- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A214150

3 Stocks Possibly Trading At A Discount Of Up To 40.6%

Reviewed by Simply Wall St

As global markets experience a rebound, driven by easing core U.S. inflation and robust bank earnings, investors are increasingly looking for opportunities amid the shifting economic landscape. With value stocks outperforming growth shares and major indices posting gains, identifying stocks that may be trading at a discount becomes particularly appealing. In such conditions, a good stock is typically characterized by strong fundamentals and potential for appreciation despite current undervaluations in the market.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Atlantic Union Bankshares (NYSE:AUB) | US$37.87 | US$75.61 | 49.9% |

| Dongsung FineTec (KOSDAQ:A033500) | ₩19640.00 | ₩36678.35 | 46.5% |

| Thai Coconut (SET:COCOCO) | THB10.80 | THB21.59 | 50% |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.9% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1114.70 | ₹2219.89 | 49.8% |

| Equity Bancshares (NYSE:EQBK) | US$43.13 | US$86.04 | 49.9% |

| LifeMD (NasdaqGM:LFMD) | US$4.90 | US$9.77 | 49.8% |

| Shinko Electric Industries (TSE:6967) | ¥5879.00 | ¥11701.41 | 49.8% |

| Hd Hyundai MipoLtd (KOSE:A010620) | ₩141300.00 | ₩257301.85 | 45.1% |

| Vista Group International (NZSE:VGL) | NZ$3.19 | NZ$6.18 | 48.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

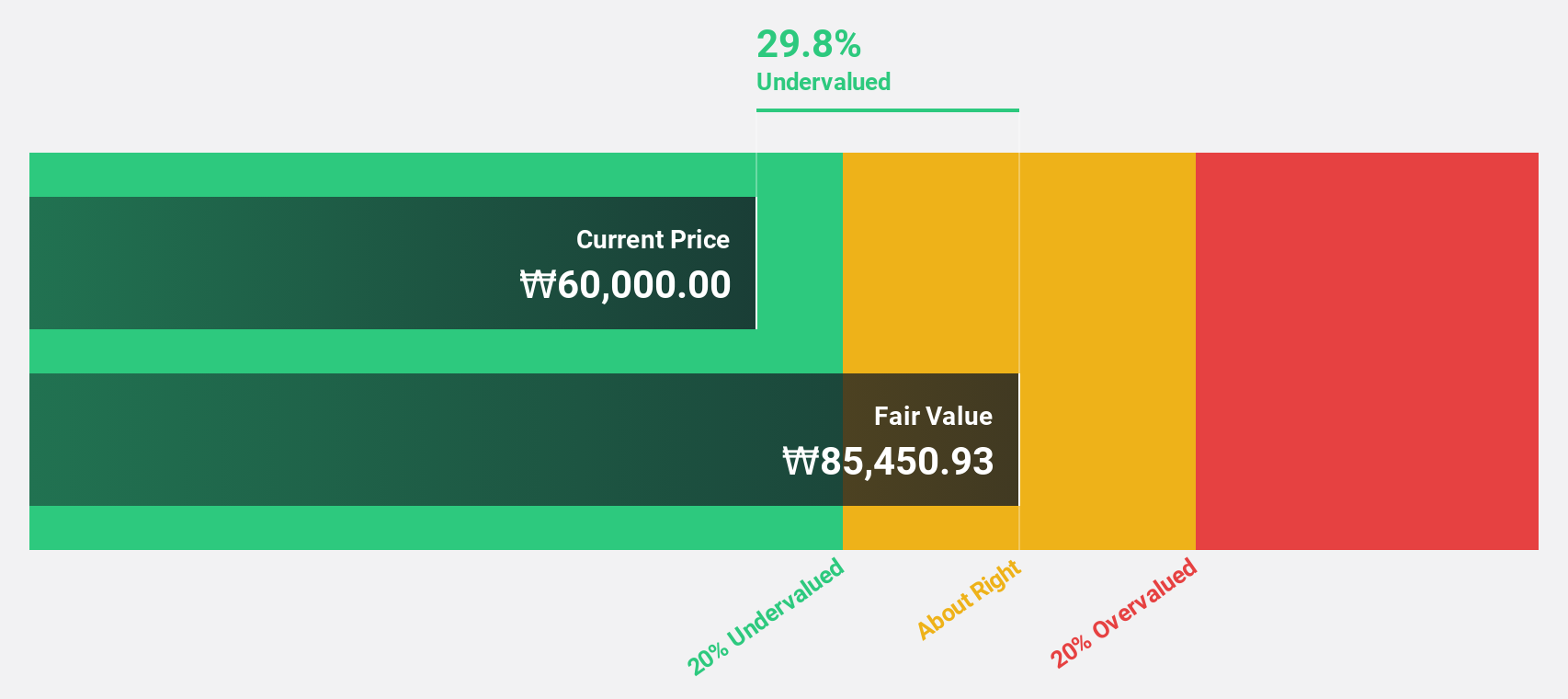

CLASSYS (KOSDAQ:A214150)

Overview: CLASSYS Inc. is a global provider of medical aesthetics devices with a market cap of ₩3.44 trillion.

