- South Korea

- /

- Communications

- /

- KOSDAQ:A051980

JOONGANG ADVANCED MATERIALS Co., Ltd.'s (KOSDAQ:051980) 33% Share Price Plunge Could Signal Some Risk

To the annoyance of some shareholders, JOONGANG ADVANCED MATERIALS Co., Ltd. (KOSDAQ:051980) shares are down a considerable 33% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 83% loss during that time.

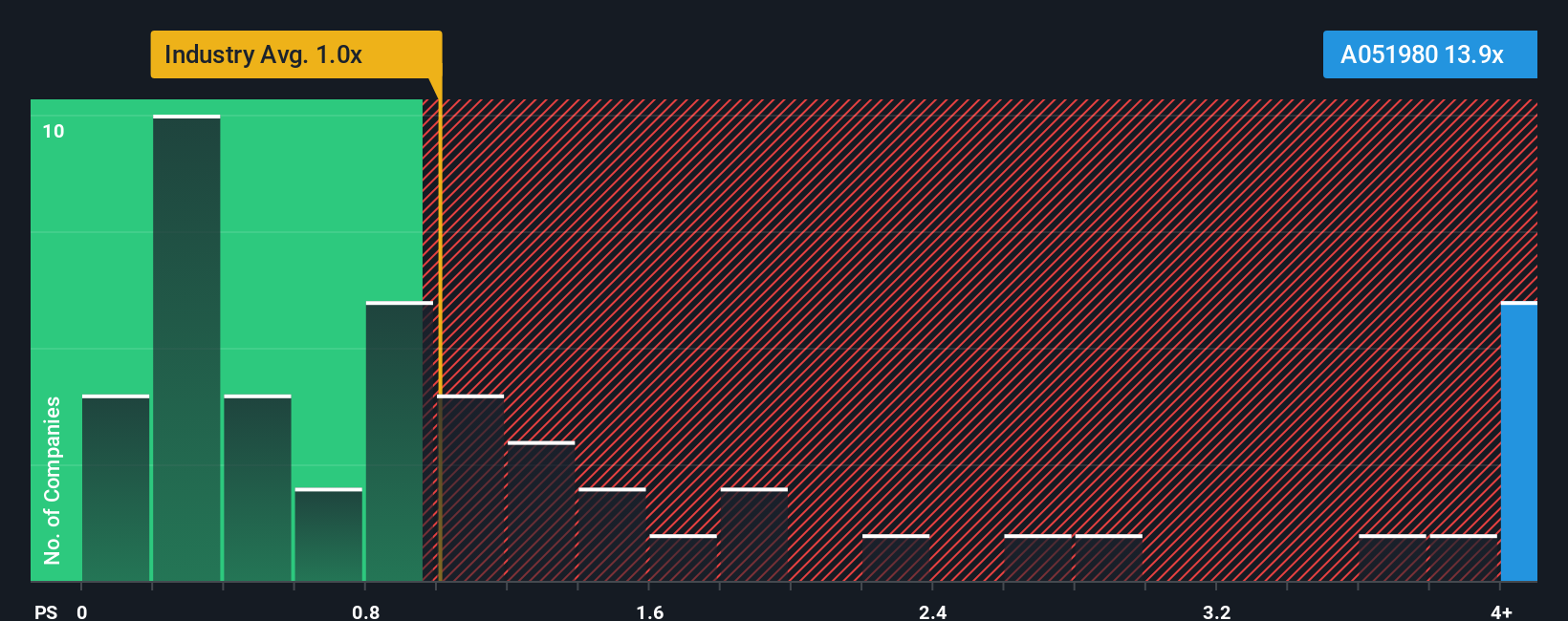

Even after such a large drop in price, you could still be forgiven for thinking JOONGANG ADVANCED MATERIALS is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 13.9x, considering almost half the companies in Korea's Communications industry have P/S ratios below 1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for JOONGANG ADVANCED MATERIALS

How JOONGANG ADVANCED MATERIALS Has Been Performing

For instance, JOONGANG ADVANCED MATERIALS' receding revenue in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on JOONGANG ADVANCED MATERIALS' earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For JOONGANG ADVANCED MATERIALS?

In order to justify its P/S ratio, JOONGANG ADVANCED MATERIALS would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 28%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 9.1% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Comparing that to the industry, which is predicted to deliver 31% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in mind, we find it worrying that JOONGANG ADVANCED MATERIALS' P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Bottom Line On JOONGANG ADVANCED MATERIALS' P/S

Even after such a strong price drop, JOONGANG ADVANCED MATERIALS' P/S still exceeds the industry median significantly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of JOONGANG ADVANCED MATERIALS revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found 3 warning signs for JOONGANG ADVANCED MATERIALS (1 is significant!) that you need to take into consideration.

If you're unsure about the strength of JOONGANG ADVANCED MATERIALS' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A051980

JOONGANG ADVANCED MATERIALS

Manufactures and sells windows, doors, light emitting diode lightings, medical devices, plastic products, and ventilation flat ducts in the Middle East, Asia, and internationally.

Flawless balance sheet with very low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)