- South Korea

- /

- Software

- /

- KOSDAQ:A263800

There's No Escaping Datasolution, Inc.'s (KOSDAQ:263800) Muted Revenues Despite A 34% Share Price Rise

Datasolution, Inc. (KOSDAQ:263800) shareholders would be excited to see that the share price has had a great month, posting a 34% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 8.1% over the last year.

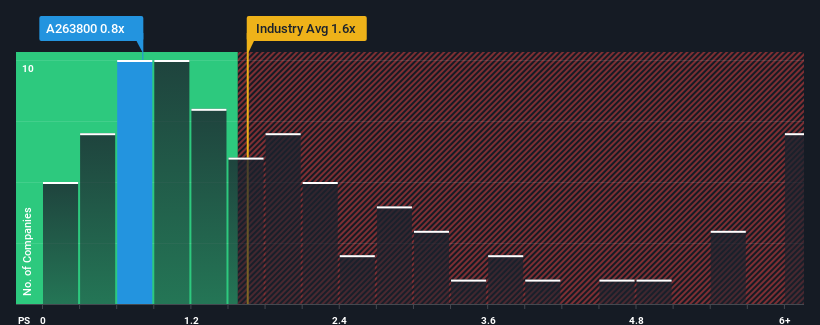

In spite of the firm bounce in price, considering around half the companies operating in Korea's Software industry have price-to-sales ratios (or "P/S") above 1.6x, you may still consider Datasolution as an solid investment opportunity with its 0.8x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Datasolution

How Datasolution Has Been Performing

Revenue has risen firmly for Datasolution recently, which is pleasing to see. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. Those who are bullish on Datasolution will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Datasolution, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Datasolution's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 9.0% gain to the company's revenues. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 19% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Datasolution's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Key Takeaway

The latest share price surge wasn't enough to lift Datasolution's P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

In line with expectations, Datasolution maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Datasolution (1 is concerning!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Datasolution, explore our interactive list of high quality stocks to get an idea of what else is out there.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A263800

Excellent balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)