3 Growth Companies With High Insider Ownership And 229% Earnings Growth

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of rising inflation and fluctuating interest rates, U.S. stock indexes are climbing toward record highs, with growth stocks notably outperforming their value counterparts. In this environment, companies with substantial insider ownership and significant earnings growth can present intriguing opportunities for investors seeking alignment between management's interests and shareholder value.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.1% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Findi (ASX:FND) | 35.8% | 118.5% |

We're going to check out a few of the best picks from our screener tool.

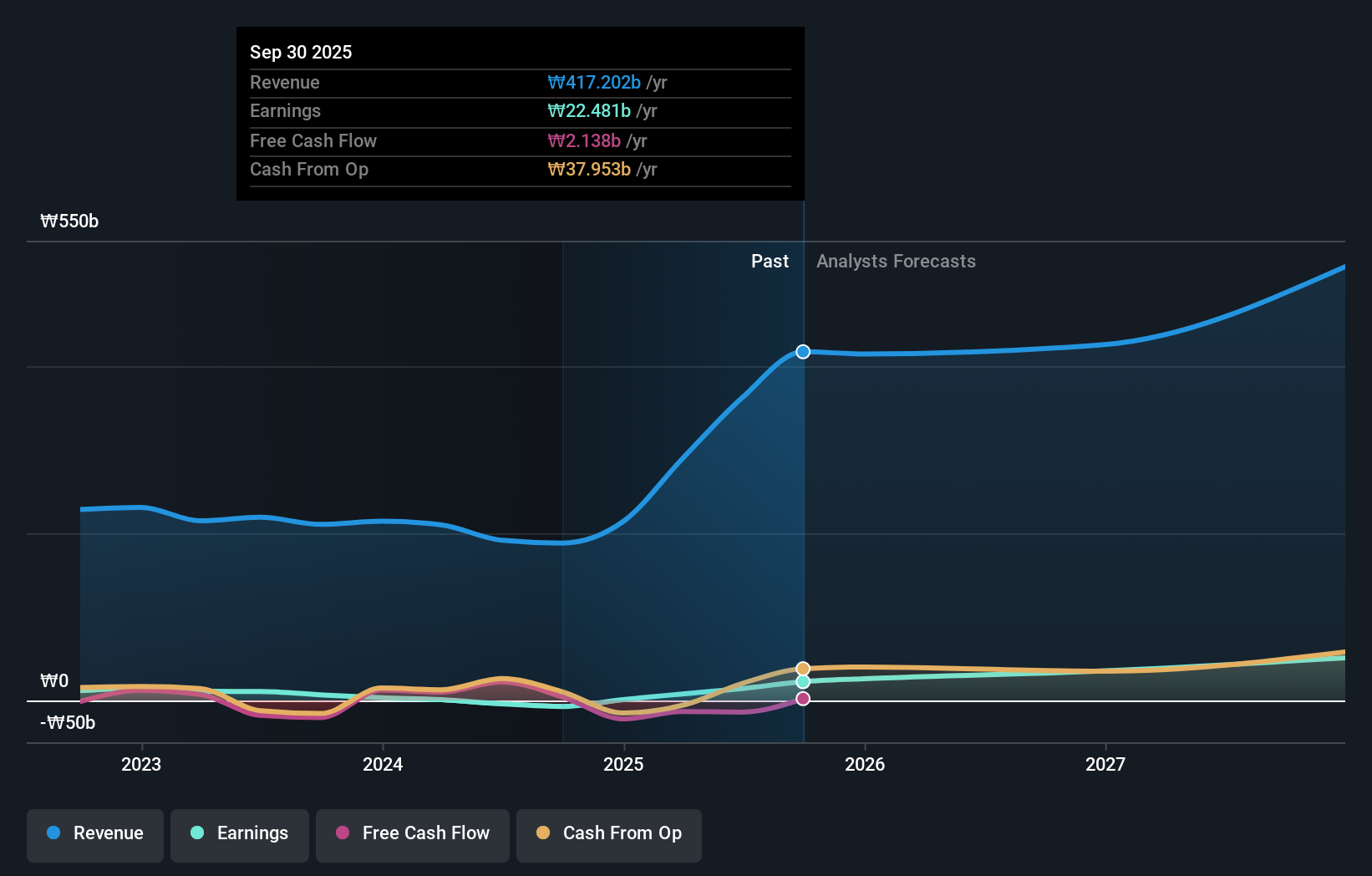

D.I (KOSE:A003160)

Simply Wall St Growth Rating: ★★★★★☆

Overview: D.I Corporation manufactures and supplies semiconductor inspection equipment in South Korea and internationally, with a market cap of ₩422.51 billion.

Operations: The company generates revenue primarily from Semiconductor Equipment (₩130.74 billion), followed by Secondary Battery Equipment (₩30.34 billion), Audio/Visual Equipment (₩14.83 billion), Electronic Components Division (₩12.96 billion), and the Environmental Facilities Sector (₩6.79 billion).

Insider Ownership: 31.8%

Earnings Growth Forecast: 229.5% p.a.

D.I. Corporation is expected to see substantial revenue growth at 77.3% annually, significantly outpacing the KR market's 9%. Earnings are projected to grow by a very large percentage per year, with profitability anticipated within three years. Despite high volatility in its share price recently, the stock trades at 73.2% below estimated fair value, suggesting potential undervaluation. No recent insider trading activity has been reported over the past three months.

- Click here and access our complete growth analysis report to understand the dynamics of D.I.

- Insights from our recent valuation report point to the potential undervaluation of D.I shares in the market.

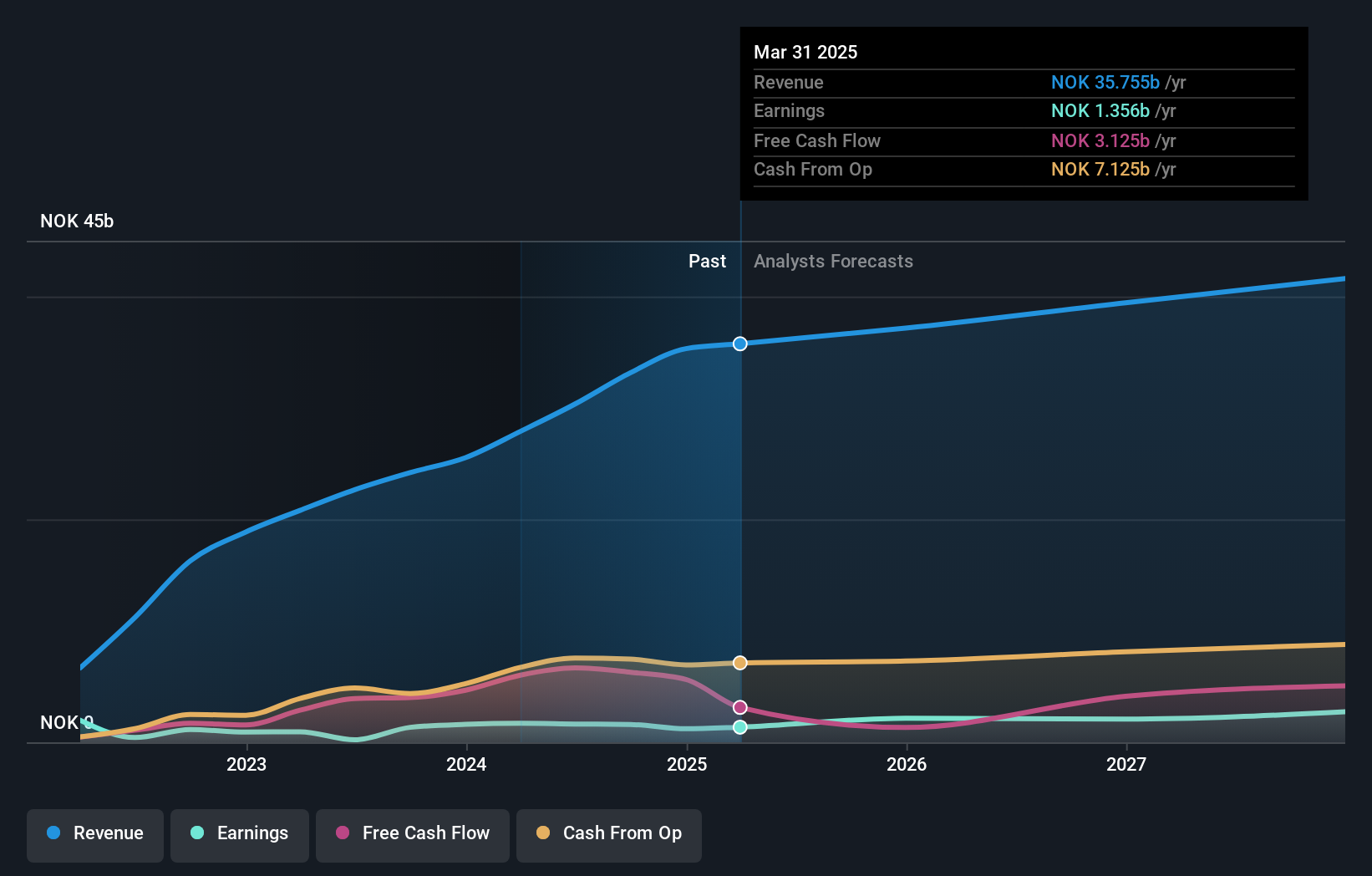

Norwegian Air Shuttle (OB:NAS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Norwegian Air Shuttle ASA, along with its subsidiaries, offers air travel services both within Norway and internationally, with a market cap of NOK11.14 billion.

Operations: The company's revenue primarily comes from its low-cost air passenger travel segment, which generated NOK34.18 billion.

Insider Ownership: 14.3%

Earnings Growth Forecast: 12.1% p.a.

Norwegian Air Shuttle's revenue is forecast to grow at 5.9% annually, surpassing the Norwegian market's 3.5%. Despite a decline in net profit margin from 6.3% to 3.5%, earnings are expected to grow by 12.1% per year, outpacing the market's 9%. The stock trades significantly below its estimated fair value and has no recent insider trading activity reported over the past three months, indicating potential undervaluation amidst growth prospects.

- Delve into the full analysis future growth report here for a deeper understanding of Norwegian Air Shuttle.

- The analysis detailed in our Norwegian Air Shuttle valuation report hints at an deflated share price compared to its estimated value.

