- South Korea

- /

- Chemicals

- /

- KOSDAQ:A121600

December 2024's Leading Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

As the global markets navigate a landscape marked by political upheavals in Europe and mixed economic signals, U.S. major indexes have shown resilience, with growth stocks leading the charge amid record highs for the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite. In this environment of sectoral divergence and economic anticipation ahead of key central bank meetings, identifying growth companies with high insider ownership can offer insights into potential market leaders that are well-aligned with internal stakeholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 27% | 24.8% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.5% | 65.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's review some notable picks from our screened stocks.

Advanced Nano Products (KOSDAQ:A121600)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Advanced Nano Products Co., Ltd. manufactures and sells high-tech materials, including displays, semiconductors, secondary batteries, and solar cells in South Korea and internationally, with a market cap of approximately ₩793.25 billion.

Operations: The company's revenue primarily comes from its Specialty Chemicals segment, amounting to approximately ₩86.63 billion.

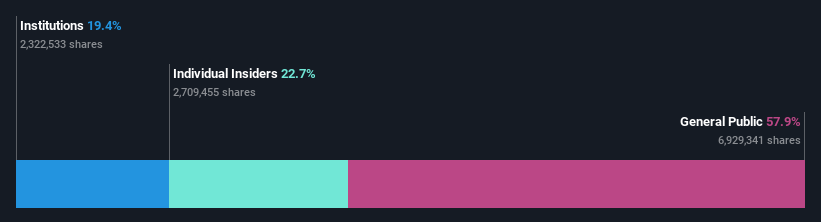

Insider Ownership: 22.6%

Advanced Nano Products is poised for significant growth, with earnings expected to rise 70% annually, outpacing the KR market's 29.6%. Revenue growth is also projected at 45% per year. Despite this potential, recent financials reveal challenges: third-quarter net income dropped to KRW 488.02 million from KRW 4,398.15 million a year ago. The stock trades slightly below its estimated fair value and maintains high insider ownership without recent substantial insider trading activity.

- Take a closer look at Advanced Nano Products' potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Advanced Nano Products is priced higher than what may be justified by its financials.

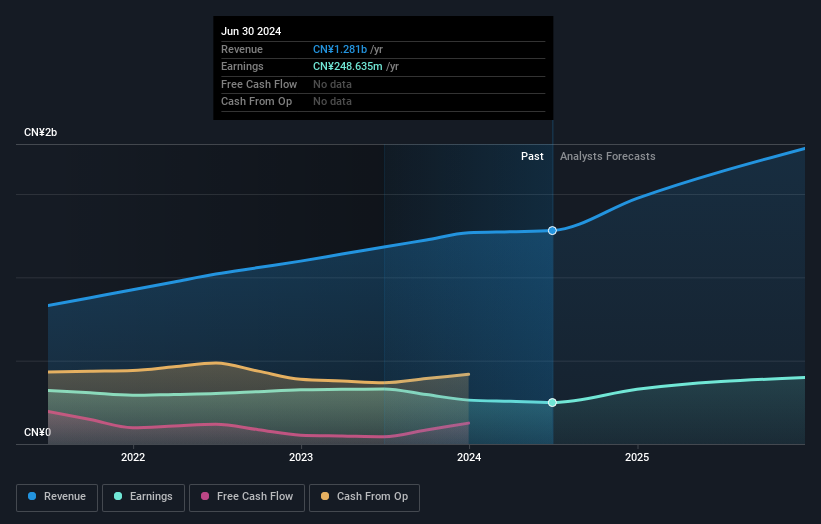

LifeTech Scientific (SEHK:1302)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LifeTech Scientific Corporation is an investment holding company that develops, manufactures, and trades interventional medical devices for cardiovascular and peripheral vascular diseases globally, with a market cap of HK$7.08 billion.

Operations: The company's revenue segments include the Structural Heart Diseases Business at CN¥523.01 million, the Peripheral Vascular Diseases Business at CN¥725.13 million, and the Cardiac Pacing and Electrophysiology Business at CN¥32.36 million.

Insider Ownership: 16%

LifeTech Scientific is positioned for robust growth, with earnings projected to increase 29.5% annually, surpassing the Hong Kong market's 11.4%. Revenue is expected to grow at 21.5% per year, exceeding the market average of 7.8%. However, profit margins have decreased from last year's 28% to 19.4%, partly due to large one-off items affecting results. Despite these challenges, insider ownership remains high with no recent significant insider trading activity reported.

- Click here to discover the nuances of LifeTech Scientific with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that LifeTech Scientific is trading beyond its estimated value.

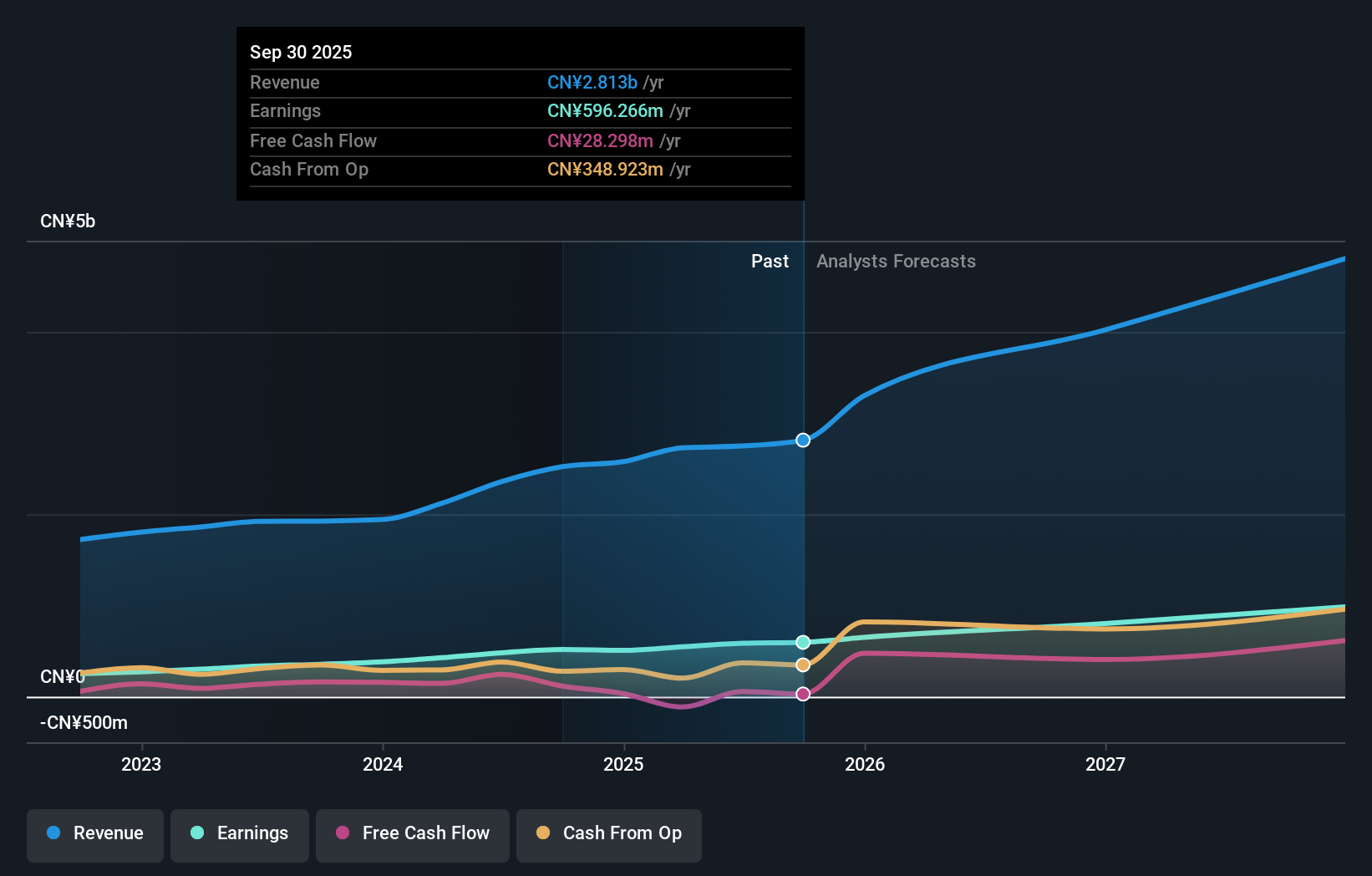

Zhejiang Jolly PharmaceuticalLTD (SZSE:300181)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Jolly Pharmaceutical Co., LTD is involved in the research, production, and marketing of Chinese medicinal products both domestically and internationally, with a market cap of CN¥11.66 billion.

Operations: The company generates revenue through its research, production, and marketing of Chinese medicinal products in both domestic and international markets.

Insider Ownership: 24%

Zhejiang Jolly Pharmaceutical shows promising growth potential, with earnings having increased by 45.4% over the past year and projected to grow 23.28% annually. Revenue is also expected to rise by 22.5% per year, outpacing the Chinese market's average growth rate. Recent earnings report highlights a net income of CNY 421.48 million for nine months ended September 2024, up from CNY 286.87 million last year, reflecting strong financial performance despite limited recent insider trading activity.

- Dive into the specifics of Zhejiang Jolly PharmaceuticalLTD here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Zhejiang Jolly PharmaceuticalLTD's current price could be quite moderate.

Make It Happen

- Gain an insight into the universe of 1515 Fast Growing Companies With High Insider Ownership by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A121600

Advanced Nano Products

Manufactures and sells high-tech materials, such as displays, semiconductors, secondary batteries, and solar cells in South Korea and internationally.

High growth potential with adequate balance sheet.