- South Korea

- /

- Pharma

- /

- KOSDAQ:A039200

3 KRX Stocks That May Be Trading Below Fair Value Estimates In October 2024

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has remained flat, yet it has shown a 7.3% increase over the past 12 months, with earnings expected to grow by 29% per annum in the coming years. In this context of steady growth and promising earnings forecasts, identifying stocks that may be trading below their fair value can offer potential opportunities for investors seeking to capitalize on undervalued assets.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| T'Way Air (KOSE:A091810) | ₩2890.00 | ₩5454.33 | 47% |

| PharmaResearch (KOSDAQ:A214450) | ₩226500.00 | ₩423683.38 | 46.5% |

| Sejin Heavy Industries (KOSE:A075580) | ₩7410.00 | ₩14804.34 | 49.9% |

| Cosmecca Korea (KOSDAQ:A241710) | ₩75300.00 | ₩149807.35 | 49.7% |

| TSE (KOSDAQ:A131290) | ₩52000.00 | ₩99561.21 | 47.8% |

| Lutronic (KOSDAQ:A085370) | ₩36700.00 | ₩63217.94 | 41.9% |

| Intellian Technologies (KOSDAQ:A189300) | ₩53400.00 | ₩91036.76 | 41.3% |

| Shinsung E&GLtd (KOSE:A011930) | ₩1535.00 | ₩2901.28 | 47.1% |

| Global Tax Free (KOSDAQ:A204620) | ₩3820.00 | ₩6414.01 | 40.4% |

| Hotel ShillaLtd (KOSE:A008770) | ₩45100.00 | ₩75436.30 | 40.2% |

Underneath we present a selection of stocks filtered out by our screen.

