- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A206640

Undiscovered Gems On None Exchange For November 2024

Reviewed by Simply Wall St

As global markets approach record highs with broad-based gains, smaller-cap indexes have notably outperformed their larger counterparts, reflecting a renewed investor interest in these often-overlooked segments. With positive sentiment driven by strong labor market data and stabilizing economic indicators, the current landscape presents an intriguing backdrop for identifying undiscovered gems that may offer unique growth opportunities. In this environment, a good stock is typically characterized by strong fundamentals and resilience to broader market volatility, making it well-suited for investors seeking potential value in the small-cap space.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| Mobile Telecommunications | NA | 4.98% | 0.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

SUNIC SYSTEM (KOSDAQ:A171090)

Simply Wall St Value Rating: ★★★★★☆

Overview: SUNIC SYSTEM Co., Ltd. specializes in the manufacturing and sale of OLED equipment, with a market capitalization of ₩398.81 billion.

Operations: SUNIC SYSTEM generates revenue primarily from the manufacturing and sale of OLED equipment. The company's net profit margin has shown variability, reflecting changes in cost structures and market conditions.

SUNIC SYSTEM, a player in the semiconductor space, has seen its earnings grow by 66.6% over the past year, outpacing the industry's 0.9%. Despite its volatile share price recently, it trades at a significant discount of 87.3% below estimated fair value, suggesting potential undervaluation. The company reported a net income of KRW 7,890 million for Q3 2024 compared to a loss last year and maintains strong financial health with more cash than total debt and an interest coverage ratio of 12.4x EBIT. Earnings are forecasted to grow significantly at over 99% annually moving forward.

- Click here and access our complete health analysis report to understand the dynamics of SUNIC SYSTEM.

Evaluate SUNIC SYSTEM's historical performance by accessing our past performance report.

Boditech Med (KOSDAQ:A206640)

Simply Wall St Value Rating: ★★★★★★

Overview: Boditech Med Inc. provides instruments and diagnostic reagents both in South Korea and internationally, with a market cap of ₩357.32 billion.

Operations: Boditech Med generates revenue primarily through the sale of instruments and diagnostic reagents. The company has a market cap of ₩357.32 billion.

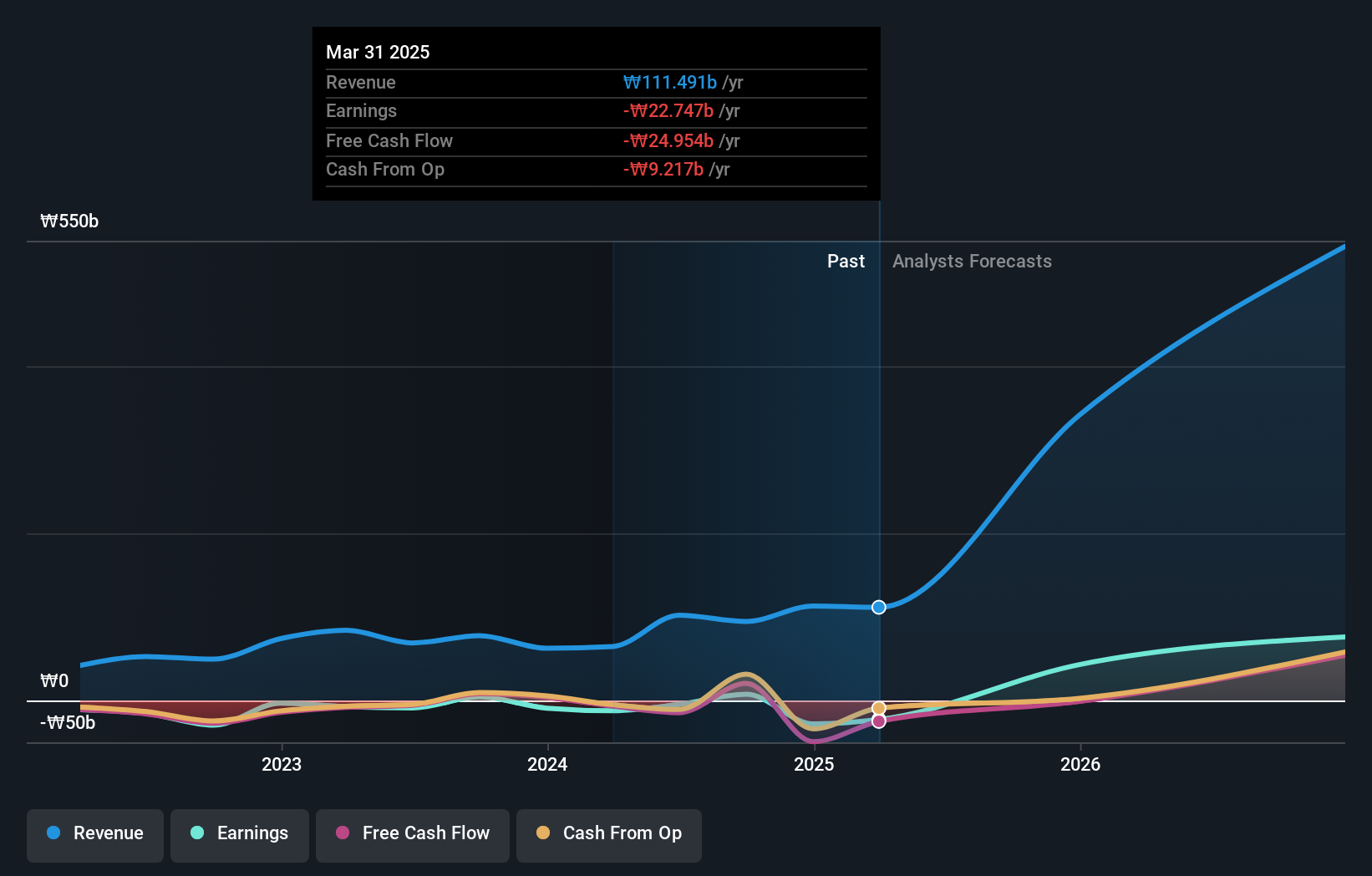

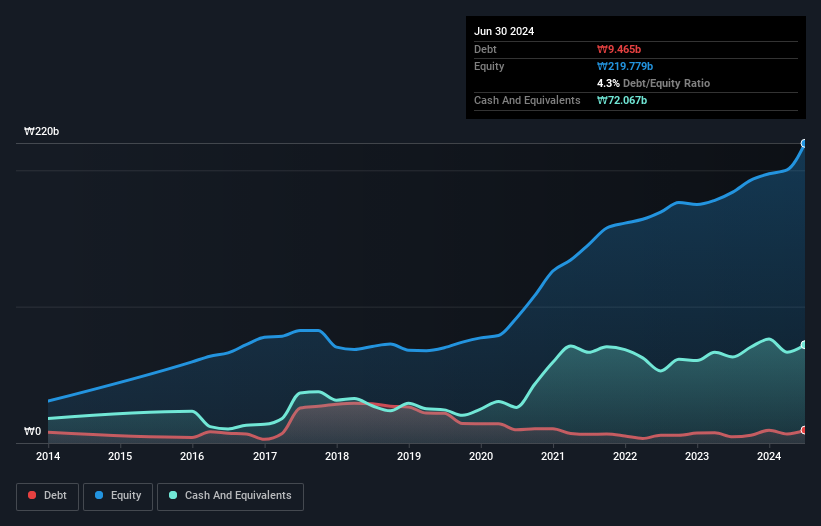

Boditech Med, a notable player in the medical equipment sector, is trading at 49.8% below its estimated fair value, signaling potential undervaluation. Over the past year, its earnings grew by 5.5%, outpacing the industry average of -8.7%. This growth is supported by high-quality earnings and a promising forecast of 21.06% annual growth. The company's debt to equity ratio has impressively decreased from 19.2% to 1.7% over five years, indicating strong financial health with more cash than total debt and sufficient interest coverage. Recently, Boditech announced a KRW 3 billion share repurchase plan to enhance shareholder value and stabilize stock prices until April 2025.

- Click here to discover the nuances of Boditech Med with our detailed analytical health report.

Gain insights into Boditech Med's past trends and performance with our Past report.

Shenzhen Textile (Holdings) (SZSE:000045)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Textile (Holdings) Co., Ltd. focuses on the research, development, production, and sale of polarizers primarily in China, with a market capitalization of CN¥5.18 billion.

Operations: The primary revenue stream for Shenzhen Textile (Holdings) Co., Ltd. is derived from the production and sale of polarizers in China. The company's financial performance is highlighted by its market capitalization, which stands at CN¥5.18 billion.

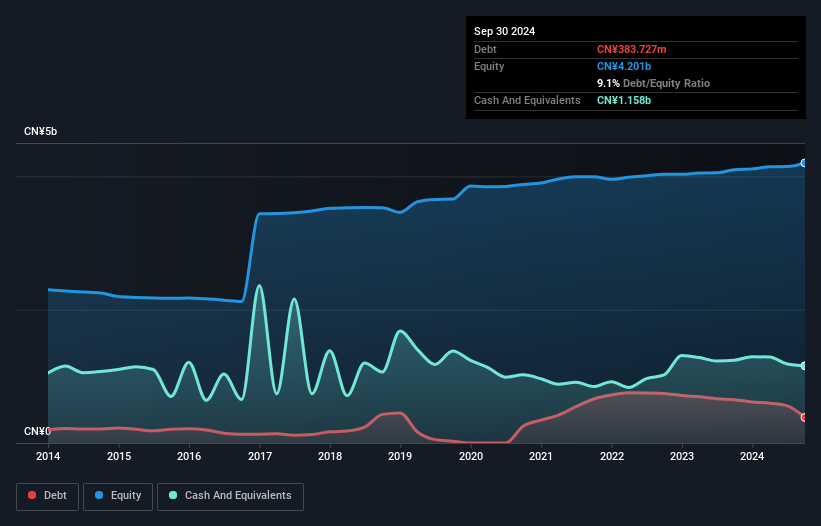

Shenzhen Textile, a smaller player in the textile industry, has shown promising financial performance recently. Over the past year, earnings grew by 9.9%, surpassing the industry's 1.8% growth rate. The company's debt to equity ratio rose from 0.7 to 9.1 over five years; however, it holds more cash than total debt and enjoys high-quality earnings with interest payments well-covered by EBIT at 27x coverage. For the first nine months of 2024, sales increased to CNY 2.52 billion from CNY 2.32 billion last year while net income climbed to CNY 78.9 million from CNY 66.58 million previously reported.

Key Takeaways

- Access the full spectrum of 4634 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boditech Med might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A206640

Boditech Med

Offers instruments and diagnostic reagents in South Korea and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives