- South Korea

- /

- Entertainment

- /

- KOSE:A352820

High Growth Tech Stocks in South Korea to Watch

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has experienced a 1.4% decline and has remained relatively flat over the past year, yet earnings are forecast to grow by an impressive 30% annually. In this context, identifying high growth tech stocks involves looking for companies that demonstrate strong potential for innovation and profitability despite recent market fluctuations.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 23.74% | 35.63% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.59% | ★★★★★★ |

Click here to see the full list of 48 stocks from our KRX High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company that specializes in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩17.85 trillion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to approximately ₩90.79 billion. The focus on long-acting biobetters and antibody technologies forms the core of its business operations.

ALTEOGEN is setting a robust trajectory in South Korea's biotech sector, underscored by its recent MFDS approval for Tergase®, a high-purity recombinant hyaluronidase. This approval not only diversifies its application across medical fields but also marks a significant step towards commercialization. Financially, the company is navigating through unprofitability with an ambitious outlook; revenue is expected to surge by 64.2% annually, outpacing the Korean market's growth of 10.5%. Moreover, ALTEOGEN plans to transition into profitability within three years, supported by a forecasted annual profit growth of 99.5%, positioning it favorably against industry norms. Despite current financial challenges and share price volatility, these developments could herald a new phase of growth and market penetration for ALTEOGEN.

- Delve into the full analysis health report here for a deeper understanding of ALTEOGEN.

Evaluate ALTEOGEN's historical performance by accessing our past performance report.

