- South Korea

- /

- IT

- /

- KOSDAQ:A173130

Here's Why We Think OPASNET (KOSDAQ:173130) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in OPASNET (KOSDAQ:173130). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide OPASNET with the means to add long-term value to shareholders.

View our latest analysis for OPASNET

OPASNET's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Shareholders will be happy to know that OPASNET's EPS has grown 20% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

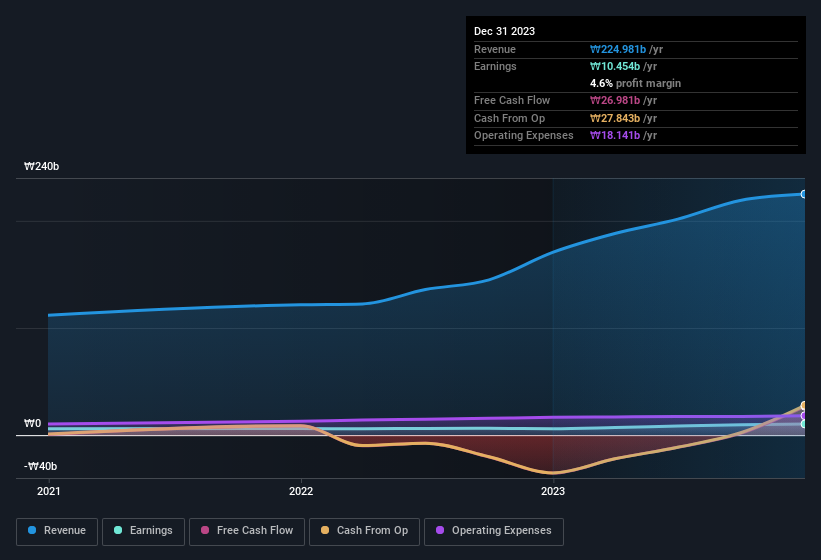

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. OPASNET maintained stable EBIT margins over the last year, all while growing revenue 32% to ₩225b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Since OPASNET is no giant, with a market capitalisation of ₩105b, you should definitely check its cash and debt before getting too excited about its prospects.

Are OPASNET Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that OPASNET insiders own a significant number of shares certainly is appealing. Owning 44% of the company, insiders have plenty riding on the performance of the the share price. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. In terms of absolute value, insiders have ₩46b invested in the business, at the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Is OPASNET Worth Keeping An Eye On?

For growth investors, OPASNET's raw rate of earnings growth is a beacon in the night. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with OPASNET , and understanding them should be part of your investment process.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of South Korean companies which have demonstrated growth backed by recent insider purchases.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A173130

OPASNET

Operates as an information technology (IT) solutions company in South Korea.

Outstanding track record with excellent balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026