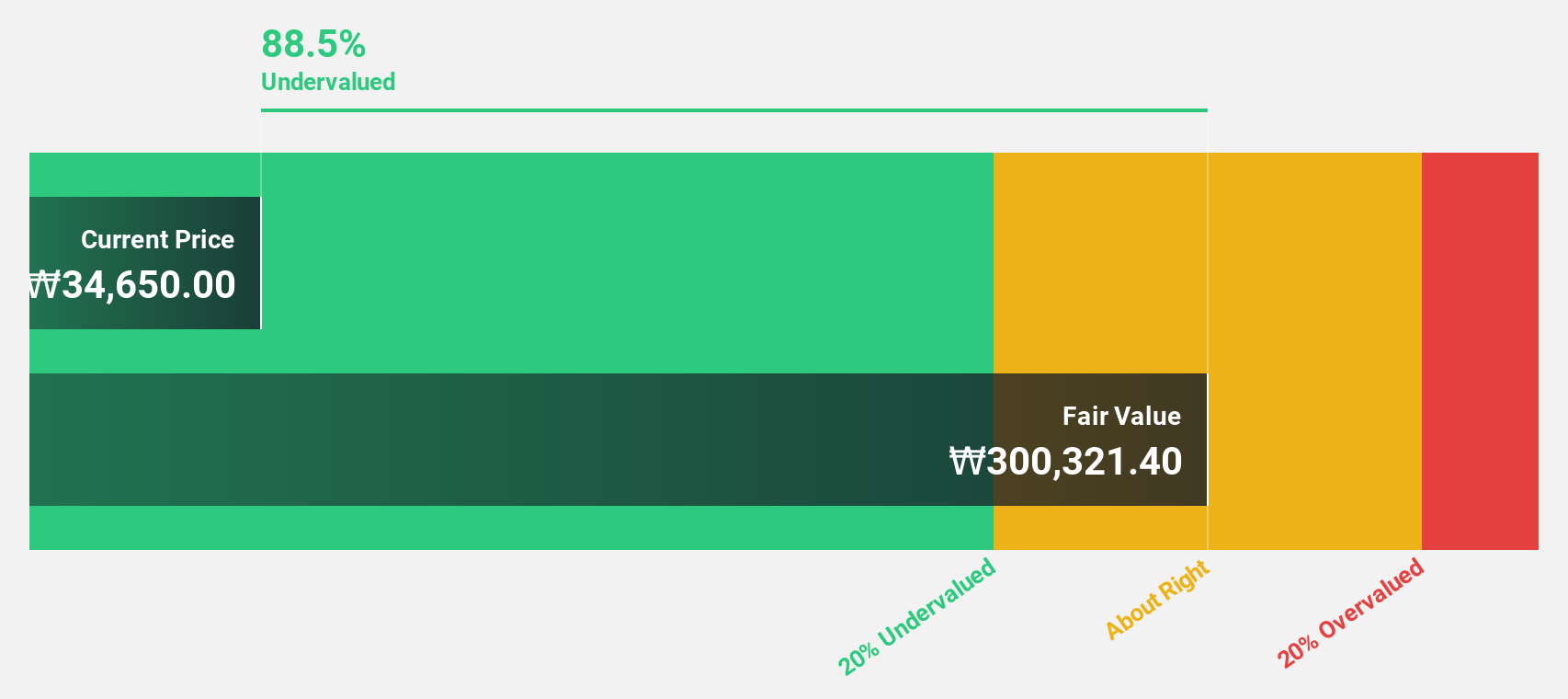

Oscotec (KOSDAQ:A039200)

Overview: Oscotec Inc. is a biotechnology company involved in drug development, functional materials, and dental bone graft materials, with a market cap of ₩1.52 trillion.

Operations: The company's revenue segments include the Food Business Division with ₩1.69 billion, Medical Business Sector at ₩1.63 billion, New Drug Business Division generating ₩990.90 million, and Functional Materials Division contributing ₩310.71 million.

Estimated Discount To Fair Value: 39.2%

Oscotec is trading at ₩39,600, significantly below its estimated fair value of ₩65,156.22. Despite a highly volatile share price recently, the stock presents an opportunity based on cash flows due to its undervaluation by over 20%. While current revenue is minimal at ₩5 billion, earnings are projected to grow by 122% annually with profitability expected within three years. Revenue growth is anticipated at a robust 68.9% per year, outpacing the market average.

- Our growth report here indicates Oscotec may be poised for an improving outlook.

- Navigate through the intricacies of Oscotec with our comprehensive financial health report here.

