- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A179900

UTI Inc.'s (KOSDAQ:179900) 11% gain last week benefited both retail investors who own 53% as well as insiders

Key Insights

- UTI's significant retail investors ownership suggests that the key decisions are influenced by shareholders from the larger public

- 42% of the business is held by the top 13 shareholders

- Insider ownership in UTI is 28%

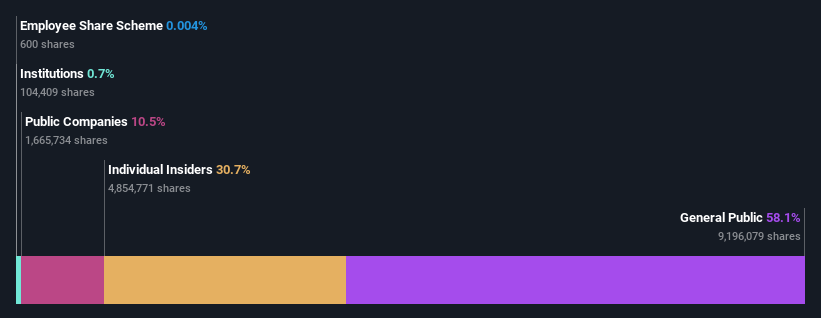

Every investor in UTI Inc. (KOSDAQ:179900) should be aware of the most powerful shareholder groups. The group holding the most number of shares in the company, around 53% to be precise, is retail investors. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

While retail investors were the group that benefitted the most from last week’s ₩40b market cap gain, insiders too had a 28% share in those profits.

In the chart below, we zoom in on the different ownership groups of UTI.

View our latest analysis for UTI

What Does The Lack Of Institutional Ownership Tell Us About UTI?

Institutional investors often avoid companies that are too small, too illiquid or too risky for their tastes. But it's unusual to see larger companies without any institutional investors.

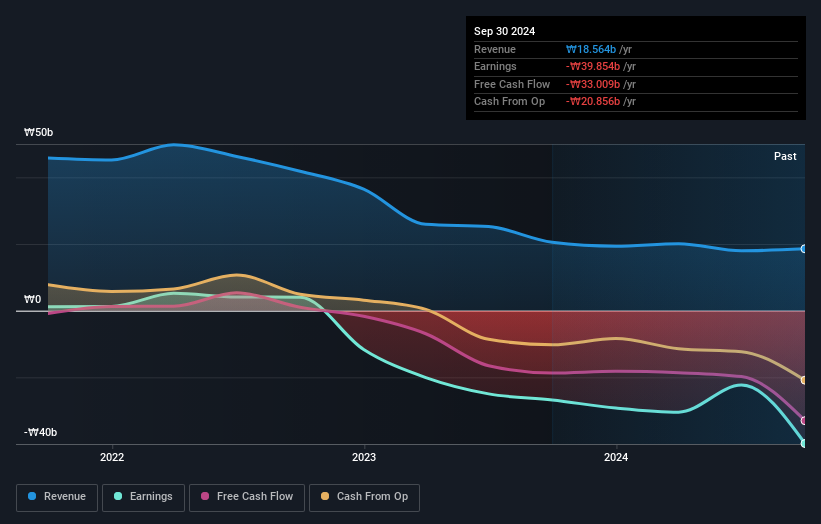

There could be various reasons why no institutions own shares in a company. Typically, small, newly listed companies don't attract much attention from fund managers, because it would not be possible for large fund managers to build a meaningful position in the company. It is also possible that fund managers don't own the stock because they aren't convinced it will perform well. Institutional investors may not find the historic growth of the business impressive, or there might be other factors at play. You can see the past revenue performance of UTI, for yourself, below.

Hedge funds don't have many shares in UTI. Looking at our data, we can see that the largest shareholder is the CEO Deok-Yeong Park with 29% of shares outstanding. With 11% and 0.9% of the shares outstanding respectively, Corning Incorporated and Tae-Hun Ko are the second and third largest shareholders.

A deeper look at our ownership data shows that the top 13 shareholders collectively hold less than half of the register, suggesting a large group of small holders where no single shareholder has a majority.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. Our information suggests that there isn't any analyst coverage of the stock, so it is probably little known.

Insider Ownership Of UTI

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

It seems insiders own a significant proportion of UTI Inc.. Insiders own ₩112b worth of shares in the ₩402b company. It is great to see insiders so invested in the business. It might be worth checking if those insiders have been buying recently.

General Public Ownership

The general public -- including retail investors -- own 53% of UTI. This size of ownership gives investors from the general public some collective power. They can and probably do influence decisions on executive compensation, dividend policies and proposed business acquisitions.

Public Company Ownership

It appears to us that public companies own 9.5% of UTI. We can't be certain but it is quite possible this is a strategic stake. The businesses may be similar, or work together.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for UTI that you should be aware of before investing here.

If you would prefer check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, backed by strong financial data.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A179900

UTI

Engages in the research, development, manufacture, and sale of smartphone camera windows and sensor glasses in South Korea and internationally.

Exceptional growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)