- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A054800

Some Investors May Be Willing To Look Past IDIS Holdings' (KOSDAQ:054800) Soft Earnings

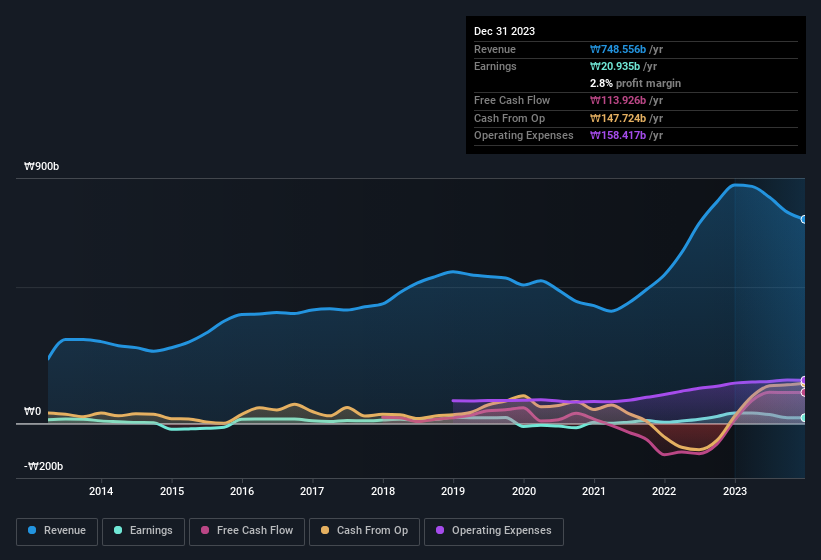

Shareholders appeared unconcerned with IDIS Holdings Co., Ltd.'s (KOSDAQ:054800) lackluster earnings report last week. Our analysis suggests that while the profits are soft, the foundations of the business are strong.

Check out our latest analysis for IDIS Holdings

A Closer Look At IDIS Holdings' Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

IDIS Holdings has an accrual ratio of -0.15 for the year to December 2023. That implies it has very good cash conversion, and that its earnings in the last year actually significantly understate its free cash flow. To wit, it produced free cash flow of ₩114b during the period, dwarfing its reported profit of ₩20.9b. IDIS Holdings' free cash flow improved over the last year, which is generally good to see. Unfortunately for shareholders, the company has also been issuing new shares, diluting their share of future earnings.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of IDIS Holdings.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. In fact, IDIS Holdings increased the number of shares on issue by 11% over the last twelve months by issuing new shares. As a result, its net income is now split between a greater number of shares. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. You can see a chart of IDIS Holdings' EPS by clicking here.

How Is Dilution Impacting IDIS Holdings' Earnings Per Share (EPS)?

IDIS Holdings has improved its profit over the last three years, with an annualized gain of 340% in that time. Net profit actually dropped by 45% in the last year. Unfortunately for shareholders, though, the earnings per share result was even worse, declining 41%. So you can see that the dilution has had a bit of an impact on shareholders.

In the long term, if IDIS Holdings' earnings per share can increase, then the share price should too. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Our Take On IDIS Holdings' Profit Performance

In conclusion, IDIS Holdings has a strong cashflow relative to earnings, which indicates good quality earnings, but the dilution means its earnings per share are dropping faster than its profit. Considering the aforementioned, we think that IDIS Holdings' profits are probably a reasonable reflection of its underlying profitability; although we'd be confident in that conclusion if we saw a cleaner set of results. If you'd like to know more about IDIS Holdings as a business, it's important to be aware of any risks it's facing. At Simply Wall St, we found 4 warning signs for IDIS Holdings and we think they deserve your attention.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A054800

IDIS Holdings

Through its subsidiaries, engages in the manufacture and distribution of video security devices in South Korea and internationally.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026