- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A192650

High Growth Tech Stocks To Watch In South Korea August 2024

Reviewed by Simply Wall St

The South Korean market has climbed 1.9% in the last 7 days, with a gain of 4.0%, and over the past 12 months, it is up 3.8%, with earnings forecast to grow by 28% annually. In light of these promising conditions, identifying high-growth tech stocks becomes crucial for investors aiming to capitalize on this upward trend.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ALTEOGEN | 48.67% | 72.95% | ★★★★★★ |

| IMLtd | 20.76% | 106.30% | ★★★★★★ |

| Bioneer | 22.49% | 89.69% | ★★★★★★ |

| NEXON Games | 31.70% | 66.31% | ★★★★★★ |

| Seojin SystemLtd | 34.20% | 58.67% | ★★★★★★ |

| EuBiologics | 28.05% | 93.39% | ★★★★★★ |

| Devsisters | 26.11% | 65.92% | ★★★★★★ |

| AmosenseLtd | 24.29% | 55.45% | ★★★★★★ |

| Park Systems | 22.50% | 37.52% | ★★★★★★ |

| UTI | 103.56% | 122.67% | ★★★★★★ |

Click here to see the full list of 49 stocks from our KRX High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

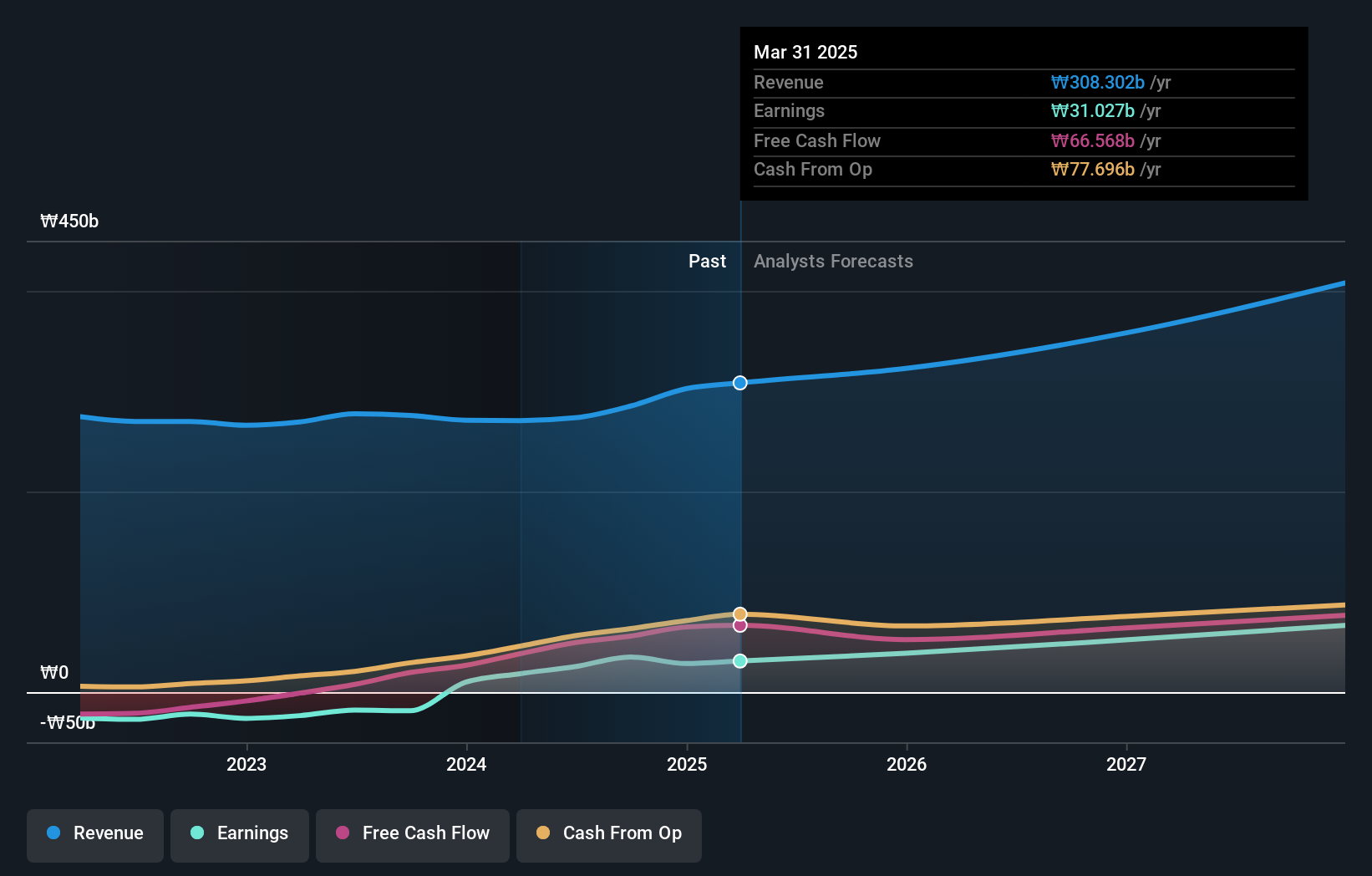

Cafe24 (KOSDAQ:A042000)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cafe24 Corp. operates a global e-commerce platform and has a market cap of ₩872.83 billion.

