- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A303030

If You Had Bought ZinitixLtd (KOSDAQ:303030) Shares A Year Ago You'd Have Earned 10% Returns

There's no doubt that investing in the stock market is a truly brilliant way to build wealth. But if when you choose to buy stocks, some of them will be below average performers. Unfortunately for shareholders, while the Zinitix Co.,Ltd (KOSDAQ:303030) share price is up 10% in the last year, that falls short of the market return. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

Check out our latest analysis for ZinitixLtd

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

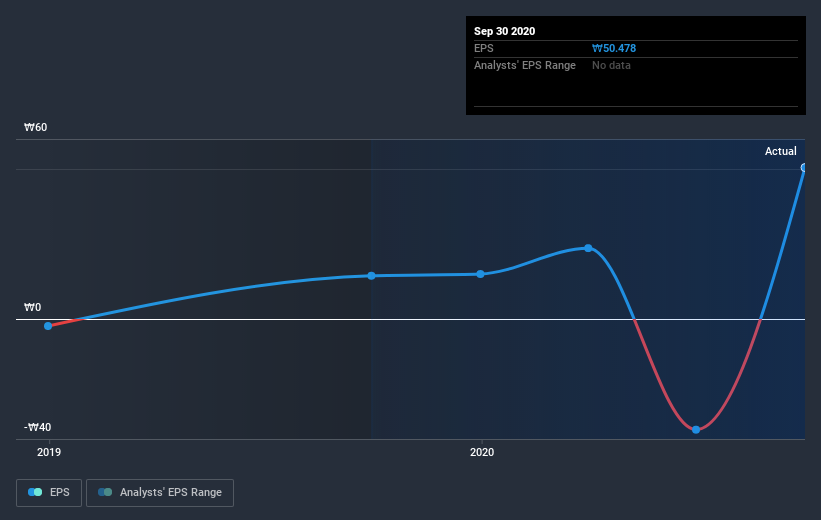

During the last year ZinitixLtd grew its earnings per share, moving from a loss to a profit.

While it's good to see positive EPS of ₩50.48 this year, the loss wasn't too bad last year. We'd argue the positive share price reflects the move to profitability. Inflection points like this can be a great time to take a closer look at a company.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

ZinitixLtd shareholders have gained 10% for the year. The bad news is that's no better than the average market return, which was roughly 55%. Shareholders are doubtless excited that the stock price has been doing even better lately, with a gain of 25% in just ninety days. The very recent increase in the share price could be evidence that the narrative is changing for the better due to fundamental improvements. It's always interesting to track share price performance over the longer term. But to understand ZinitixLtd better, we need to consider many other factors. For example, we've discovered 3 warning signs for ZinitixLtd (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading ZinitixLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zinitix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A303030

Zinitix

Zinitix Co., Ltd manufactures and sells system ICs in South Korea and internationally.

Mediocre balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)