- South Korea

- /

- IT

- /

- KOSDAQ:A351330

Subdued Growth No Barrier To ISAAC Engineering Co.,Ltd (KOSDAQ:351330) With Shares Advancing 27%

ISAAC Engineering Co.,Ltd (KOSDAQ:351330) shareholders have had their patience rewarded with a 27% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 37% in the last year.

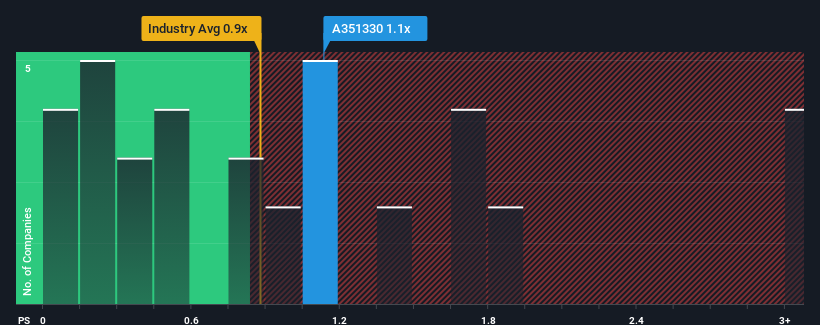

Even after such a large jump in price, you could still be forgiven for feeling indifferent about ISAAC EngineeringLtd's P/S ratio of 1.1x, since the median price-to-sales (or "P/S") ratio for the IT industry in Korea is also close to 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for ISAAC EngineeringLtd

What Does ISAAC EngineeringLtd's P/S Mean For Shareholders?

Recent times have been pleasing for ISAAC EngineeringLtd as its revenue has risen in spite of the industry's average revenue going into reverse. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think ISAAC EngineeringLtd's future stacks up against the industry? In that case, our free report is a great place to start.How Is ISAAC EngineeringLtd's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like ISAAC EngineeringLtd's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 68% last year. The strong recent performance means it was also able to grow revenue by 138% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 15% during the coming year according to the sole analyst following the company. Meanwhile, the broader industry is forecast to expand by 7.9%, which paints a poor picture.

In light of this, it's somewhat alarming that ISAAC EngineeringLtd's P/S sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What We Can Learn From ISAAC EngineeringLtd's P/S?

Its shares have lifted substantially and now ISAAC EngineeringLtd's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It appears that ISAAC EngineeringLtd currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

You always need to take note of risks, for example - ISAAC EngineeringLtd has 2 warning signs we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A351330

ISAAC EngineeringLtd

An engineering service company, provides optimal solutions for process and factory automation.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)