- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A168360

PEMTRON Corporation's (KOSDAQ:168360) 26% Share Price Plunge Could Signal Some Risk

The PEMTRON Corporation (KOSDAQ:168360) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 12% in that time.

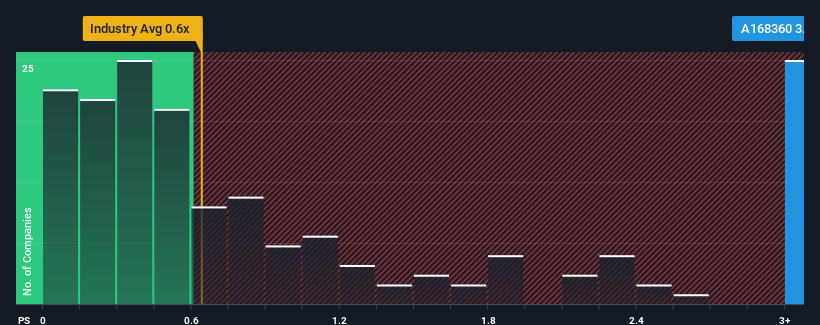

In spite of the heavy fall in price, when almost half of the companies in Korea's Electronic industry have price-to-sales ratios (or "P/S") below 0.6x, you may still consider PEMTRON as a stock not worth researching with its 3.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for PEMTRON

How Has PEMTRON Performed Recently?

For instance, PEMTRON's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for PEMTRON, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, PEMTRON would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 23%. As a result, revenue from three years ago have also fallen 1.5% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 8.5% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we find it worrying that PEMTRON's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What Does PEMTRON's P/S Mean For Investors?

Even after such a strong price drop, PEMTRON's P/S still exceeds the industry median significantly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that PEMTRON currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

It is also worth noting that we have found 3 warning signs for PEMTRON that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A168360

PEMTRON

Develops, manufactures, and supplies electronic product parts and semiconductor inspection equipment.

Low risk with worrying balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)