Operations: Cafe24 Corp. generates revenue primarily through its Internet Business Solution segment, which accounts for ₩229.13 billion, followed by Transit and Clothing segments contributing ₩44.55 billion and ₩19.87 billion respectively. The company also reports consolidated adjustments of -₩14.37 billion in its financials.

South Korea's tech sector is witnessing rapid growth, with Cafe24 standing out due to its robust R&D investments and promising revenue projections. The company’s R&D expenses have surged, accounting for 10.7% of its revenue, highlighting a strong commitment to innovation. Revenue is expected to grow at an impressive 44% per year, outpacing the broader market's growth rate of 10.6%. Despite recent volatility in share price, Cafe24's strategic focus on SaaS models ensures recurring revenue from subscriptions while positioning itself favorably in the competitive landscape. Cafe24 has also made significant strides in expanding its client base by targeting e-commerce businesses seeking comprehensive online solutions. This approach not only broadens their market reach but also enhances customer retention through integrated services. With a forecasted return on equity of 12.5% over the next three years and expectations to achieve profitability within this period, Cafe24 presents a compelling narrative of growth and resilience amidst South Korea’s dynamic tech industry landscape.

- Get an in-depth perspective on Cafe24's performance by reading our health report here.

Assess Cafe24's past performance with our detailed historical performance reports.

