- South Korea

- /

- Machinery

- /

- KOSE:A042660

The 15% return this week takes Hanwha Ocean's (KRX:042660) shareholders three-year gains to 194%

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But when you pick a company that is really flourishing, you can make more than 100%. To wit, the Hanwha Ocean Co., Ltd. (KRX:042660) share price has flown 156% in the last three years. Most would be happy with that. It's also good to see the share price up 70% over the last quarter.

Since the stock has added ₩2.0t to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for Hanwha Ocean

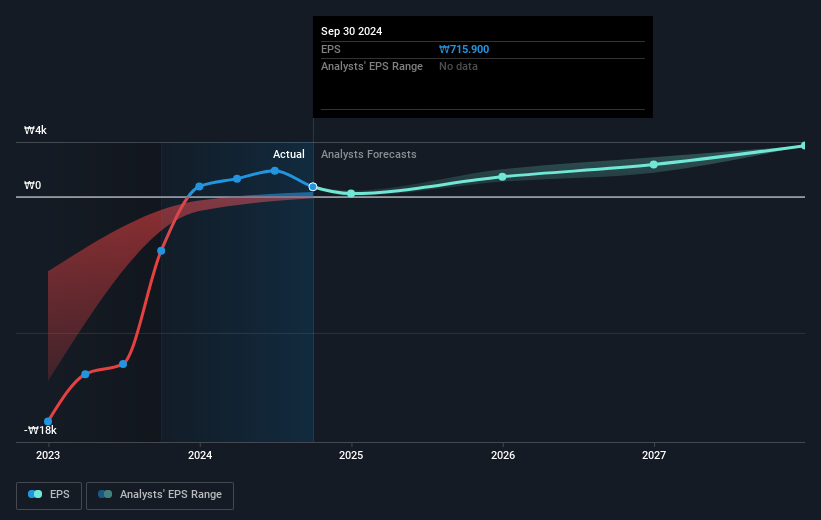

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Hanwha Ocean became profitable within the last three years. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It is of course excellent to see how Hanwha Ocean has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Hanwha Ocean's financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Hanwha Ocean's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Hanwha Ocean shareholders, and that cash payout contributed to why its TSR of 194%, over the last 3 years, is better than the share price return.

A Different Perspective

We're pleased to report that Hanwha Ocean shareholders have received a total shareholder return of 133% over one year. That's better than the annualised return of 18% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Hanwha Ocean has 3 warning signs (and 2 which make us uncomfortable) we think you should know about.

Of course Hanwha Ocean may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hanwha Ocean might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A042660

Hanwha Ocean

Operates as a shipbuilding and offshore contractor in South Korea and internationally.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives