- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A240810

Unpleasant Surprises Could Be In Store For Wonik IPS Co., Ltd.'s (KOSDAQ:240810) Shares

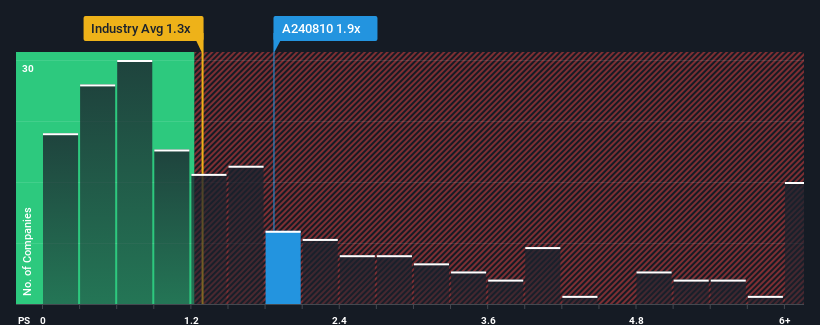

When you see that almost half of the companies in the Semiconductor industry in Korea have price-to-sales ratios (or "P/S") below 1.3x, Wonik IPS Co., Ltd. (KOSDAQ:240810) looks to be giving off some sell signals with its 1.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Wonik IPS

How Has Wonik IPS Performed Recently?

Wonik IPS hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Wonik IPS will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Wonik IPS would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 45% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 14% per year as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 20% per annum, which is noticeably more attractive.

In light of this, it's alarming that Wonik IPS' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Wonik IPS' P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Wonik IPS, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Wonik IPS with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Wonik IPS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A240810

Wonik IPS

Researches and develops, manufactures, and sells semiconductor, display, and solar cell systems in South Korea.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives