- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A140860

Top Growth Companies With Insider Ownership December 2024

Reviewed by Simply Wall St

As global markets continue to navigate a complex landscape, recent trends have seen major U.S. stock indexes reaching record highs amid a rally in growth stocks, while geopolitical developments and economic data releases keep investors on their toes. With the S&P 500 and Nasdaq Composite leading gains, growth shares have notably outperformed value stocks by the largest margin since early 2023, highlighting the potential for companies with robust insider ownership to capitalize on these favorable conditions. In this context, identifying growth companies with significant insider ownership can be crucial as it often signals confidence from those closest to the business in its long-term prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 27% | 24.8% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.5% | 65.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's uncover some gems from our specialized screener.

Park Systems (KOSDAQ:A140860)

Simply Wall St Growth Rating: ★★★★★★

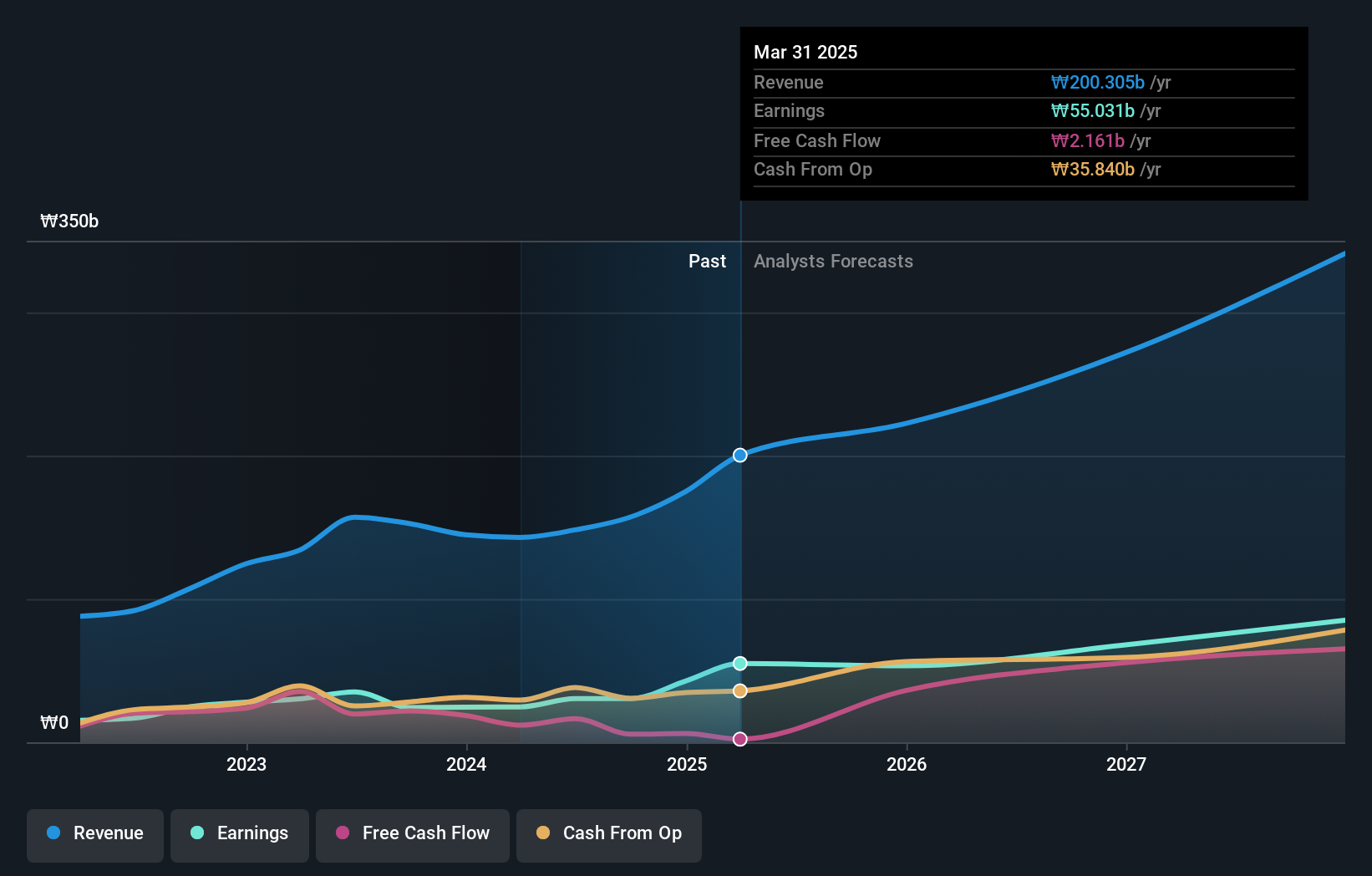

Overview: Park Systems Corp. develops, manufactures, and sells atomic force microscopy systems globally, with a market cap of ₩1.41 trillion.

Operations: The company generates revenue from its Scientific & Technical Instruments segment, amounting to ₩157.20 billion.

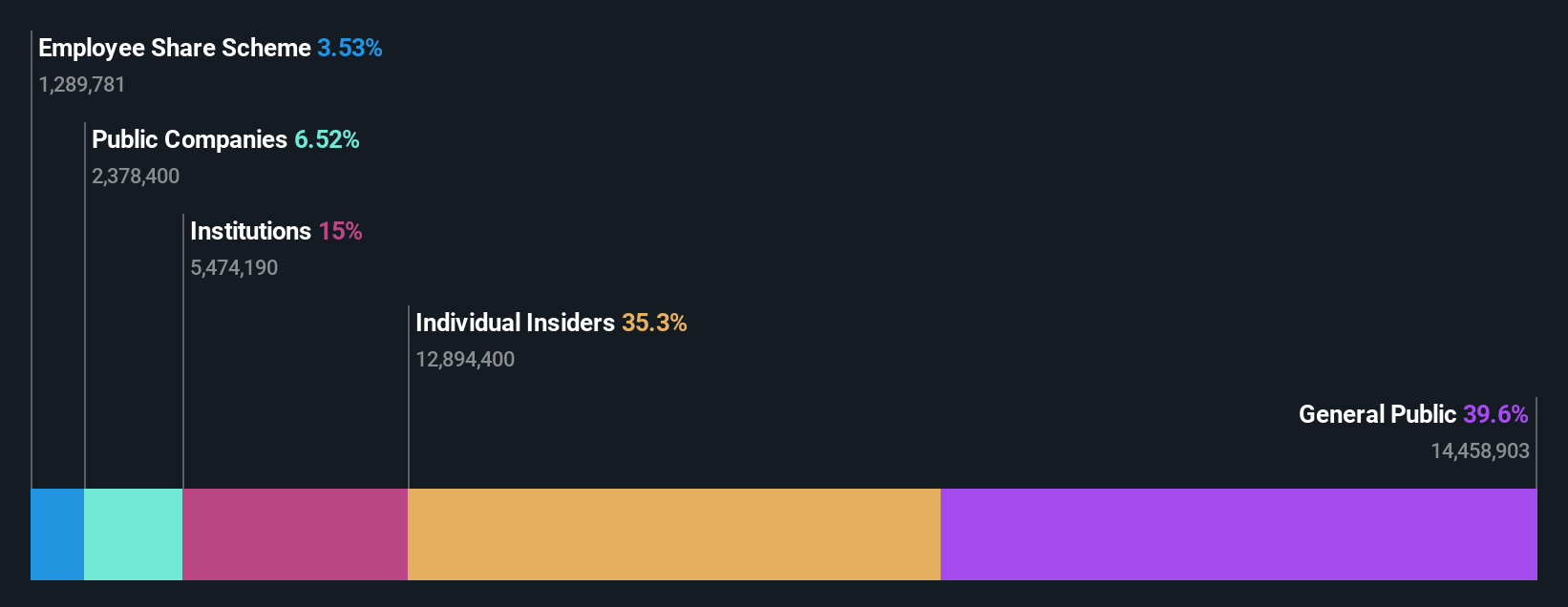

Insider Ownership: 33%

Park Systems is positioned for strong growth, with forecasted annual revenue and earnings growth of 23.7% and 36.2%, respectively, outpacing the Korean market averages. The company recently partnered with Labindia Instruments to expand its presence in India's burgeoning semiconductor industry, aligning well with the country's strategic initiatives. This expansion is timely given the rising demand for advanced semiconductor technologies in India, enhancing Park Systems' influence as a leader in nanoscale analysis technologies.

