- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A057540

Should OmnisystemLtd (KOSDAQ:057540) Be Disappointed With Their 22% Profit?

Omnisystem Co.,Ltd. (KOSDAQ:057540) shareholders might be concerned after seeing the share price drop 13% in the last month. Taking a longer term view we see the stock is up over one year. But to be blunt its return of 22% fall short of what you could have got from an index fund (around 34%).

View our latest analysis for OmnisystemLtd

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year OmnisystemLtd saw its earnings per share (EPS) drop below zero. While some may see this as temporary, we're a skeptical bunch, and so we're a little surprised to see the share price go up. It may be that the company has done well on other metrics.

OmnisystemLtd's revenue actually dropped 5.6% over last year. So the fundamental metrics don't provide an obvious explanation for the share price gain.

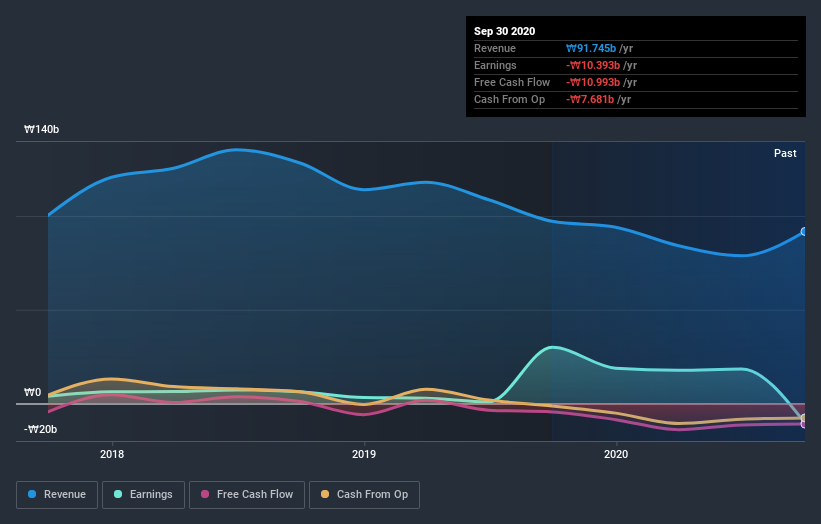

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on OmnisystemLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

OmnisystemLtd shareholders gained a total return of 22% during the year. But that was short of the market average. But at least that's still a gain! Over five years the TSR has been a reduction of 2% per year, over five years. It could well be that the business is stabilizing. It's always interesting to track share price performance over the longer term. But to understand OmnisystemLtd better, we need to consider many other factors. For example, we've discovered 2 warning signs for OmnisystemLtd that you should be aware of before investing here.

We will like OmnisystemLtd better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading OmnisystemLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A057540

OmnisystemLtd

Manufactures and sells meter reading systems in South Korea.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026