRECISIONLtd's P/S still exceeds the industry median significantly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of POONGWON PRECISIONLtd revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 3 warning signs for POONGWON PRECISIONLtd you should be aware of, and 2 of them shouldn't be ignored.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A371950

POONGWON PRECISIONLtd

Poongwon Precision Co., Ltd. produces and supplies parts for AMOLED manufacturing in South Korea.

Very low risk with worrying balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)