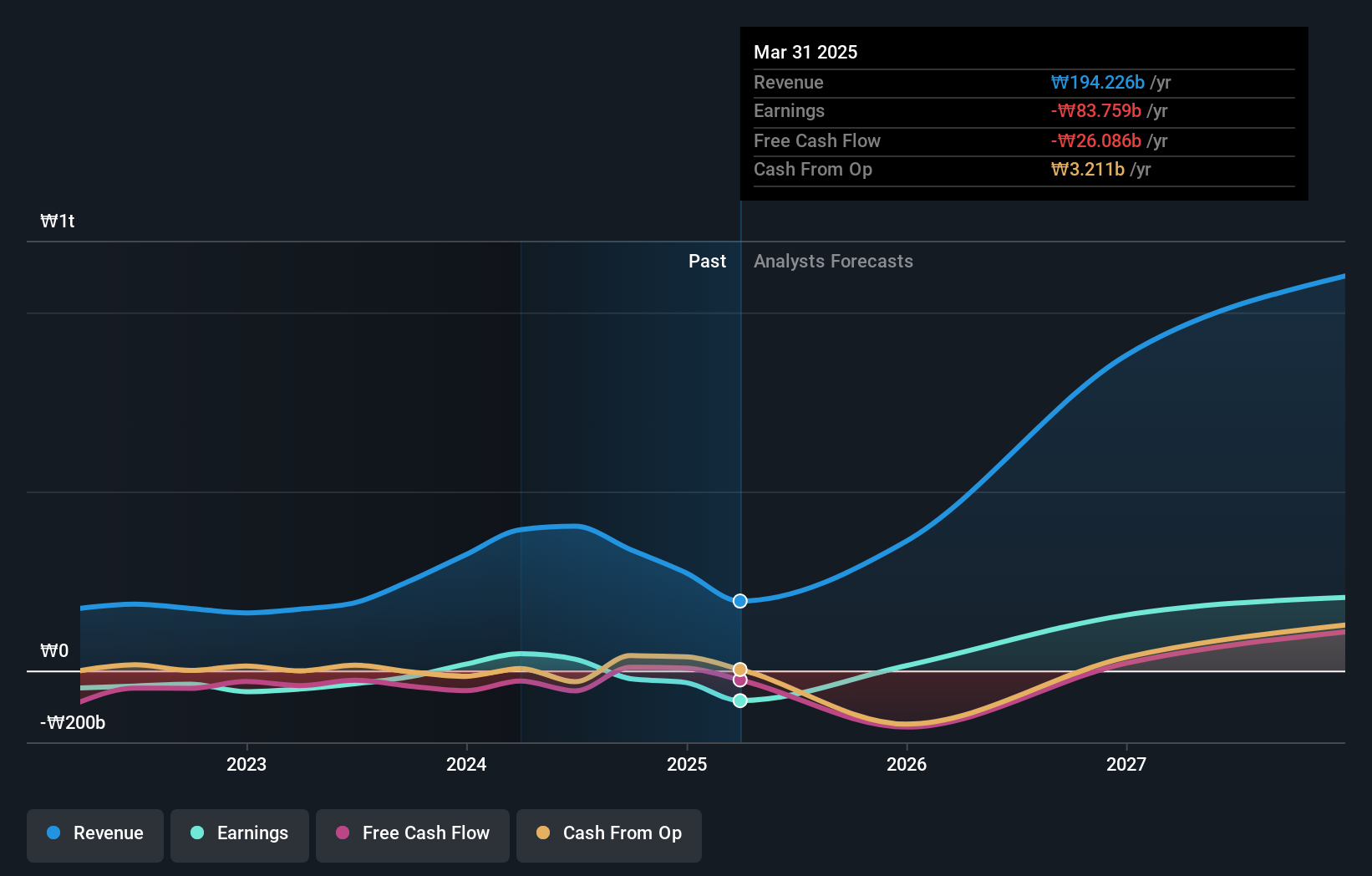

JNTC (KOSDAQ:A204270)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JNTC Co., Ltd. operates in South Korea, offering connector, hinge, and tempered glass products with a market cap of ₩1.26 trillion.

Operations: The company generates revenue primarily from the manufacturing and sales of mobile parts, amounting to ₩402.99 billion.

In the dynamic landscape of South Korea's tech sector, JNTC is making notable strides with a focus on innovation and market adaptation. The company's commitment to research and development is evident, allocating 51.9% of its revenue towards R&D efforts aimed at pioneering advancements in software solutions. This investment strategy not only underscores JNTC’s dedication to growth but also positions it as a forward-thinking entity amidst intense competition. Furthermore, with an expected annual revenue increase of 18.1%, JNTC is outpacing the broader market growth rate of 10.5%, reflecting its effective capture of emerging opportunities in technology deployment and client engagement. Despite challenges such as a highly volatile share price over the past three months, these factors highlight JNTC’s potential to adapt and thrive in an ever-evolving industry landscape.

- Dive into the specifics of JNTC here with our thorough health report.

Understand JNTC's track record by examining our Past report.

