- South Korea

- /

- Tech Hardware

- /

- KOSDAQ:A089150

These 4 Measures Indicate That Korea Computer Terminal (KOSDAQ:089150) Is Using Debt Reasonably Well

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Korea Computer Terminal Inc. (KOSDAQ:089150) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Korea Computer Terminal

How Much Debt Does Korea Computer Terminal Carry?

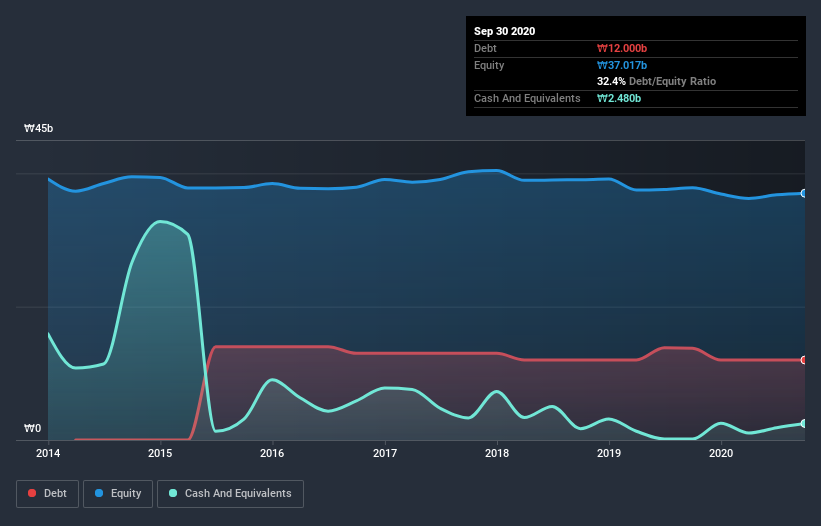

You can click the graphic below for the historical numbers, but it shows that Korea Computer Terminal had ₩12.0b of debt in September 2020, down from ₩13.7b, one year before. However, it also had ₩2.48b in cash, and so its net debt is ₩9.51b.

A Look At Korea Computer Terminal's Liabilities

The latest balance sheet data shows that Korea Computer Terminal had liabilities of ₩1.97b due within a year, and liabilities of ₩17.6b falling due after that. Offsetting this, it had ₩2.48b in cash and ₩707.5m in receivables that were due within 12 months. So its liabilities total ₩16.4b more than the combination of its cash and short-term receivables.

Given Korea Computer Terminal has a market capitalization of ₩93.8b, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Korea Computer Terminal's debt is 3.9 times its EBITDA, and its EBIT cover its interest expense 4.5 times over. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Sadly, Korea Computer Terminal's EBIT actually dropped 8.2% in the last year. If that earnings trend continues then its debt load will grow heavy like the heart of a polar bear watching its sole cub. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Korea Computer Terminal will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Korea Computer Terminal actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

On our analysis Korea Computer Terminal's conversion of EBIT to free cash flow should signal that it won't have too much trouble with its debt. But the other factors we noted above weren't so encouraging. For example, its net debt to EBITDA makes us a little nervous about its debt. When we consider all the elements mentioned above, it seems to us that Korea Computer Terminal is managing its debt quite well. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Korea Computer Terminal (of which 1 is potentially serious!) you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Korea Computer Terminal, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Korea Computer Terminal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A089150

Korea Computer Terminal

Manufactures and sells terminals in South Korea and internationally.

Questionable track record with imperfect balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)