- South Korea

- /

- Industrials

- /

- KOSE:A001040

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape of mixed economic signals and political developments, major U.S. stock indexes have shown varied performance, with growth stocks outpacing their value counterparts significantly. Amidst this backdrop, dividend stocks continue to attract investors seeking steady income streams and potential resilience against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.15% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.74% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.99% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.19% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.05% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.05% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.35% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.75% | ★★★★★☆ |

Click here to see the full list of 1931 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

CJ (KOSE:A001040)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CJ Corporation operates globally in the food and food services, bio, logistics and retail, and entertainment and media sectors, with a market cap of ₩3.04 trillion.

Operations: CJ Corporation's revenue segments include Food and Food Services at ₩16.62 billion, Logistics & New Distribution at ₩18.74 billion, Bio at ₩9.76 billion, and Entertainment & Media at ₩5.49 billion.

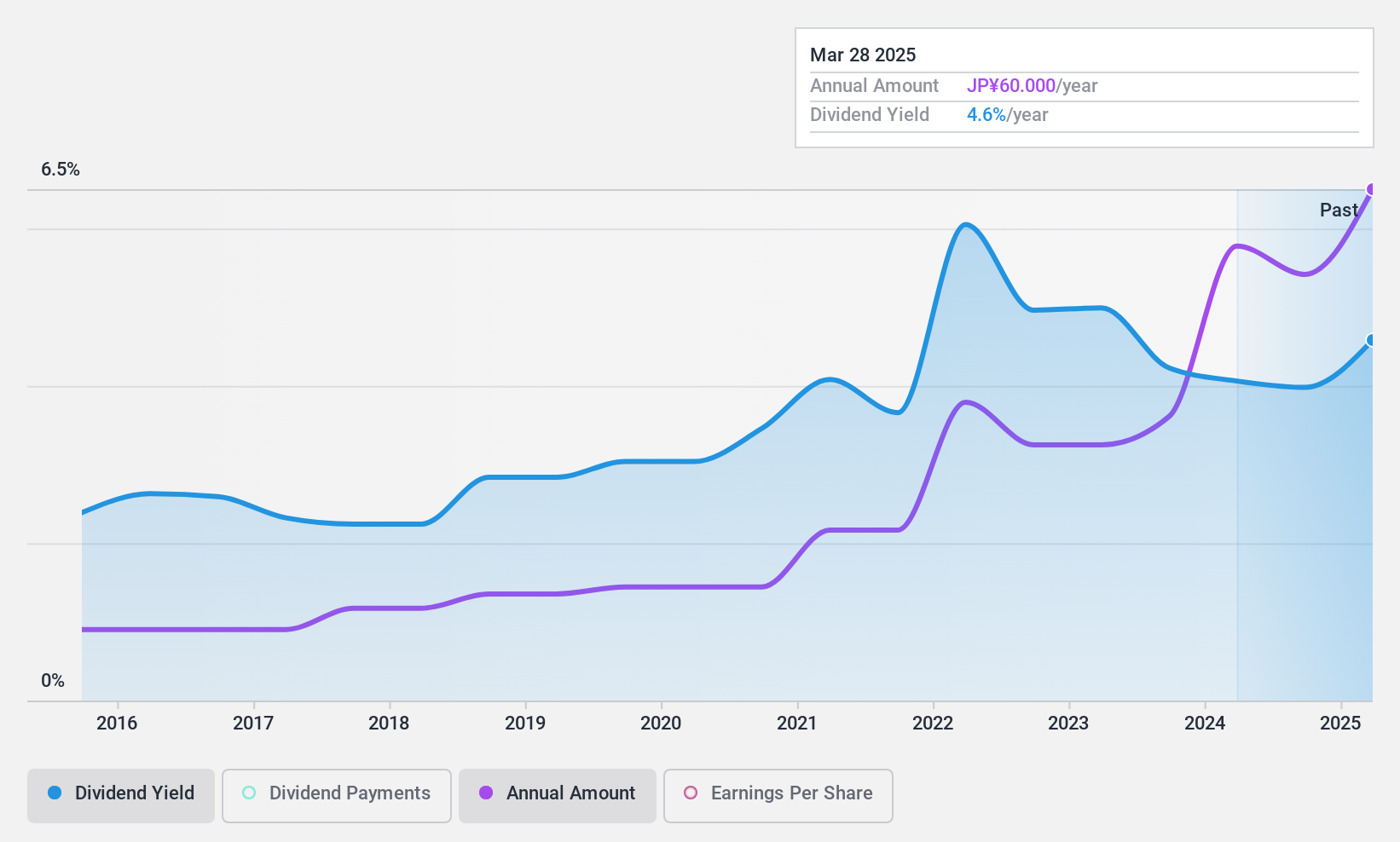

Dividend Yield: 3%

CJ Corporation's dividend payments have been stable and growing over the past decade, though the high payout ratio of 112.2% suggests they are not well covered by earnings. Despite a low dividend yield of 3.04%, which is below market top-tier payers, dividends are supported by a low cash payout ratio of 4.4%. Recent financial results show increased sales but a net loss in Q3 2024, highlighting potential challenges for future payouts amidst its high debt levels.

- Navigate through the intricacies of CJ with our comprehensive dividend report here.

- Our valuation report unveils the possibility CJ's shares may be trading at a discount.

Yondenko (TSE:1939)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yondenko Corporation operates in Japan, focusing on electrical and electrical power transmission and distribution facilities construction, with a market cap of ¥70.78 billion.

Operations: Yondenko Corporation's revenue is primarily derived from its Facility Construction Segment, which accounts for ¥95.54 billion, supplemented by its Solar Power Generation Business contributing ¥2.19 billion and Lease Segment adding ¥2.81 billion.

Dividend Yield: 3.9%

Yondenko's dividend payments have been volatile over the past decade, with a payout ratio of 51.7% indicating coverage by earnings but not by free cash flows. Despite this, recent guidance revisions improved earnings forecasts and increased dividends to ¥180 per share for fiscal year ending March 2025, up from ¥140 previously. The current yield is in Japan's top 25% but remains unreliable due to historical volatility and lack of free cash flow coverage.

- Click here and access our complete dividend analysis report to understand the dynamics of Yondenko.

- Our valuation report here indicates Yondenko may be overvalued.

GSI Creos (TSE:8101)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: GSI Creos Corporation operates globally, providing textiles and industrial products, with a market cap of ¥26.46 billion.

Operations: GSI Creos Corporation generates revenue through its global provision of textiles and industrial products.

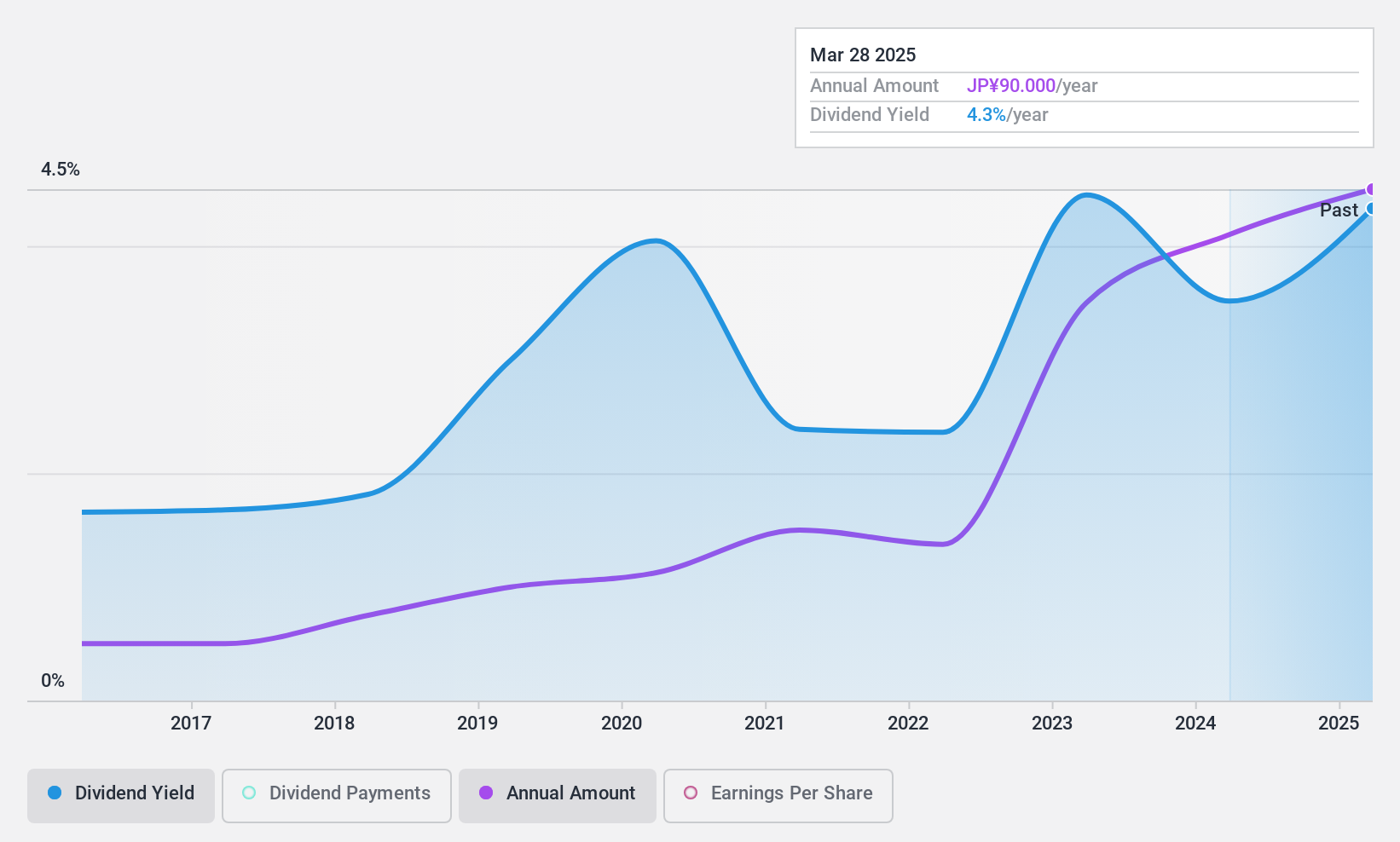

Dividend Yield: 4.1%

GSI Creos offers a dividend yield of 4.13%, placing it in the top 25% of Japanese dividend payers, with stable and reliable payments over the past decade. However, despite a reasonable payout ratio of 52% covered by earnings, dividends are not well-supported by free cash flows due to a high cash payout ratio (¥69.04 billion). This suggests potential sustainability concerns if cash flow issues persist.

- Take a closer look at GSI Creos' potential here in our dividend report.

- According our valuation report, there's an indication that GSI Creos' share price might be on the expensive side.

Taking Advantage

- Gain an insight into the universe of 1931 Top Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A001040

CJ

Engages in the food and food services, bio, logistics and retail, and entertainment and media businesses worldwide.

Good value with adequate balance sheet and pays a dividend.