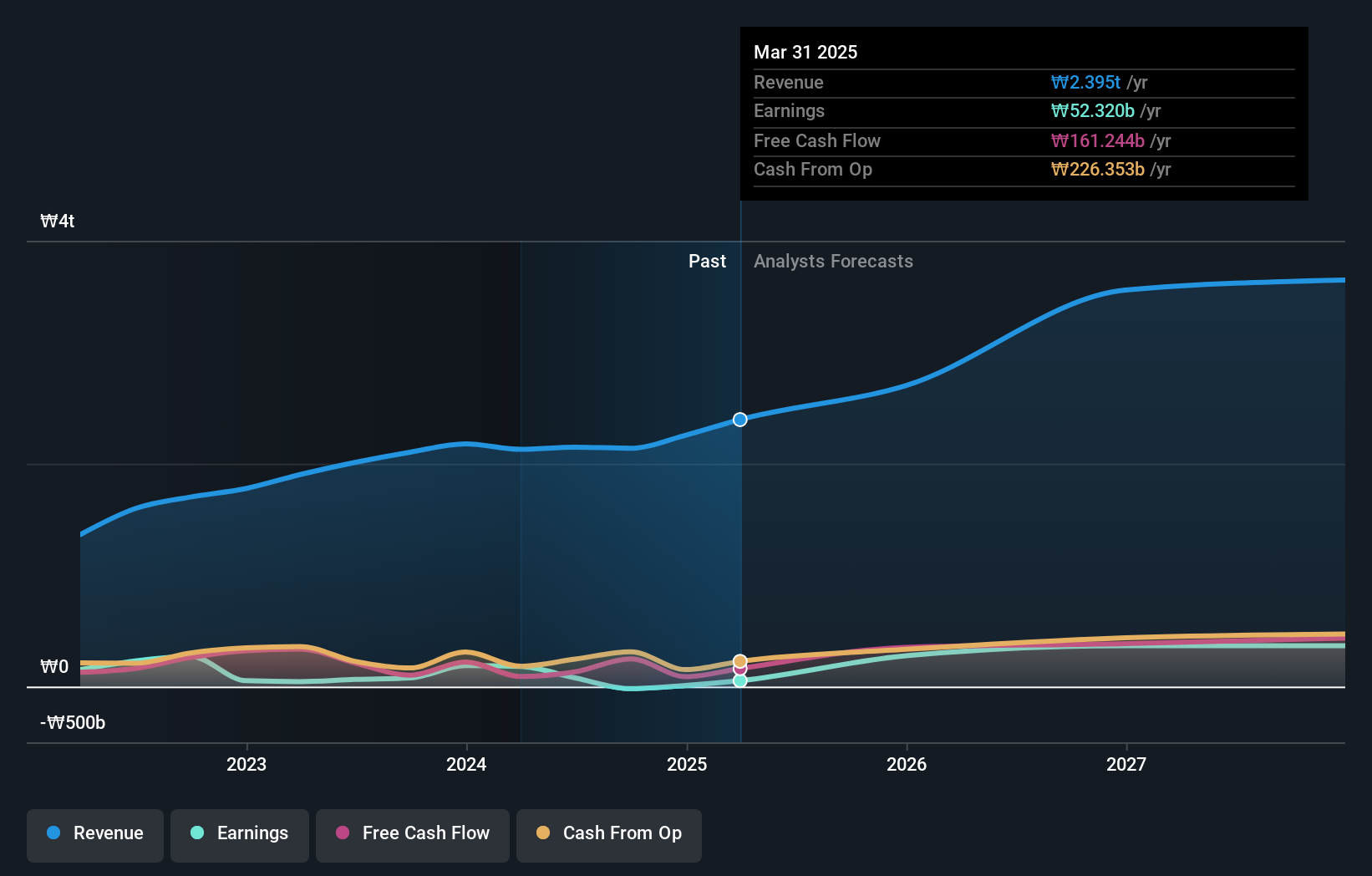

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. operates in music production, publishing, and artist development and management with a market cap of ₩7.09 trillion.

Operations: HYBE Co., Ltd. generates revenue primarily from its Label and Solution segments, with the Label segment contributing ₩1.28 trillion and the Solution segment adding ₩1.24 trillion. The Platform segment also plays a role, bringing in ₩361.12 billion in revenue.

HYBE, a South Korean entertainment giant, demonstrates robust growth with its earnings expected to climb by 42.2% annually, outpacing the broader market's 29.7%. This surge is bolstered by a notable R&D commitment, channeling 14% of revenues into research initiatives aimed at innovation in digital content and artist management technologies. Recently completing a share repurchase of KRW 26 billion enhances shareholder value and signals confidence in its financial health despite facing substantial one-off losses of ₩189.4 billion last year which skewed profitability metrics temporarily.

- Click to explore a detailed breakdown of our findings in HYBE's health report.

Assess HYBE's past performance with our detailed historical performance reports.

Summing It All Up

- Navigate through the entire inventory of 48 KRX High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HYBE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A352820

HYBE

Engages in the music production, publishing, and artist development and management businesses.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)