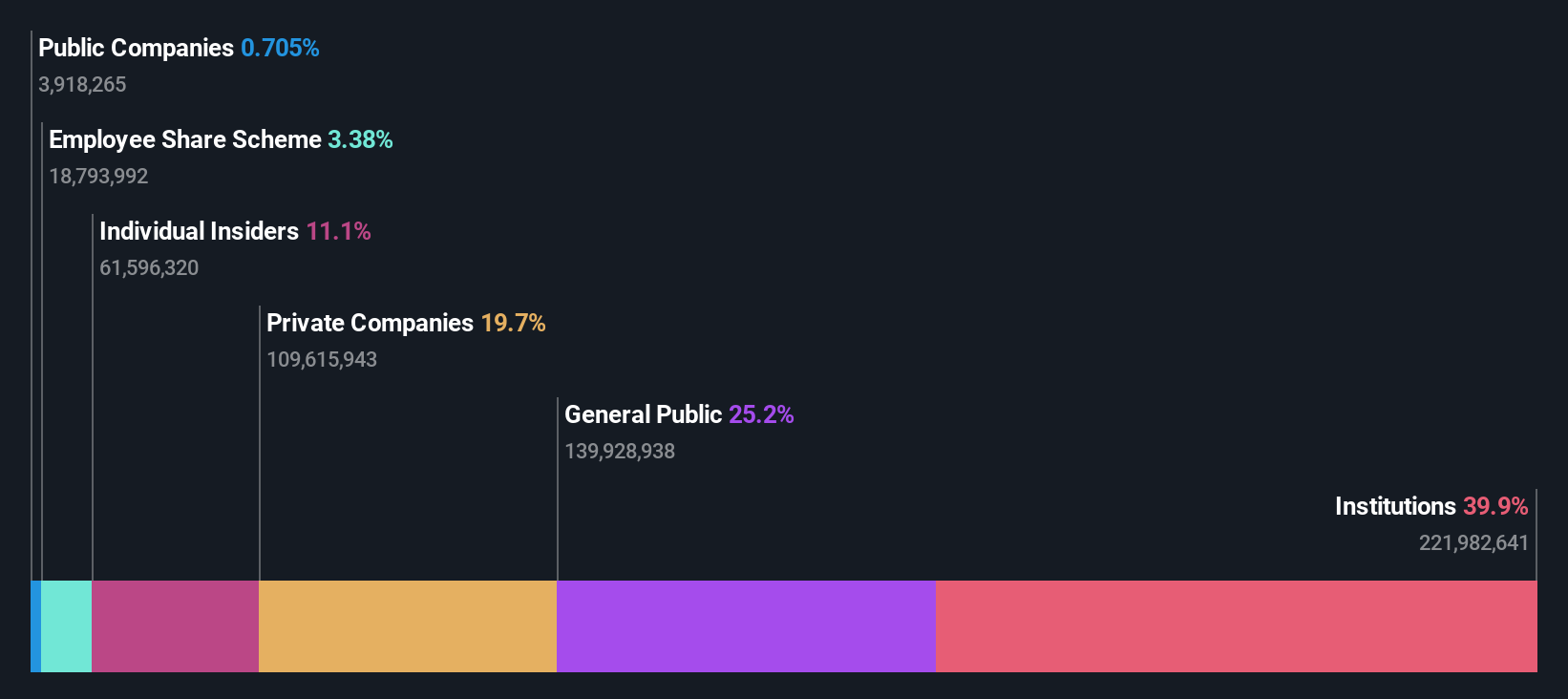

RemeGen (SEHK:9995)

Simply Wall St Growth Rating: ★★★★★☆

Overview: RemeGen Co., Ltd. is a biopharmaceutical company focused on discovering, developing, and commercializing biologics for autoimmune, oncology, and ophthalmic diseases in Mainland China and the United States, with a market cap of approximately HK$14.08 billion.

Operations: The company's revenue segment is primarily derived from biopharmaceutical research, service, production, and sales, amounting to CN¥1.52 billion.

Insider Ownership: 11.4%

Earnings Growth Forecast: 51.9% p.a.

RemeGen's revenue is projected to grow at 23.3% annually, outpacing the Hong Kong market's 7.9%. Despite a current net loss, profitability is expected within three years with earnings growth forecasted at 51.95% per year. The stock trades significantly below its estimated fair value, suggesting potential undervaluation. Recent clinical trial results for Disitamab Vedotin show promising efficacy and safety in treating HER2-expressing muscle-invasive bladder cancer, enhancing the company's growth prospects in targeted therapies.

- Click to explore a detailed breakdown of our findings in RemeGen's earnings growth report.

- Our valuation report unveils the possibility RemeGen's shares may be trading at a discount.

Taking Advantage

- Discover the full array of 1464 Fast Growing Companies With High Insider Ownership right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9995

RemeGen

A biopharmaceutical company, engages in the discovery, development, and commercialization of biologics for the treatment of autoimmune, oncology, and ophthalmic diseases with unmet medical needs in Mainland China and the United States.

Undervalued with high growth potential.

Market Insights

Community Narratives