- South Korea

- /

- Machinery

- /

- KOSDAQ:A013030

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by record highs in major U.S. stock indexes and mixed sector performances, investors are keenly observing the implications of labor market data and potential interest rate adjustments by the Federal Reserve. Amid these dynamic conditions, dividend stocks present an appealing option for those seeking steady income streams, especially as certain sectors like energy and utilities face downward pressure while growth stocks rally. In such a climate, identifying dividend stocks with strong fundamentals can offer stability and potential returns despite broader market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.61% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.99% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.86% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.61% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.46% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.41% | ★★★★★★ |

Click here to see the full list of 1944 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

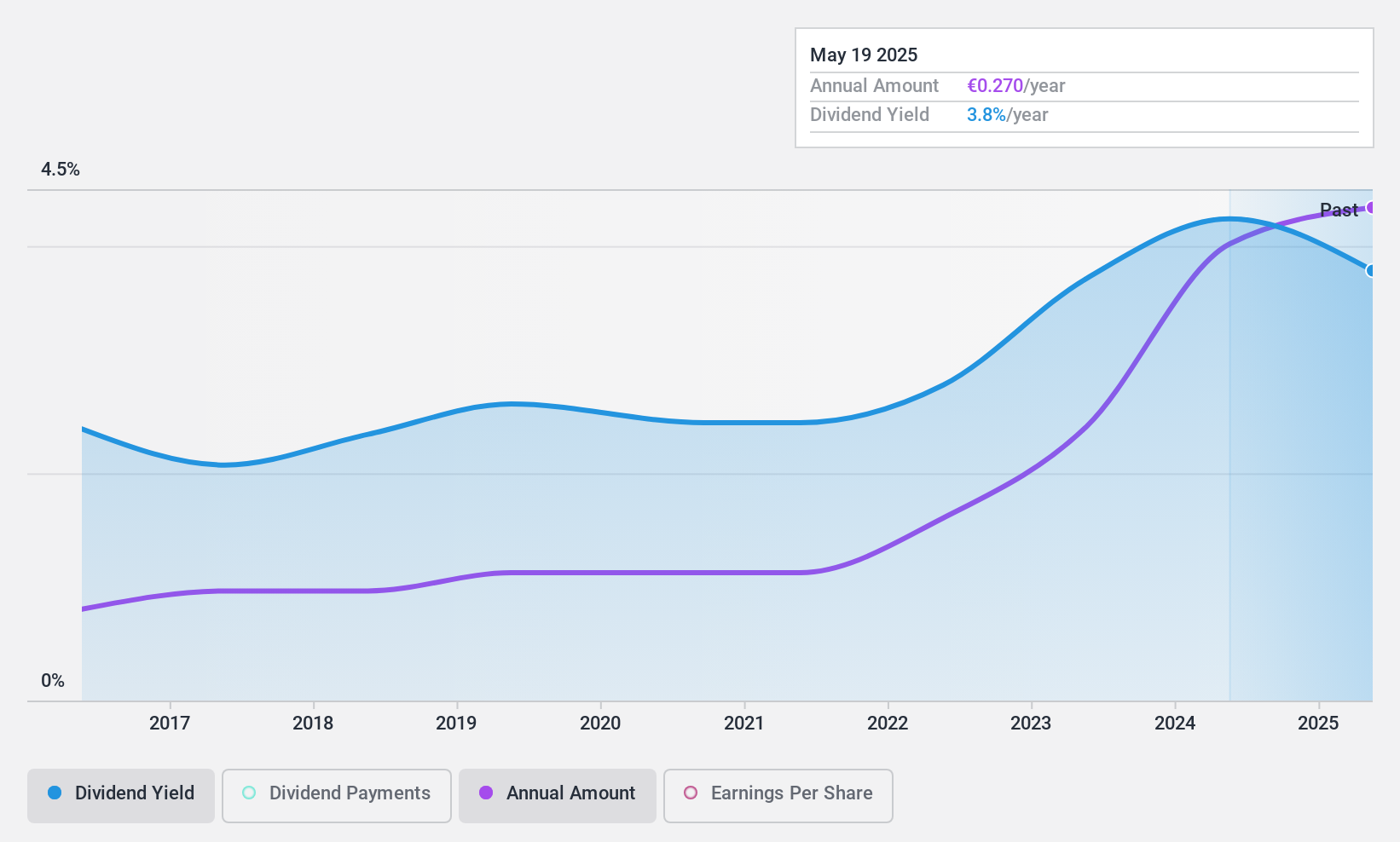

Caltagirone (BIT:CALT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Caltagirone SpA operates through its subsidiaries in the media, real estate, and publishing sectors, with a market cap of €778.38 million.

Operations: Caltagirone SpA generates its revenue through several key segments: €112.65 million from publishing, €186.77 million from constructions, €35.27 million from management of properties, and €1.64 billion from cement, concrete, and aggregates.

Dividend Yield: 3.9%

Caltagirone's dividend yield of 3.86% is below the top tier in the Italian market but remains reliable and stable, having grown over the past decade. The dividends are well covered by earnings, with a payout ratio of 21.7%, and cash flows, with a cash payout ratio of 9.1%. Additionally, Caltagirone trades significantly below its estimated fair value, suggesting potential value for investors seeking stable dividend income.

- Click here to discover the nuances of Caltagirone with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Caltagirone's current price could be quite moderate.

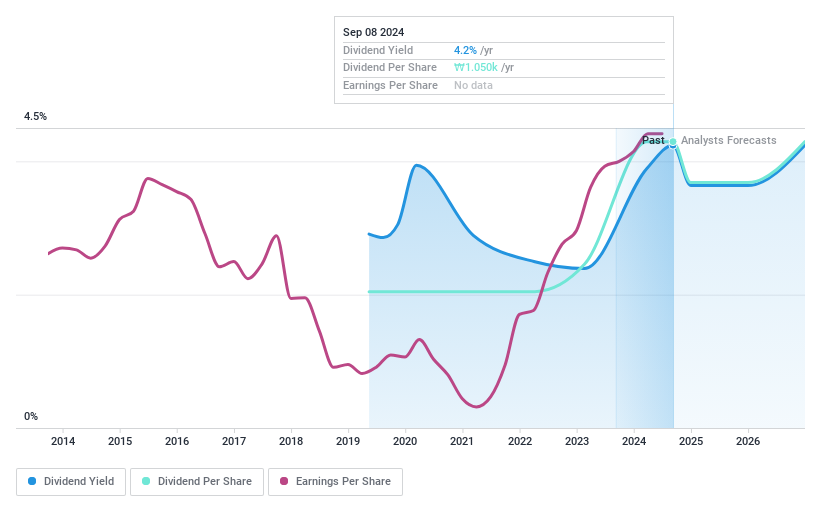

Hy-Lok (KOSDAQ:A013030)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hy-Lok Corporation operates in the fluid and control system industry worldwide, with a market cap of ₩308.02 billion.

Operations: Hy-Lok Corporation generates revenue primarily from the manufacture and sale of fittings for mechanical equipment, flange valves, unions, and nipples, amounting to ₩188.07 billion.

Dividend Yield: 4.2%

Hy-Lok's dividend yield of 4.21% is among the top 25% in South Korea, with stable payments despite a short history of six years. The dividends are well covered by earnings and cash flows, with payout ratios of 28.4% and 27.8%, respectively, indicating sustainability. Trading significantly below its fair value enhances its appeal for investors seeking value alongside dividends. Recent buybacks completed at KRW 4,951.42 million may further support shareholder returns.

- Dive into the specifics of Hy-Lok here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Hy-Lok shares in the market.

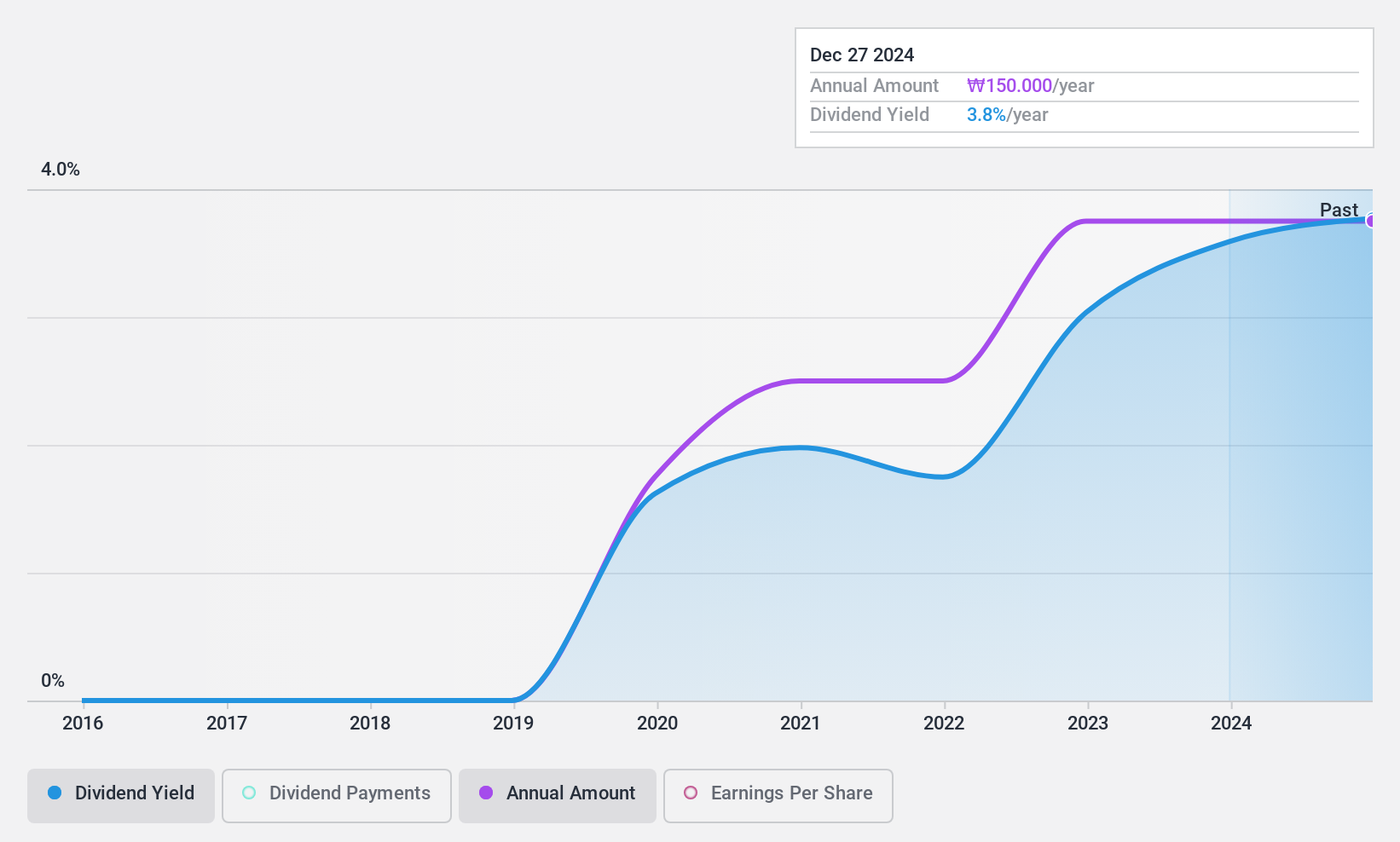

ILJIN HoldingsLtd (KOSE:A015860)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ILJIN Holdings Co., Ltd. operates globally as a specialized company in parts and materials, with a market cap of ₩176.35 billion.

Operations: ILJIN Holdings Co., Ltd. generates revenue from various segments, including Tool Material (₩148.50 million), Medical Devices (₩57.87 million), and Front Line Power (₩1.46 billion), along with Real Estate Rental (₩10.34 million).

Dividend Yield: 4%

ILJIN Holdings Ltd. offers a compelling dividend profile with a yield of 4.02%, placing it in the top 25% of South Korean dividend payers, supported by low payout ratios (earnings: 25.8%, cash flows: 49.1%). Despite only five years of payments, dividends have been stable and growing, backed by recent earnings growth of 31%. However, recent financial results indicate challenges, with third-quarter sales declining significantly to KRW 483 million from KRW 5 billion year-on-year.

- Get an in-depth perspective on ILJIN HoldingsLtd's performance by reading our dividend report here.

- Our expertly prepared valuation report ILJIN HoldingsLtd implies its share price may be too high.

Where To Now?

- Click through to start exploring the rest of the 1941 Top Dividend Stocks now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hy-Lok might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A013030

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives