- South Korea

- /

- Semiconductors

- /

- KOSE:A000660

Risks To Shareholder Returns Are Elevated At These Prices For SK hynix Inc. (KRX:000660)

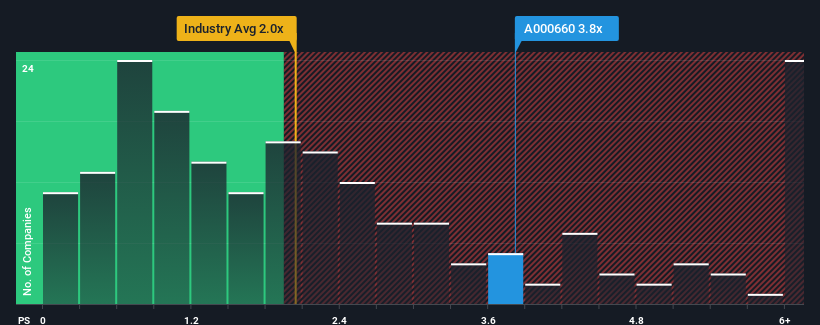

When you see that almost half of the companies in the Semiconductor industry in Korea have price-to-sales ratios (or "P/S") below 2x, SK hynix Inc. (KRX:000660) looks to be giving off some sell signals with its 3.8x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for SK hynix

How SK hynix Has Been Performing

With revenue that's retreating more than the industry's average of late, SK hynix has been very sluggish. It might be that many expect the dismal revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on SK hynix.How Is SK hynix's Revenue Growth Trending?

SK hynix's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 27%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 35% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 33% per year, which is not materially different.

With this in consideration, we find it intriguing that SK hynix's P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What Does SK hynix's P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that SK hynix currently trades on a higher than expected P/S. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for SK hynix with six simple checks.

If these risks are making you reconsider your opinion on SK hynix, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A000660

SK hynix

Engages in the manufacture, distribution, and sale of semiconductor products in Korea, China, rest of Asia, the United States, and Europe.

Excellent balance sheet with reasonable growth potential.