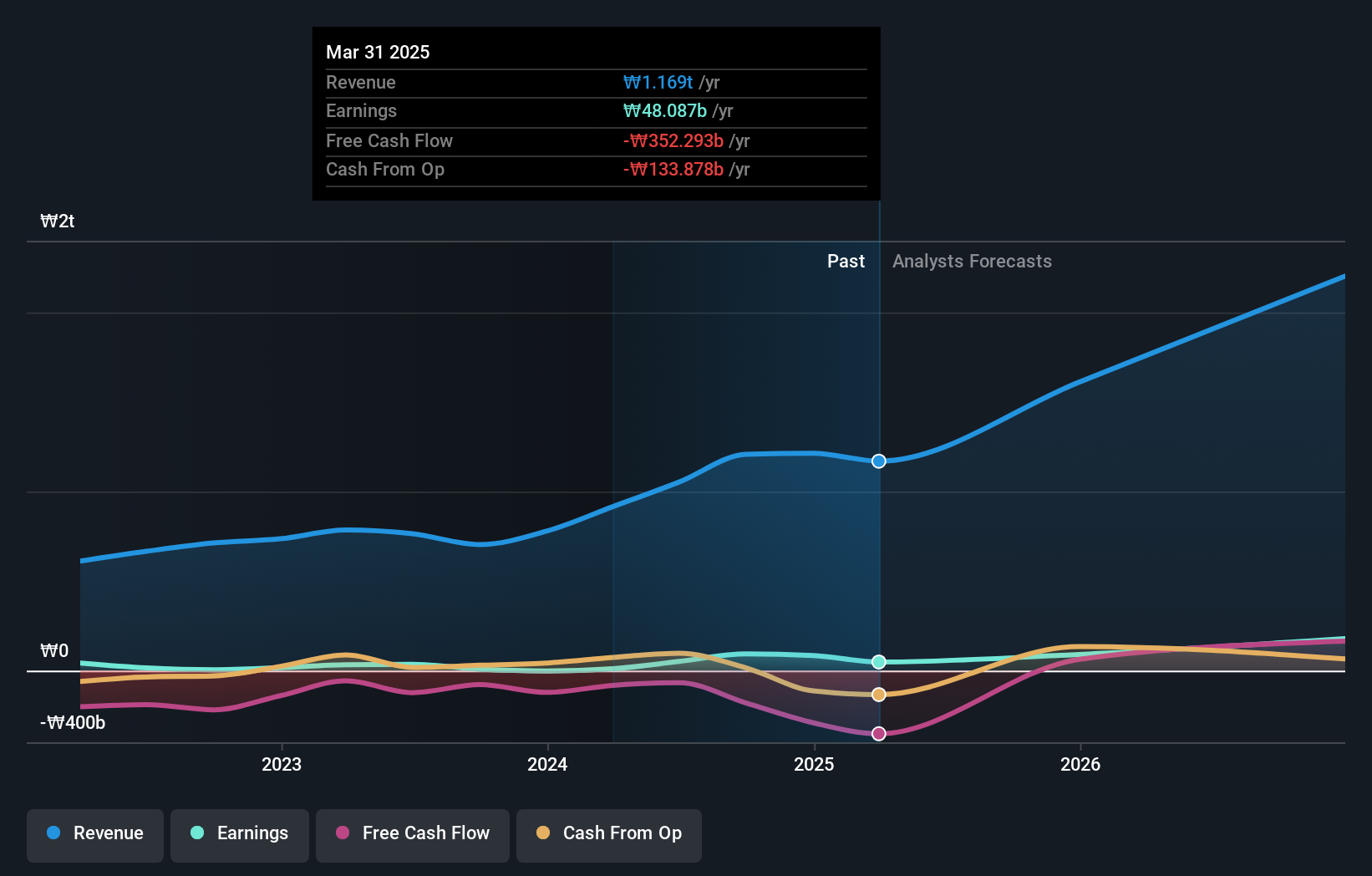

Seojin SystemLtd (KOSDAQ:A178320)

Simply Wall St Growth Rating: ★★★★★★

Overview: Seojin System Co., Ltd. specializes in providing telecom equipment, repeaters, mechanical products, and LED and other equipment with a market cap of ₩1.53 billion.

Operations: Seojin System Co., Ltd. generates revenue primarily from its EMS (₩1.22 billion) and semiconductor (₩158.64 million) segments, with a significant adjustment and removal amount of -₩717.58 million impacting overall figures. The company focuses on telecom equipment, repeaters, mechanical products, and LED equipment within these segments.

Seojin SystemLtd has demonstrated significant growth potential, with revenue expected to grow at 34.2% per year and earnings forecasted to increase by 58.7% annually. The company has also invested heavily in R&D, allocating KRW 20 billion annually, which underscores its commitment to innovation and maintaining a competitive edge in the tech industry. Recently, Seojin raised KRW 100 billion through private placements, enhancing its financial position and capacity for future expansion.

- Unlock comprehensive insights into our analysis of Seojin SystemLtd stock in this health report.

Evaluate Seojin SystemLtd's historical performance by accessing our past performance report.

