- South Korea

- /

- Semiconductors

- /

- KOSE:A077500

How Does Uniquest's (KRX:077500) P/E Compare To Its Industry, After Its Big Share Price Gain?

It's really great to see that even after a strong run, Uniquest (KRX:077500) shares have been powering on, with a gain of 36% in the last thirty days. And the full year gain of 14% isn't too shabby, either!

All else being equal, a sharp share price increase should make a stock less attractive to potential investors. In the long term, share prices tend to follow earnings per share, but in the short term prices bounce around in response to short term factors (which are not always obvious). So some would prefer to hold off buying when there is a lot of optimism towards a stock. Perhaps the simplest way to get a read on investors' expectations of a business is to look at its Price to Earnings Ratio (PE Ratio). Investors have optimistic expectations of companies with higher P/E ratios, compared to companies with lower P/E ratios.

See our latest analysis for Uniquest

How Does Uniquest's P/E Ratio Compare To Its Peers?

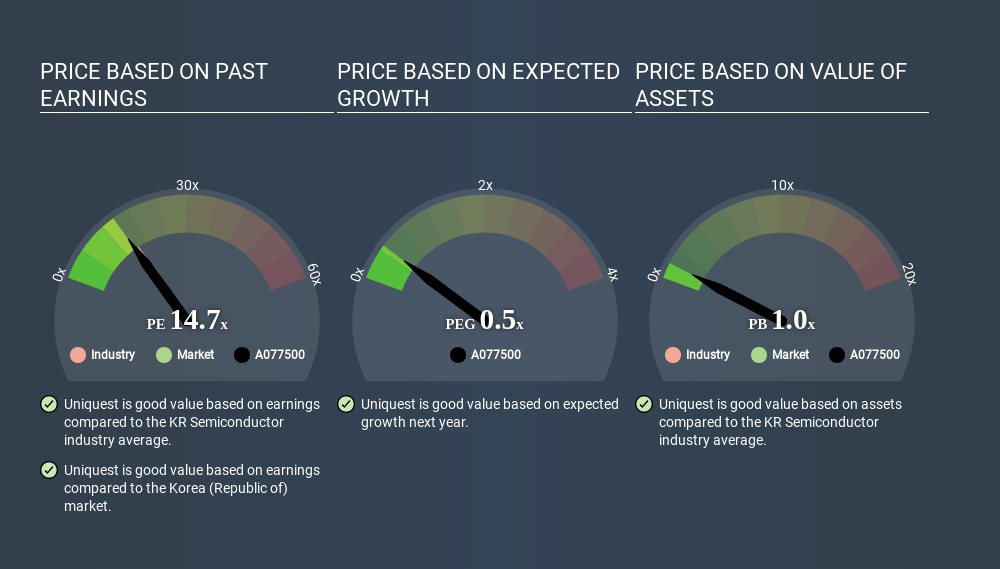

Uniquest has a P/E ratio of 14.73. The image below shows that Uniquest has a P/E ratio that is roughly in line with the semiconductor industry average (15.7).

That indicates that the market expects Uniquest will perform roughly in line with other companies in its industry. So if Uniquest actually outperforms its peers going forward, that should be a positive for the share price. I would further inform my view by checking insider buying and selling., among other things.

How Growth Rates Impact P/E Ratios

P/E ratios primarily reflect market expectations around earnings growth rates. Earnings growth means that in the future the 'E' will be higher. Therefore, even if you pay a high multiple of earnings now, that multiple will become lower in the future. So while a stock may look expensive based on past earnings, it could be cheap based on future earnings.

Uniquest's earnings per share fell by 30% in the last twelve months. But it has grown its earnings per share by 11% per year over the last five years.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

One drawback of using a P/E ratio is that it considers market capitalization, but not the balance sheet. Thus, the metric does not reflect cash or debt held by the company. In theory, a company can lower its future P/E ratio by using cash or debt to invest in growth.

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

So What Does Uniquest's Balance Sheet Tell Us?

Uniquest's net debt is 16% of its market cap. This could bring some additional risk, and reduce the number of investment options for management; worth remembering if you compare its P/E to businesses without debt.

The Verdict On Uniquest's P/E Ratio

Uniquest trades on a P/E ratio of 14.7, which is fairly close to the KR market average of 15.0. When you consider the lack of EPS growth last year (along with some debt), it seems the market is optimistic about the future for the business. What is very clear is that the market has become more optimistic about Uniquest over the last month, with the P/E ratio rising from 10.8 back then to 14.7 today. If you like to buy stocks that have recently impressed the market, then this one might be a candidate; but if you prefer to invest when there is 'blood in the streets', then you may feel the opportunity has passed.

When the market is wrong about a stock, it gives savvy investors an opportunity. If it is underestimating a company, investors can make money by buying and holding the shares until the market corrects itself. So this free report on the analyst consensus forecasts could help you make a master move on this stock.

But note: Uniquest may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About KOSE:A077500

Uniquest

Engages in manufacturing, selling, importing, and exporting of semiconductors, electrical, and electronic components in South Korea, the United States, and Hongkong.

Moderate risk with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)