Operations: The company generates revenue primarily from its Surgical & Medical Equipment segment, amounting to ₩215.54 billion.

Estimated Discount To Fair Value: 20.3%

CLASSYS appears undervalued, trading over 20% below its estimated fair value of ₩66,389.18. Analysts project a strong revenue growth rate of 26.5% annually, outpacing the Korean market's average. Earnings are similarly expected to grow significantly at 29.6% per year, surpassing market expectations. Recent strategic moves include a ₩25 billion share buyback aimed at enhancing shareholder value and stabilizing stock price, alongside expanding into the US market through a partnership with Cartessa Aesthetics for their EVERESSE technology.

- According our earnings growth report, there's an indication that CLASSYS might be ready to expand.

- Get an in-depth perspective on CLASSYS' balance sheet by reading our health report here.

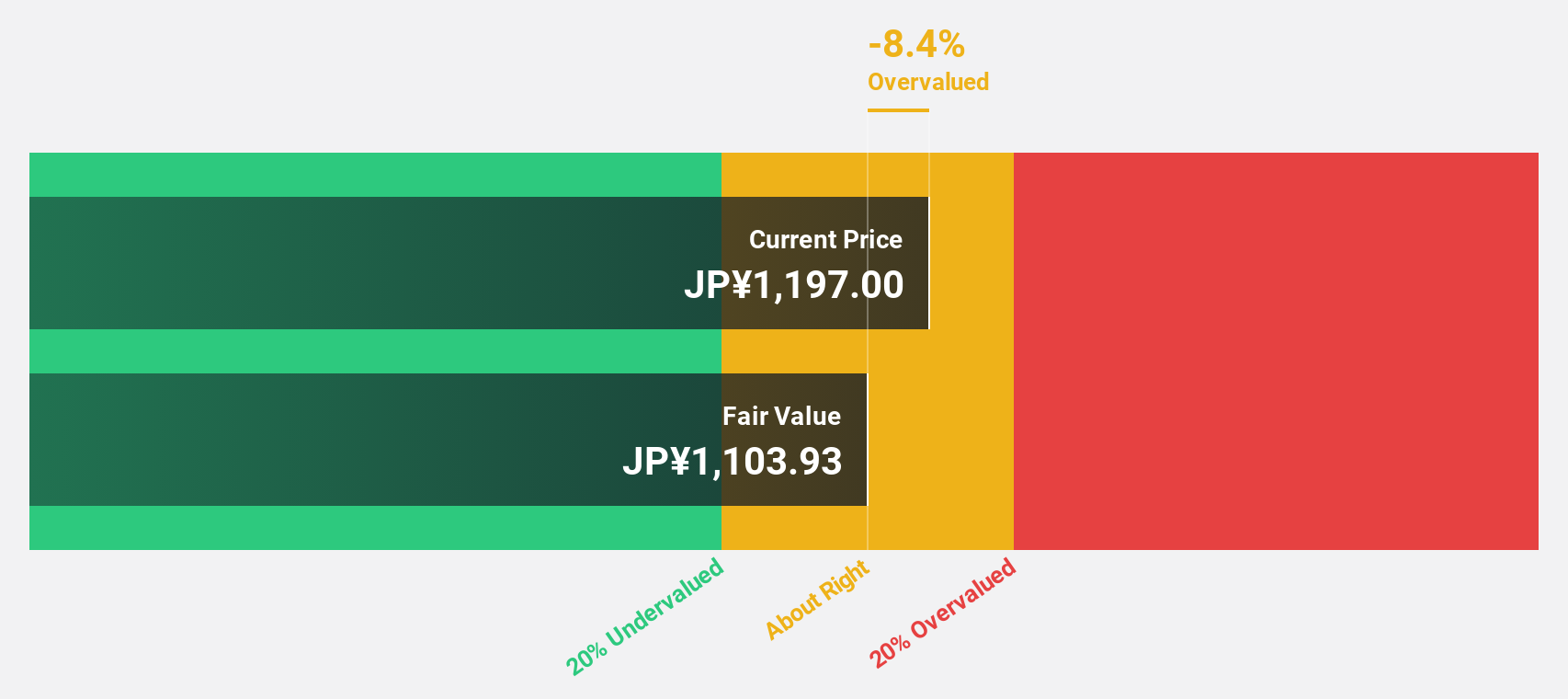

Sumco (TSE:3436)

Overview: Sumco Corporation manufactures and sells silicon wafers for the semiconductor industry across Japan, the United States, China, Taiwan, Korea, and internationally with a market cap of ¥407.41 billion.

Operations: The company's revenue is primarily derived from its Crystalline Silicon segment, amounting to ¥401.75 billion.

Estimated Discount To Fair Value: 24%

Sumco is trading at 24% below its estimated fair value of ¥1542.83, suggesting potential undervaluation based on cash flows. Despite recent volatility and a decline in profit margins from 17.6% to 5.3%, earnings are forecasted to grow significantly at 29.51% annually, outpacing the Japanese market's average growth rate of 8.1%. Recent earnings reports show decreased sales and net income compared to last year, with revised dividend forecasts reflecting cautious financial management amid these changes.

- Insights from our recent growth report point to a promising forecast for Sumco's business outlook.

- Unlock comprehensive insights into our analysis of Sumco stock in this financial health report.

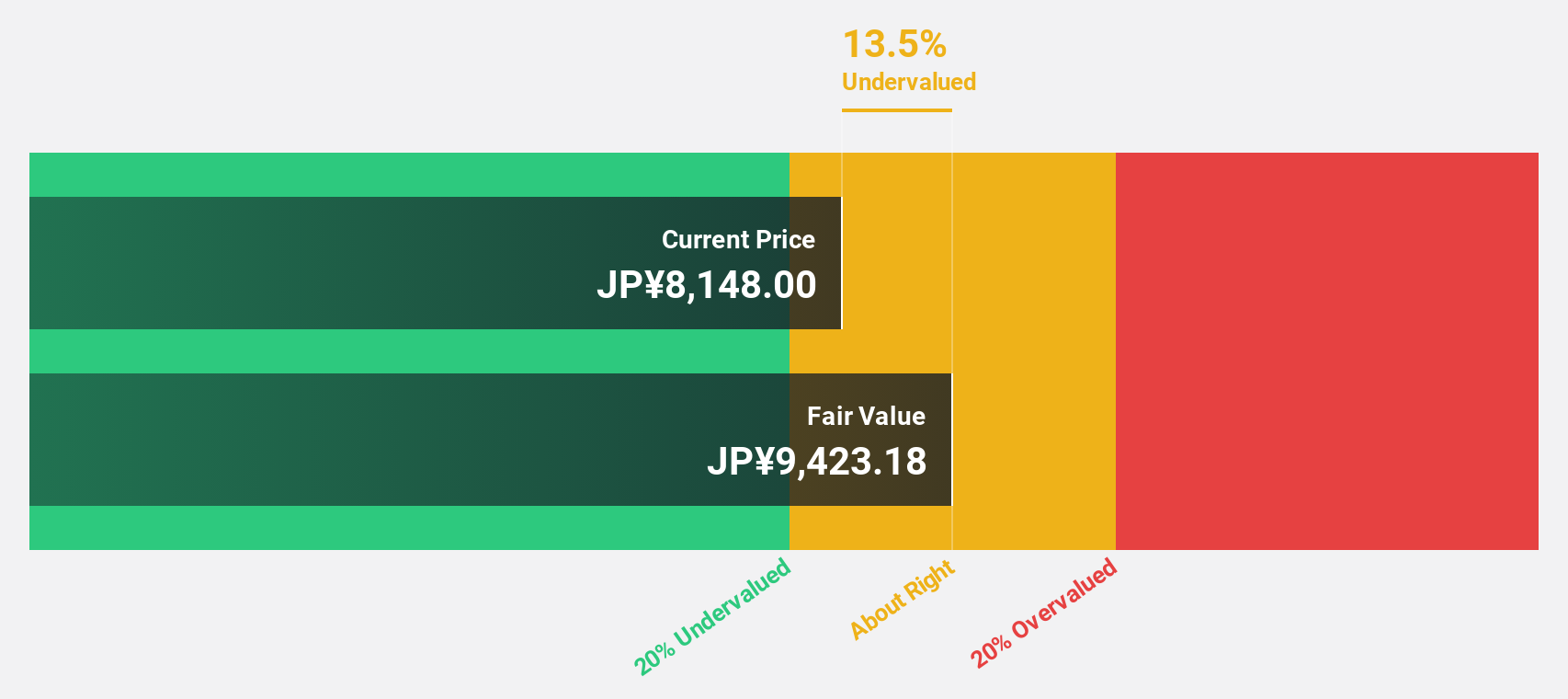

Zensho Holdings (TSE:7550)

Overview: Zensho Holdings Co., Ltd. operates food service chain restaurants both in Japan and internationally, with a market cap of ¥1.32 trillion.

Operations: The company's revenue segments include Restaurants at ¥148.60 million, Global Sukiya at ¥279.84 million, Global Fast Food at ¥302.52 million, Global Hamasushi at ¥220.45 million, and Corporate and Support services contributing ¥383.15 billion.

Estimated Discount To Fair Value: 40.6%

Zensho Holdings is trading significantly below its estimated fair value of ¥14,278.29, highlighting potential undervaluation based on cash flows. Earnings grew by 76.9% last year and are forecasted to increase by 19.8% annually, outpacing the Japanese market's growth rate of 8.1%. Despite a high debt level, Zensho's revenue is expected to grow faster than the market at 6.9% per year, supported by recent dividend increases and fixed-income offerings enhancing financial stability.

- The growth report we've compiled suggests that Zensho Holdings' future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Zensho Holdings' balance sheet health report.

Next Steps

- Delve into our full catalog of 875 Undervalued Stocks Based On Cash Flows here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A214150

Exceptional growth potential with excellent balance sheet.