- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A083310

Positive Sentiment Still Eludes LOT VACUUM Co., Ltd. (KOSDAQ:083310) Following 27% Share Price Slump

Unfortunately for some shareholders, the LOT VACUUM Co., Ltd. (KOSDAQ:083310) share price has dived 27% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 54% loss during that time.

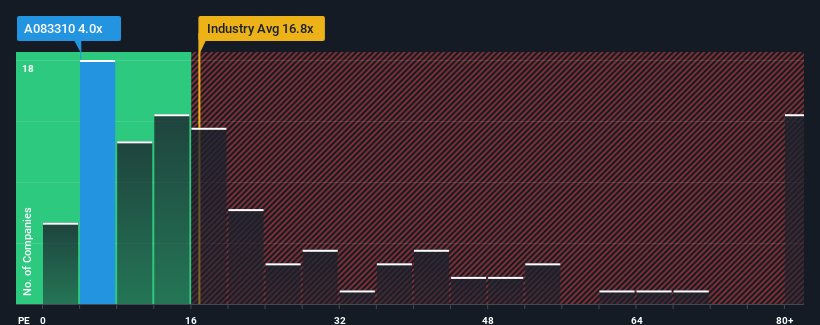

Since its price has dipped substantially, given about half the companies in Korea have price-to-earnings ratios (or "P/E's") above 11x, you may consider LOT VACUUM as a highly attractive investment with its 4x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times have been quite advantageous for LOT VACUUM as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for LOT VACUUM

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like LOT VACUUM's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 41% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 578% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 31% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that LOT VACUUM is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From LOT VACUUM's P/E?

Having almost fallen off a cliff, LOT VACUUM's share price has pulled its P/E way down as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that LOT VACUUM currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You always need to take note of risks, for example - LOT VACUUM has 1 warning sign we think you should be aware of.

If these risks are making you reconsider your opinion on LOT VACUUM, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A083310

LOT VACUUM

Manufactures and sells semiconductor manufacturing machinery in South Korea.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives