- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A140860

High Growth Tech Stocks In South Korea Park Systems And 2 More

Reviewed by Simply Wall St

The South Korean market has climbed 1.9% in the last 7 days, with a gain of 4.0%, and is up 3.8% over the last 12 months, with earnings expected to grow by 28% per annum over the next few years. In this favorable environment, identifying high-growth tech stocks like Park Systems and two others can be crucial for investors looking to capitalize on these promising trends.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ALTEOGEN | 48.67% | 72.95% | ★★★★★★ |

| IMLtd | 20.76% | 106.30% | ★★★★★★ |

| Bioneer | 22.49% | 89.69% | ★★★★★★ |

| NEXON Games | 31.70% | 66.31% | ★★★★★★ |

| Seojin SystemLtd | 34.20% | 58.67% | ★★★★★★ |

| EuBiologics | 28.05% | 93.39% | ★★★★★★ |

| Devsisters | 26.11% | 65.92% | ★★★★★★ |

| AmosenseLtd | 24.29% | 55.45% | ★★★★★★ |

| Park Systems | 22.50% | 37.52% | ★★★★★★ |

| UTI | 103.56% | 122.67% | ★★★★★★ |

Click here to see the full list of 48 stocks from our KRX High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Park Systems (KOSDAQ:A140860)

Simply Wall St Growth Rating: ★★★★★★

Overview: Park Systems Corp. develops, manufactures, and sells atomic force microscopy (AFM) systems worldwide and has a market cap of approximately ₩1.32 trillion.

Operations: Park Systems Corp. generates revenue primarily from its Scientific & Technical Instruments segment, amounting to ₩142.98 billion. The company focuses on the development, manufacturing, and sales of atomic force microscopy (AFM) systems globally.

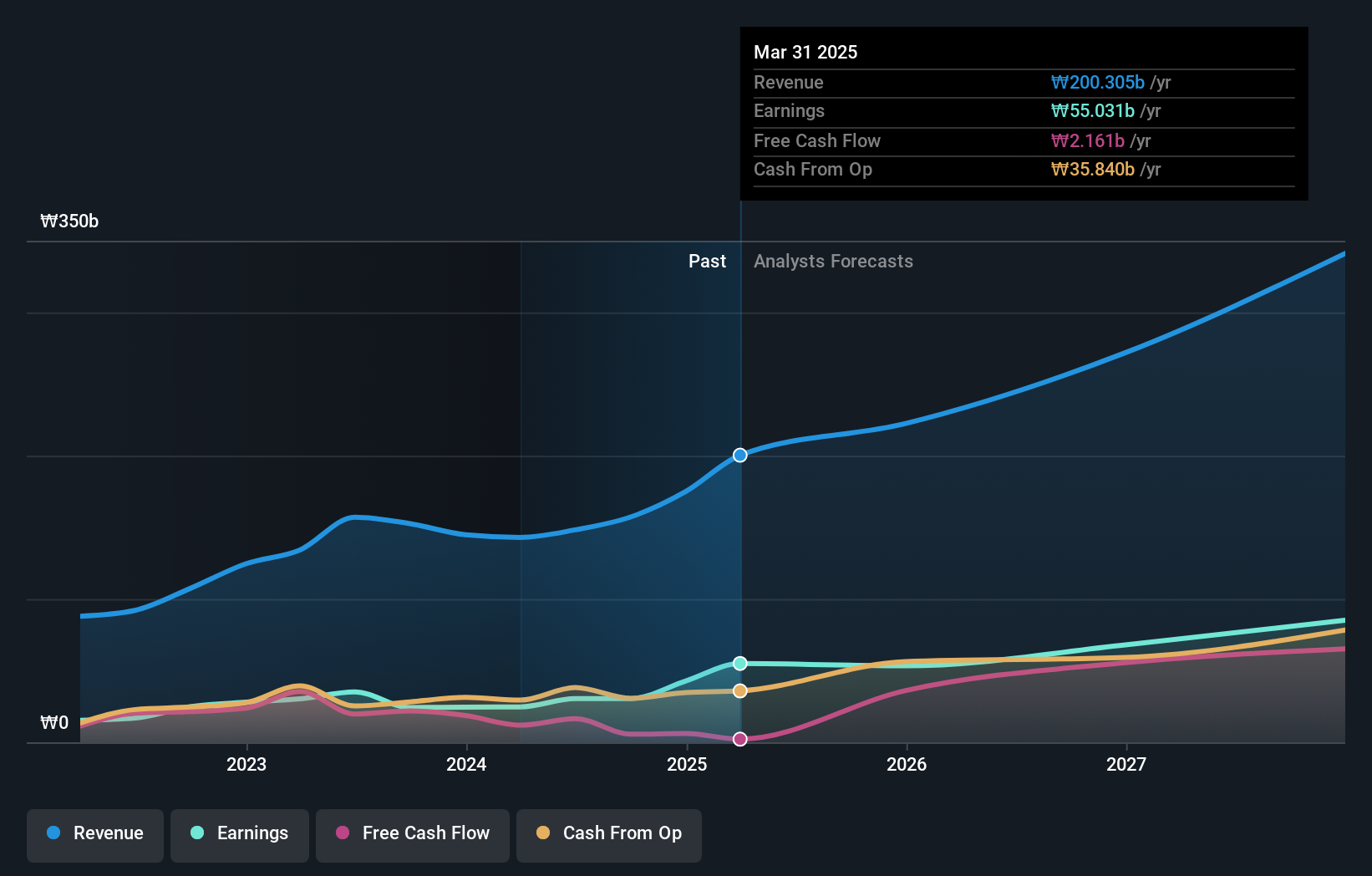

Park Systems' recent release of the FX200 atomic force microscope (AFM) marks a significant technological leap, enhancing both research and industrial applications. The company's focus on R&D is evident with an expenditure growth rate of 22.5%, driving innovation such as the FX200, which features advanced mechanics for lower noise and minimal thermal drift. Despite a past earnings decline of 18.6%, projected annual earnings growth at 37.5% and revenue growth at 22.5% underscore its potential in South Korea's tech landscape.

- Click to explore a detailed breakdown of our findings in Park Systems' health report.

Gain insights into Park Systems' past trends and performance with our Past report.

Intellian Technologies (KOSDAQ:A189300)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Intellian Technologies, Inc. specializes in providing satellite antennas and terminals both in South Korea and internationally, with a market cap of ₩569.23 billion.

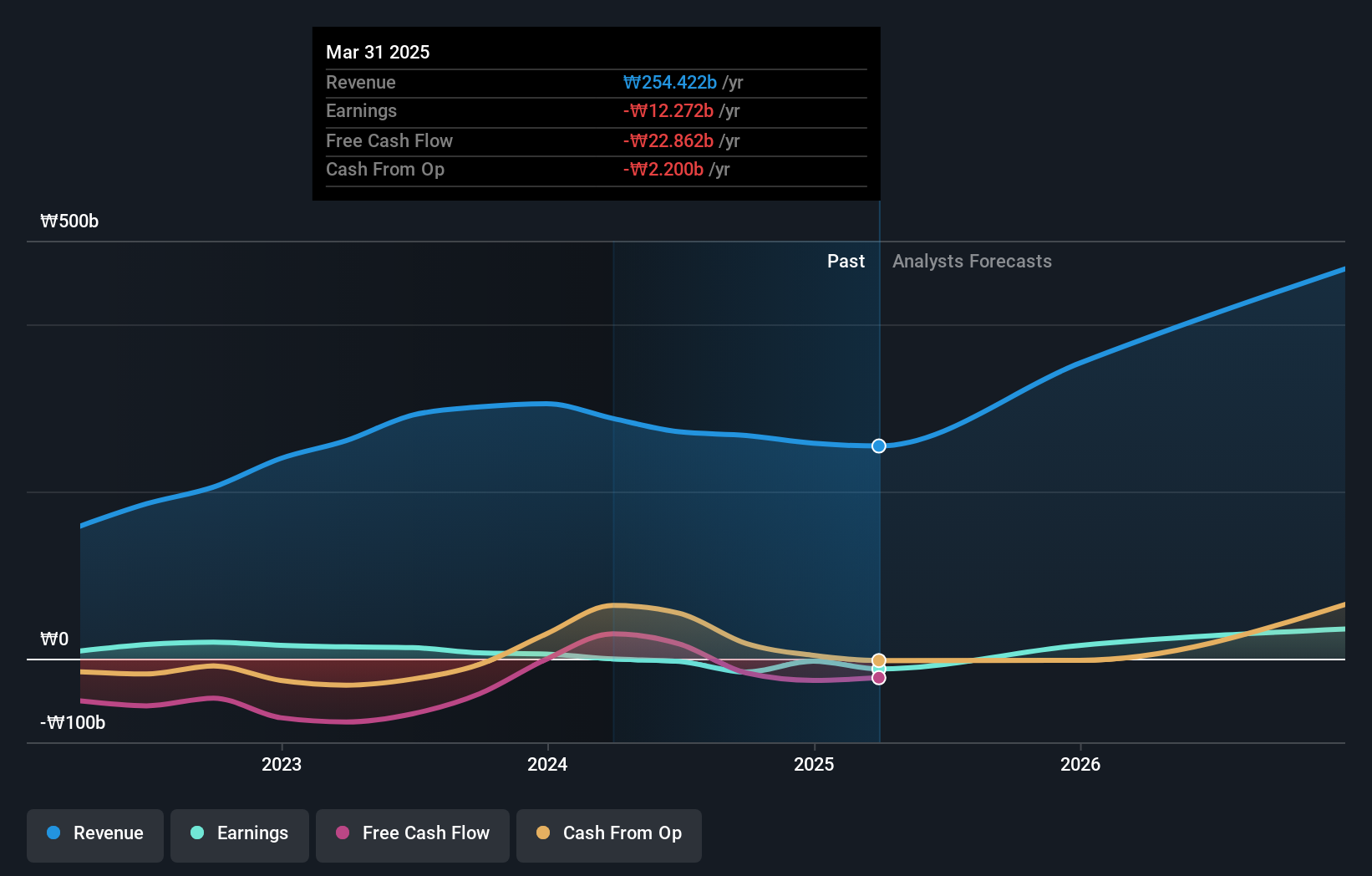

Operations: The company generates revenue primarily from the sale of telecommunication equipment, amounting to ₩287.35 billion. Its operations span both domestic and international markets, focusing on satellite antennas and terminals.

Intellian Technologies' robust R&D expenditure, comprising 12.5% of its revenue, underscores its commitment to innovation in satellite communication systems. The company's revenue growth is forecasted at 30.2% annually, significantly outpacing the Korean market's 10.7%. Additionally, earnings are expected to surge by 78.3% per year over the next three years, reflecting strong future prospects despite current unprofitability. Recent share repurchases totaling KRW 4.99 billion further indicate confidence in long-term value creation.

Lotte Energy Materials (KOSE:A020150)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lotte Energy Materials Corporation, with a market cap of ₩1.63 trillion, produces and sells elecfoils in Korea and internationally.

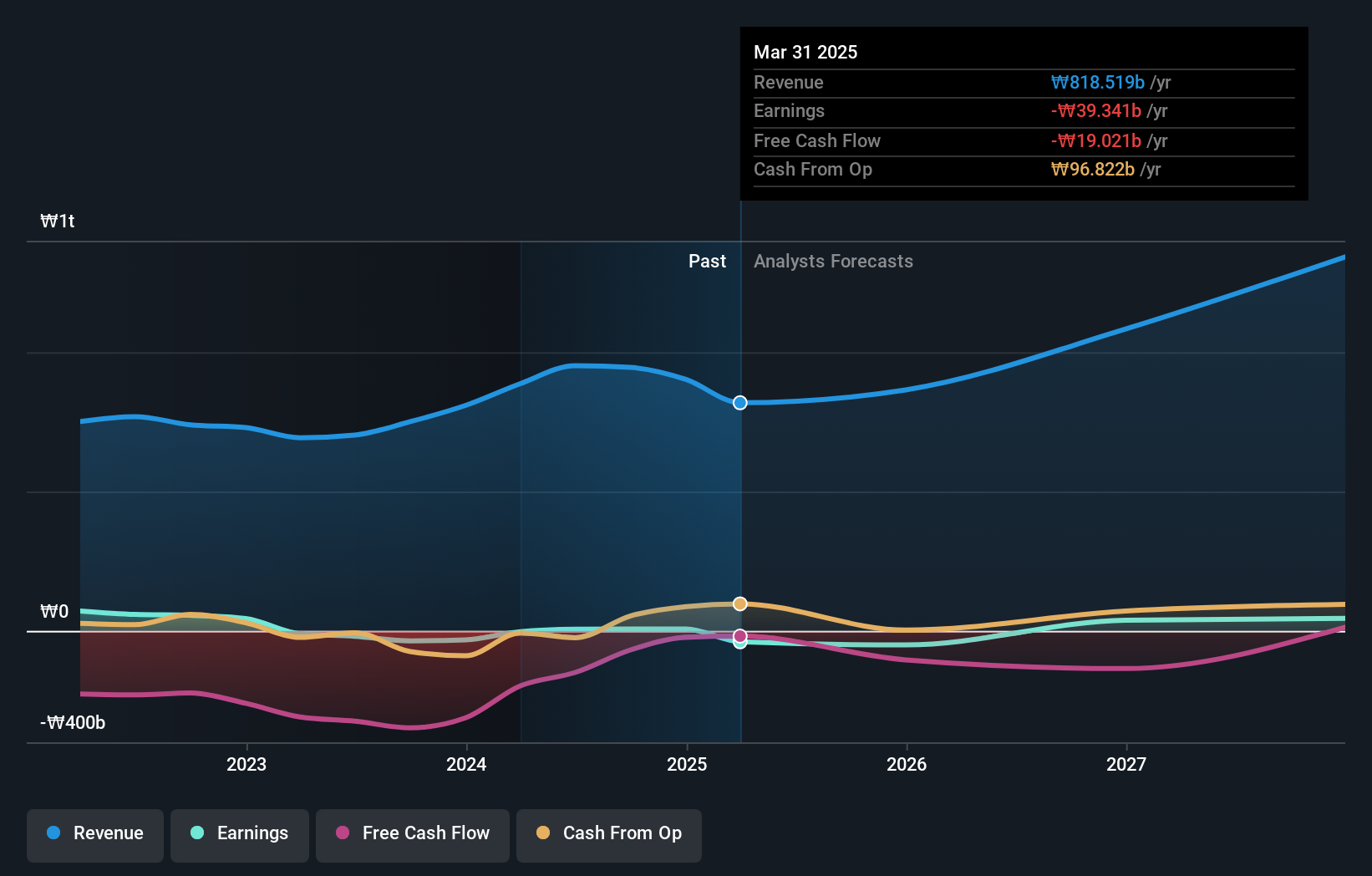

Operations: The company generates revenue primarily from its manufacturing sector, contributing ₩728.15 billion, and the service sector, adding ₩201.60 million. The net profit margin for the latest period stands at 12%.

Lotte Energy Materials' strategic focus on R&D, with expenditures accounting for 17.0% of revenue, highlights its dedication to advancing energy storage solutions. The company projects a robust annual earnings growth rate of 57.05%, significantly outpacing the market average of 10.7%. Recent share repurchases amounting to ₩4 billion signal confidence in long-term value creation. As South Korea's tech landscape evolves, Lotte's innovations in battery materials position it favorably for future industry demands and partnerships with major clients like Samsung SDI.

Seize The Opportunity

- Unlock more gems! Our KRX High Growth Tech and AI Stocks screener has unearthed 45 more companies for you to explore.Click here to unveil our expertly curated list of 48 KRX High Growth Tech and AI Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A140860

Park Systems

Develops, manufactures, and sells atomic force microscopy (AFM) systems worldwide.

Exceptional growth potential with excellent balance sheet.