- Click here and access our complete growth analysis report to understand the dynamics of Park Systems.

- Upon reviewing our latest valuation report, Park Systems' share price might be too optimistic.

ABL Bio (KOSDAQ:A298380)

Simply Wall St Growth Rating: ★★★★★☆

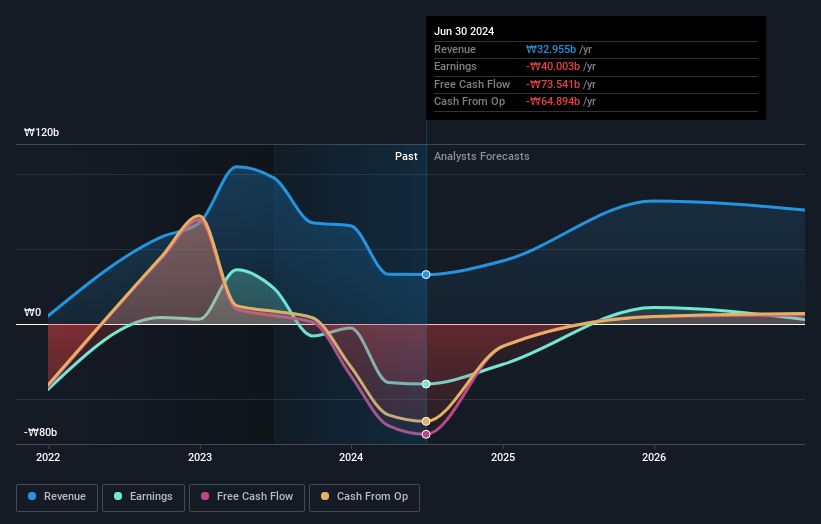

Overview: ABL Bio Inc. is a biotech research company specializing in therapeutic drugs for immuno-oncology and neurodegenerative diseases, with a market cap of ₩1.42 trillion.

Operations: The company's revenue segment is derived entirely from its biotechnology startups, generating ₩32.32 billion.

Insider Ownership: 30.4%

ABL Bio is poised for significant growth, with revenue expected to increase by 25.5% annually, surpassing the Korean market's average growth. The company is anticipated to become profitable within three years, marking above-average market profit growth. Despite recent share price volatility and a low forecasted return on equity of 9.1%, ABL Bio's participation in international conferences like the World ADC Conference highlights its active engagement in advancing protein engineering technologies.

- Delve into the full analysis future growth report here for a deeper understanding of ABL Bio.

- Our comprehensive valuation report raises the possibility that ABL Bio is priced higher than what may be justified by its financials.

Avant Group (TSE:3836)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Avant Group Corporation, with a market cap of ¥72.43 billion, operates through its subsidiaries to offer accounting, business intelligence, and outsourcing services.

Operations: The company's revenue is derived from three main segments: Group Governance Business at ¥7.88 billion, Management Solutions Business at ¥8.96 billion, and Digital Transformation Promotion Business at ¥9.16 billion.

Insider Ownership: 34%

Avant Group is positioned for growth, with revenue expected to rise by 15.8% annually, outpacing the JP market's average. Earnings are also forecasted to grow at 18.1% per year, exceeding market expectations. Despite high share price volatility and trading below estimated fair value, Avant Group has completed a significant share buyback of 615,600 shares worth ¥828.93 million, reflecting strategic capital management amid stable insider ownership levels and no recent substantial insider trading activity.

- Click to explore a detailed breakdown of our findings in Avant Group's earnings growth report.

- Our valuation report here indicates Avant Group may be overvalued.

Key Takeaways

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1515 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A140860

Park Systems

Develops, manufactures, and sells atomic force microscopy (AFM) systems worldwide.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives