- South Korea

- /

- Software

- /

- KOSDAQ:A108860

High Growth Tech Stocks in Asia to Watch This December 2025

Reviewed by Simply Wall St

As global markets remain focused on the potential for interest rate cuts and shifting economic indicators, Asian tech stocks have attracted attention amid a backdrop of mixed manufacturing data and evolving consumer sentiment. In this environment, identifying high-growth opportunities often involves looking for companies with strong innovation capabilities and adaptability to changing market conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Fositek | 37.83% | 51.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 35.80% | 36.87% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Zhongji Innolight | 34.82% | 35.50% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Selvas AI (KOSDAQ:A108860)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Selvas AI Inc. is an artificial intelligence company based in South Korea with a market capitalization of ₩400.22 billion.

Operations: Selvas AI Inc. focuses on artificial intelligence technologies in South Korea, with a market capitalization of ₩400.22 billion.

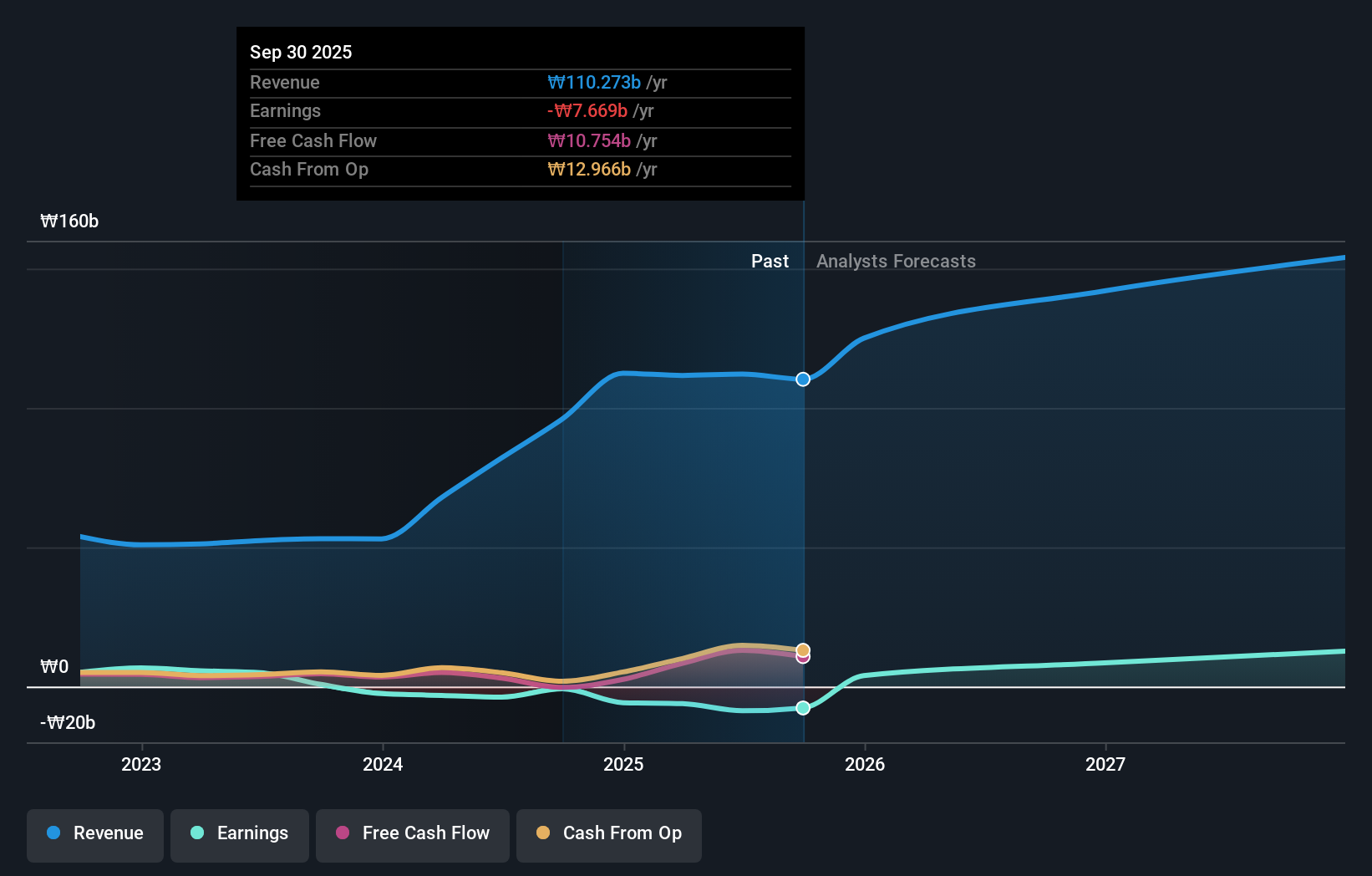

Selvas AI, a contender in the high-growth tech sector in Asia, is navigating a challenging landscape with its recent earnings revealing significant swings. In the latest quarter, it turned a net income of KRW 888.64 million from a prior loss, showing resilience and potential for recovery. Despite this rebound, annual revenue growth at 13.6% trails behind the more aggressive industry benchmarks but exceeds Korea's average market growth of 10.4%. The company's commitment to innovation is evident from its R&D spending trends which are crucial for sustaining long-term competitiveness in the software industry. Looking ahead, Selvas AI is expected to achieve profitability within three years with earnings projected to surge by approximately 91.8% annually—a promising outlook that underscores its potential amidst prevailing market challenges.

- Dive into the specifics of Selvas AI here with our thorough health report.

Explore historical data to track Selvas AI's performance over time in our Past section.

Yidu Tech (SEHK:2158)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Yidu Tech Inc. is an investment holding company that offers healthcare solutions utilizing big data and artificial intelligence technologies across the People's Republic of China, Brunei, Singapore, and internationally, with a market cap of HK$5.43 billion.

Operations: Yidu Tech generates revenue through three primary segments: Life Sciences Solutions (CN¥240.75 million), Big Data Platform and Solutions (CN¥365.40 million), and Health Management Platform and Solutions (CN¥137.49 million). The company leverages big data and AI technologies to provide these healthcare solutions across multiple regions, including China, Brunei, Singapore, and beyond.

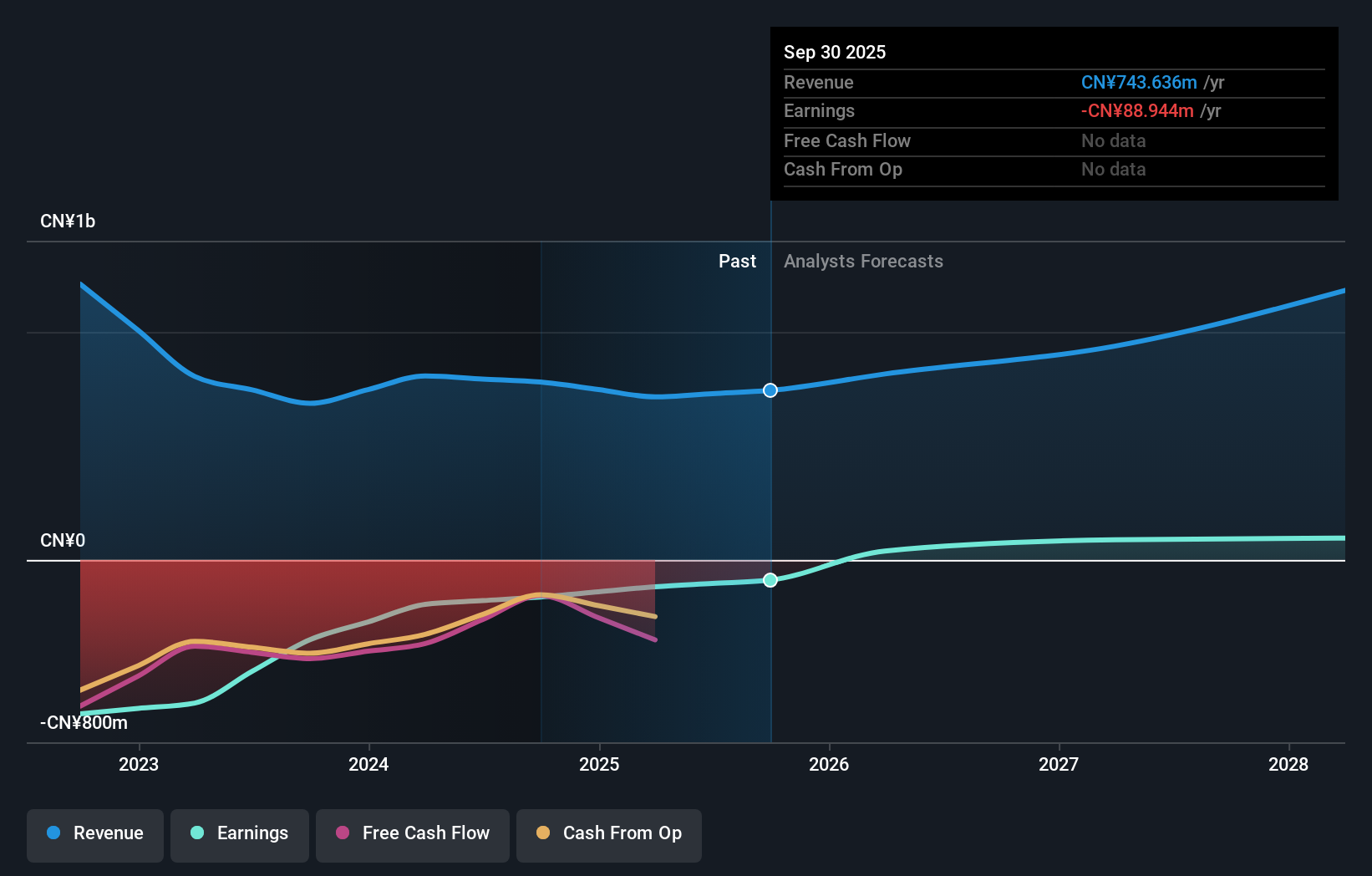

Yidu Tech, navigating through a transformative phase, reported a narrowed net loss to CNY 14.6 million from CNY 43.45 million year-over-year, alongside a sales increase to CNY 358.11 million. This reflects an improving trajectory with revenue growth outpacing the Hong Kong market's average by nearly 10%. The firm's strategic share repurchases initiated in September aim to bolster shareholder value by potentially enhancing per-share metrics. With earnings projected to soar by an annualized rate of 103.7% and R&D investments pivotal for its long-term positioning in healthcare technology, Yidu Tech seems poised for a turnaround despite current unprofitability.

- Unlock comprehensive insights into our analysis of Yidu Tech stock in this health report.

Gain insights into Yidu Tech's historical performance by reviewing our past performance report.

Bonree Data Technology (SHSE:688229)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bonree Data Technology Co., Ltd offers application performance management services for enterprises in China and has a market cap of CN¥2.67 billion.

Operations: Bonree Data Technology Co., Ltd focuses on delivering application performance management solutions to enterprises in China. The company operates within the technology sector, providing services that enhance the efficiency and reliability of enterprise applications.

Bonree Data Technology, amidst a challenging fiscal period, managed to reduce its net loss to CNY 41.75 million from CNY 63.16 million year-over-year, reflecting a notable improvement despite a slight dip in revenue from CNY 105.12 million to CNY 101 million. This trend underscores the company's resilience in tough market conditions and highlights its commitment to refining operational efficiencies. Moreover, with an annualized earnings growth forecast at an impressive 127%, Bonree is strategically positioning itself for future profitability. The firm's substantial investment in R&D, crucial for maintaining competitive edge in the fast-evolving tech landscape of Asia, signals strong potential for innovation-led growth.

Where To Now?

- Navigate through the entire inventory of 187 Asian High Growth Tech and AI Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A108860

Selvas AI

Operates as an artificial intelligence (AI) company in South Korea.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)