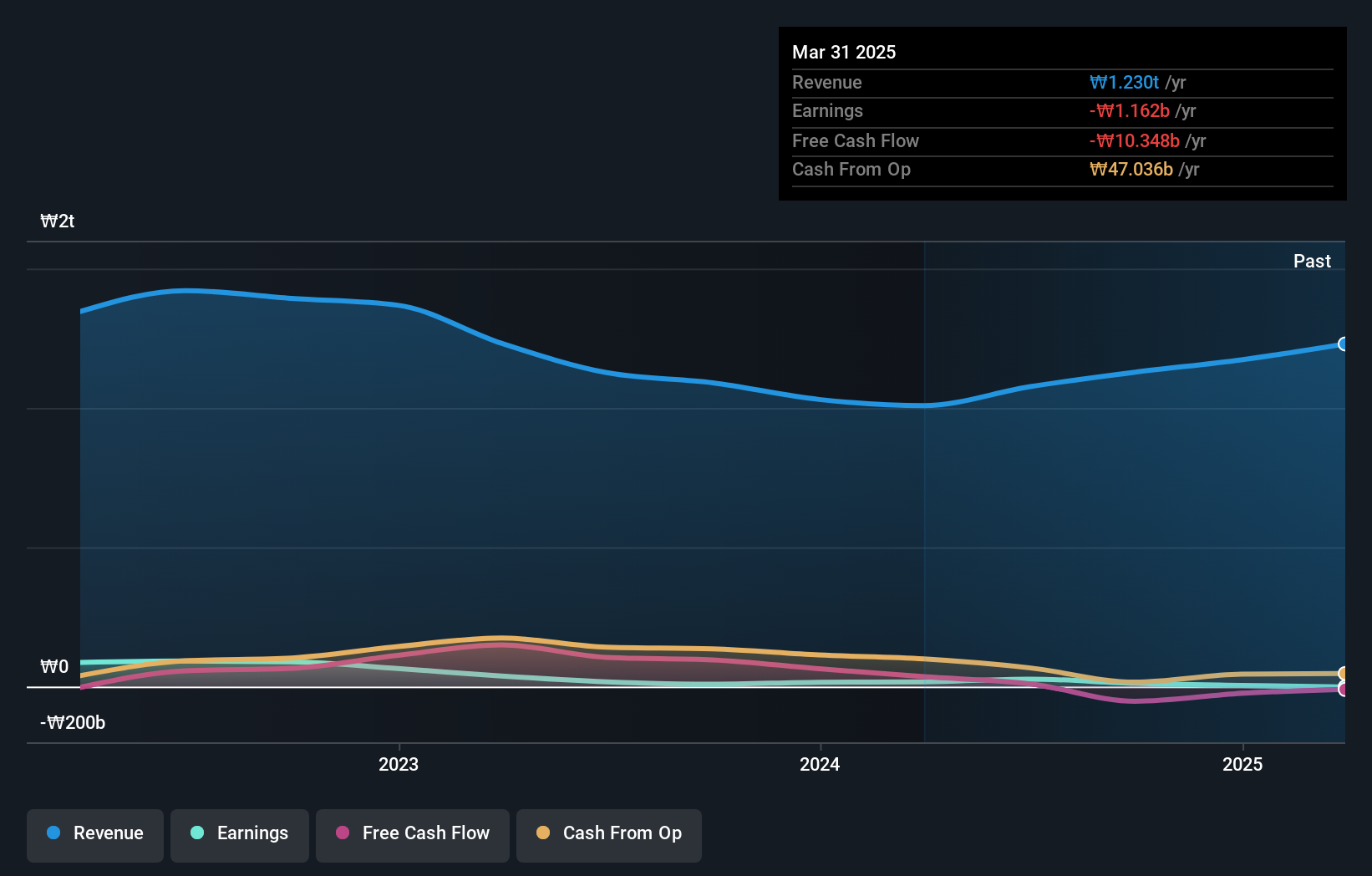

DREAMTECH (KOSE:A192650)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DREAMTECH Co., Ltd. engages in the design, development, and manufacture of modules both in South Korea and internationally, with a market cap of ₩598.61 billion.

Operations: DREAMTECH Co., Ltd. generates revenue primarily from IT & Mobile Communications (₩420.89 billion), Compact Camera Modules (₩354.11 billion), and Biometrics, Healthcare & Convergence (₩232.83 billion). The company focuses on the design, development, and manufacture of these modules for both domestic and international markets.

Dreamtech's strategic alliances, such as the recent collaboration with Saffron Tech, highlight its innovative approach in sectors like beauty and wellness. The company's revenue is projected to grow at 15.4% annually, outpacing the broader KR market growth of 10.6%. Despite a challenging past year with a -55.3% earnings decline, future earnings are expected to rise by 30.3% per year. Dreamtech has also repurchased 459,790 shares for KRW 5 billion this year to enhance shareholder value and stabilize stock price. Investing heavily in R&D with expenditures amounting to KRW 20 billion annually underscores Dreamtech’s commitment to innovation and maintaining a competitive edge in tech industries. This focus on research supports their development of cutting-edge technologies that meet rising demands across various markets. With profit margins currently at 1.7%, down from last year's 3%, there is room for improvement as the company continues its growth trajectory through strategic initiatives and technological advancements.

- Dive into the specifics of DREAMTECH here with our thorough health report.

Review our historical performance report to gain insights into DREAMTECH's's past performance.

Make It Happen

- Access the full spectrum of 49 KRX High Growth Tech and AI Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A192650

DREAMTECH

Engages in the design, development, and manufacture of modules in South Korea and internationally.

Excellent balance sheet with reasonable growth potential.