- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A088130

There's A Lot To Like About Dong A Eltek's (KOSDAQ:088130) Upcoming ₩150 Dividend

Dong A Eltek Co., Ltd. (KOSDAQ:088130) is about to trade ex-dividend in the next three days. Ex-dividend means that investors that purchase the stock on or after the 29th of December will not receive this dividend, which will be paid on the 21st of April.

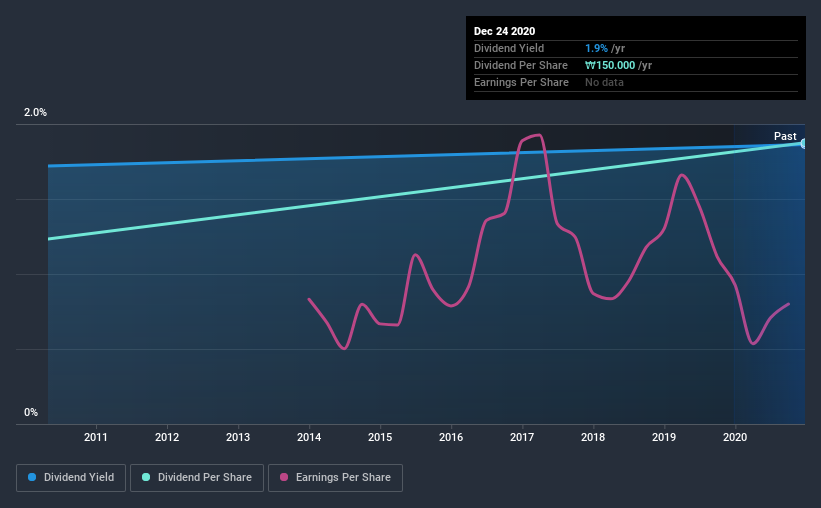

Dong A Eltek's next dividend payment will be ₩150 per share, and in the last 12 months, the company paid a total of ₩150 per share. Last year's total dividend payments show that Dong A Eltek has a trailing yield of 1.9% on the current share price of ₩8050. If you buy this business for its dividend, you should have an idea of whether Dong A Eltek's dividend is reliable and sustainable. So we need to investigate whether Dong A Eltek can afford its dividend, and if the dividend could grow.

Check out our latest analysis for Dong A Eltek

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Dong A Eltek paid out just 16% of its profit last year, which we think is conservatively low and leaves plenty of margin for unexpected circumstances. A useful secondary check can be to evaluate whether Dong A Eltek generated enough free cash flow to afford its dividend. Fortunately, it paid out only 31% of its free cash flow in the past year.

It's positive to see that Dong A Eltek's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see how much of its profit Dong A Eltek paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. With that in mind, we're encouraged by the steady growth at Dong A Eltek, with earnings per share up 3.7% on average over the last five years. Recent earnings growth has been limited. Yet there are several ways to grow the dividend, and one of them is simply that the company may choose to pay out more of its earnings as dividends.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Dong A Eltek has delivered 4.3% dividend growth per year on average over the past 10 years. It's encouraging to see the company lifting dividends while earnings are growing, suggesting at least some corporate interest in rewarding shareholders.

The Bottom Line

From a dividend perspective, should investors buy or avoid Dong A Eltek? Earnings per share have been growing moderately, and Dong A Eltek is paying out less than half its earnings and cash flow as dividends, which is an attractive combination as it suggests the company is investing in growth. It might be nice to see earnings growing faster, but Dong A Eltek is being conservative with its dividend payouts and could still perform reasonably over the long run. Dong A Eltek looks solid on this analysis overall, and we'd definitely consider investigating it more closely.

So while Dong A Eltek looks good from a dividend perspective, it's always worthwhile being up to date with the risks involved in this stock. We've identified 2 warning signs with Dong A Eltek (at least 1 which makes us a bit uncomfortable), and understanding these should be part of your investment process.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Dong A Eltek, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A088130

Dong A Eltek

Manufactures and sells display equipment in South Korea and internationally.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)