- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A239890

Earnings growth of 15% over 3 years hasn't been enough to translate into positive returns for P&H Tech (KOSDAQ:239890) shareholders

As an investor, mistakes are inevitable. But you have a problem if you face massive losses more than once in a while. So take a moment to sympathize with the long term shareholders of P&H Tech Co., Ltd. (KOSDAQ:239890), who have seen the share price tank a massive 70% over a three year period. That would certainly shake our confidence in the decision to own the stock. And over the last year the share price fell 68%, so we doubt many shareholders are delighted. Furthermore, it's down 19% in about a quarter. That's not much fun for holders. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

With the stock having lost 11% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for P&H Tech

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Although the share price is down over three years, P&H Tech actually managed to grow EPS by 53% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

We note that, in three years, revenue has actually grown at a 17% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating P&H Tech further; while we may be missing something on this analysis, there might also be an opportunity.

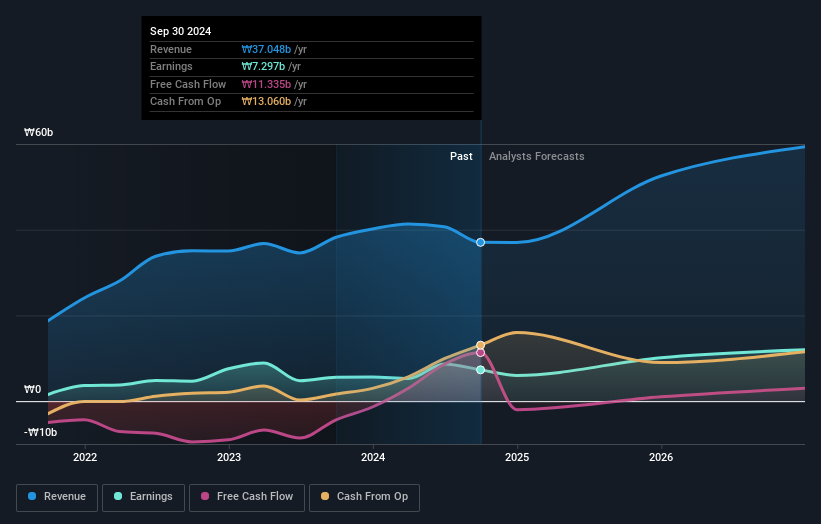

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how P&H Tech has grown profits over the years, but the future is more important for shareholders. This free interactive report on P&H Tech's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We regret to report that P&H Tech shareholders are down 68% for the year. Unfortunately, that's worse than the broader market decline of 2.5%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 7%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand P&H Tech better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for P&H Tech you should know about.

Of course P&H Tech may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A239890

P&H Tech

Develops, produces, and sells organic light emitting diode (OLED) materials and catalysts.

Flawless balance sheet with reasonable growth potential.