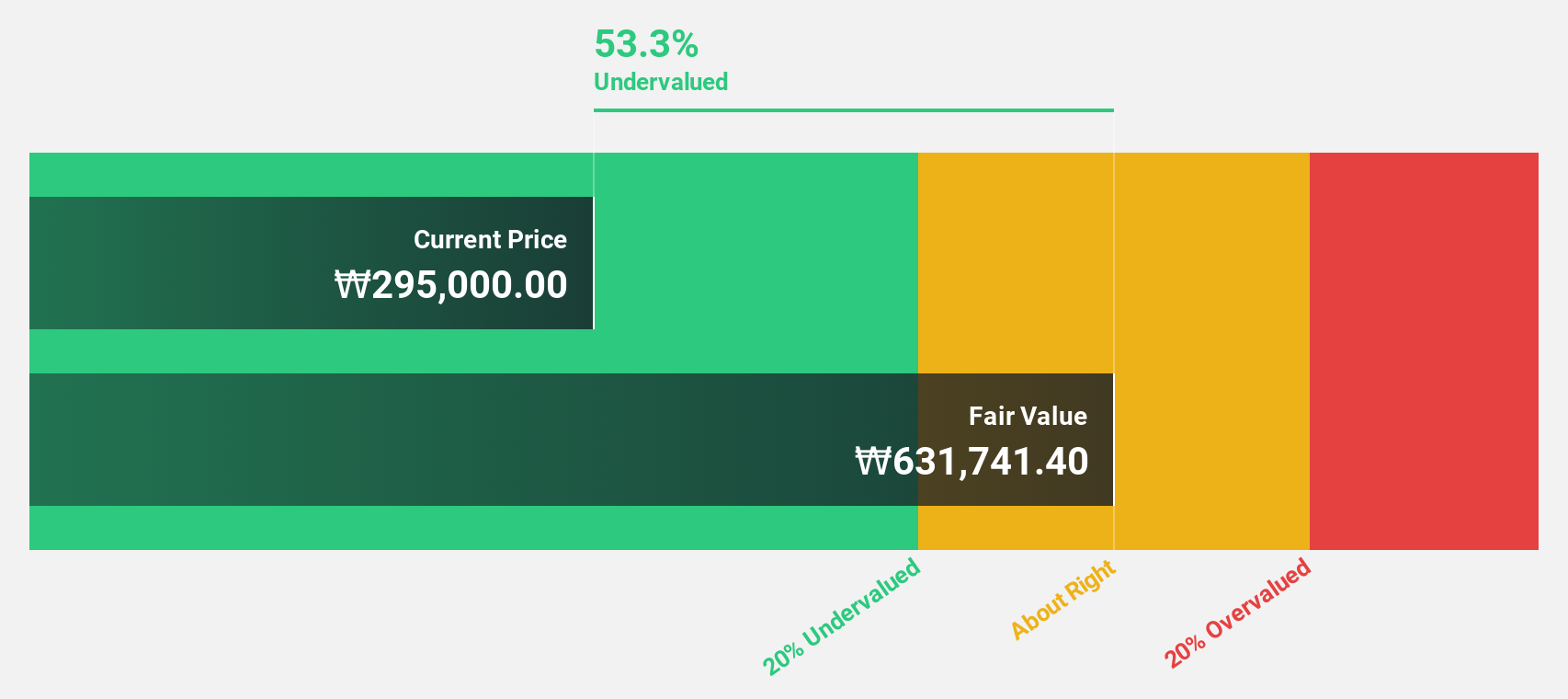

SK hynix (KOSE:A000660)

Overview: SK hynix Inc., along with its subsidiaries, manufactures, distributes, and sells semiconductor products across Korea, China, the rest of Asia, the United States, and Europe with a market cap of approximately ₩131.46 trillion.

Operations: The company's revenue is primarily derived from the manufacture and sale of semiconductor products, amounting to approximately ₩49.22 billion.

Estimated Discount To Fair Value: 11.8%

SK hynix is trading at ₩190,900, below its estimated fair value of ₩216,546.07. The company recently returned to profitability with a net income of ₩6.04 trillion for the first half of 2024, compared to a loss last year. Earnings are forecasted to grow significantly by 40.3% annually over the next three years, outpacing market averages. Despite recent share price volatility and large one-off items impacting results, revenue growth remains strong at 21.9% per year.

- According our earnings growth report, there's an indication that SK hynix might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of SK hynix.

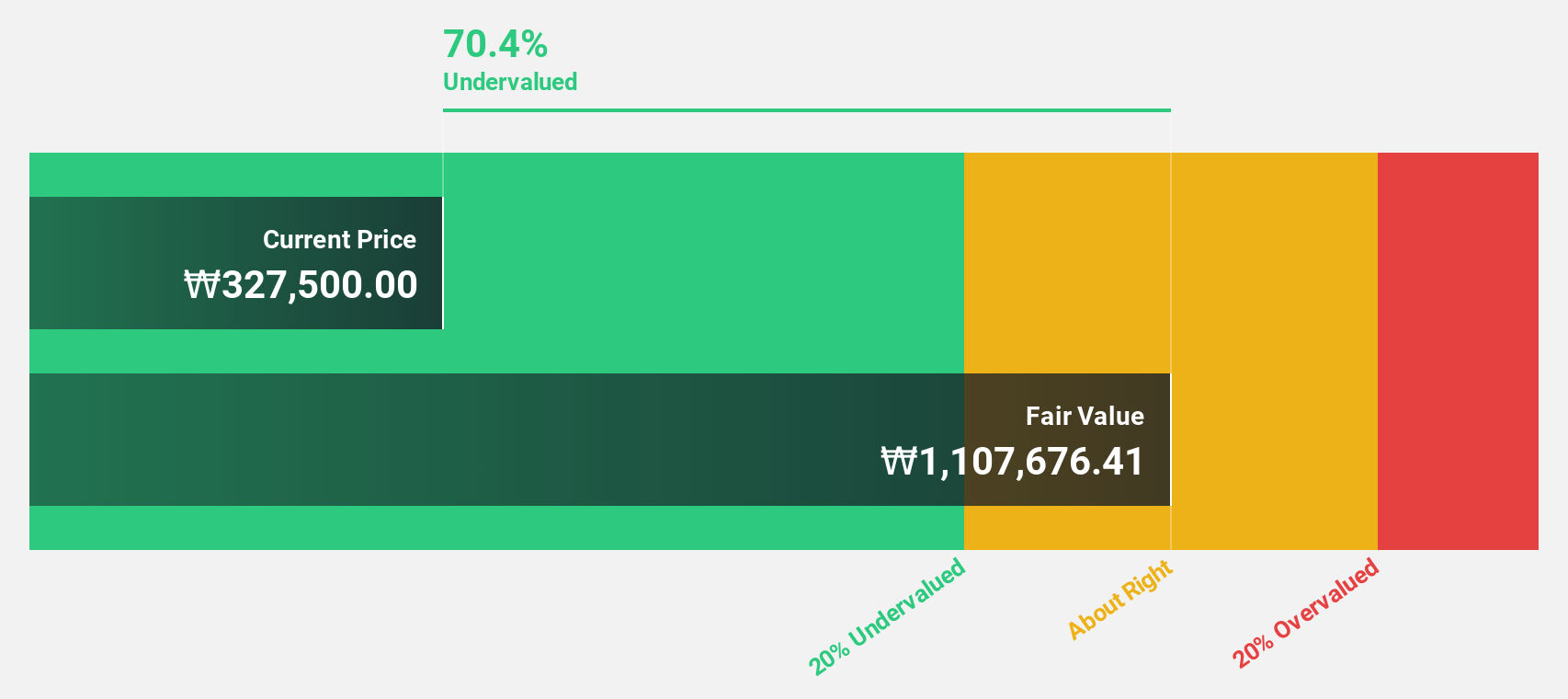

HD Korea Shipbuilding & Offshore Engineering (KOSE:A009540)

Overview: HD Korea Shipbuilding & Offshore Engineering Co., Ltd. operates in the shipbuilding and offshore engineering industry with a market cap of ₩13.92 trillion.

Operations: The company's revenue segments include Shipbuilding at ₩21.80 trillion, Engine at ₩4.21 trillion, Green Energy at ₩467.66 million, and Marine Plant at ₩802.72 million.

Estimated Discount To Fair Value: 17%

HD Korea Shipbuilding & Offshore Engineering is trading at ₩196,800, below its estimated fair value of ₩237,218.84. Earnings surged to ₩481.08 billion in the first half of 2024 from a loss last year, and are projected to grow significantly by 39.2% annually over the next three years, surpassing market averages. Recent strategic partnerships in ammonia technology could enhance future revenue streams despite a forecasted low return on equity of 14.3%.

- Our expertly prepared growth report on HD Korea Shipbuilding & Offshore Engineering implies its future financial outlook may be stronger than recent results.

- Take a closer look at HD Korea Shipbuilding & Offshore Engineering's balance sheet health here in our report.

Where To Now?

- Click here to access our complete index of 30 Undervalued KRX Stocks Based On Cash Flows.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A039200

Oscotec

Operates as a biotechnology company, engages in the drug development, functional materials and related products, and dental bone graft material businesses.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives