- China

- /

- Metals and Mining

- /

- SHSE:600988

3 Dynamic Growth Stocks With Up To 30% Insider Ownership

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, with major indices like the S&P 500 and Nasdaq Composite reaching record highs, investors are closely watching how anticipated policy changes might impact growth and inflation. Amidst this backdrop of economic optimism and uncertainty, stocks with high insider ownership can offer unique insights into company confidence and potential resilience in fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| On Holding (NYSE:ONON) | 31% | 29.7% |

| GPS Participações e Empreendimentos (BOVESPA:GGPS3) | 24% | 38.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 49.1% |

| Pharma Mar (BME:PHM) | 11.8% | 56.4% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Underneath we present a selection of stocks filtered out by our screen.

EO Technics (KOSDAQ:A039030)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EO Technics Co., Ltd. manufactures and supplies laser processing equipment globally, with a market cap of ₩1.65 trillion.

Operations: The Semiconductor Machine Division generates revenue of ₩292.91 billion.

Insider Ownership: 30.7%

EO Technics is poised for significant growth, with earnings projected to increase by 51.37% annually, outpacing the broader South Korean market's 28.9%. Revenue is also expected to grow robustly at 28.9% per year, surpassing the market average of 9.7%. Despite its high volatility and low forecasted return on equity of 15.2%, the stock trades at a discount of 10.5% below estimated fair value, indicating potential upside as insiders maintain their positions without recent substantial trading activity.

- Dive into the specifics of EO Technics here with our thorough growth forecast report.

- Our valuation report unveils the possibility EO Technics' shares may be trading at a premium.

Mowi (OB:MOWI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mowi ASA is a seafood company that farms, produces, and supplies Atlantic salmon products globally, with a market cap of NOK101.04 billion.

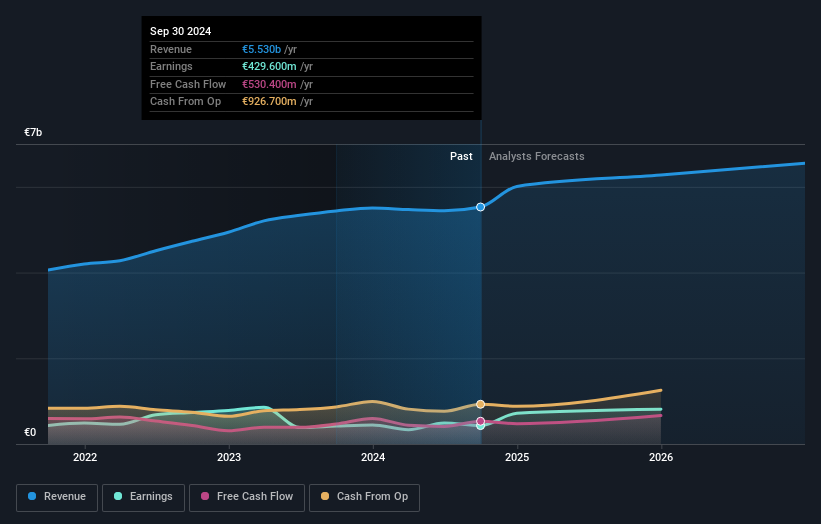

Operations: The company's revenue segments include Feed (€1.11 billion), Farming (€3.46 billion), Sales & Marketing - Markets (€3.90 billion), and Sales and Marketing - Consumer Products (€3.68 billion).

Insider Ownership: 15.4%

Mowi's earnings are forecast to grow significantly at 38.1% annually, surpassing the Norwegian market average. Despite high debt levels and an unstable dividend history, insiders have been net buyers recently, though not in substantial volumes. The stock trades at a significant discount to its estimated fair value. Recent earnings showed increased sales but lower net income compared to last year, and Mowi is actively seeking mergers and acquisitions while reviewing strategic alternatives for its Canada West unit.

- Navigate through the intricacies of Mowi with our comprehensive analyst estimates report here.

- Our valuation report here indicates Mowi may be undervalued.

Chifeng Jilong Gold MiningLtd (SHSE:600988)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Chifeng Jilong Gold Mining Co., Ltd. is a company engaged in the mining of gold and non-ferrous metals, with a market capitalization of CN¥28.33 billion.

Operations: Chifeng Jilong Gold Mining Co., Ltd. generates its revenue primarily from the mining of gold and non-ferrous metals.

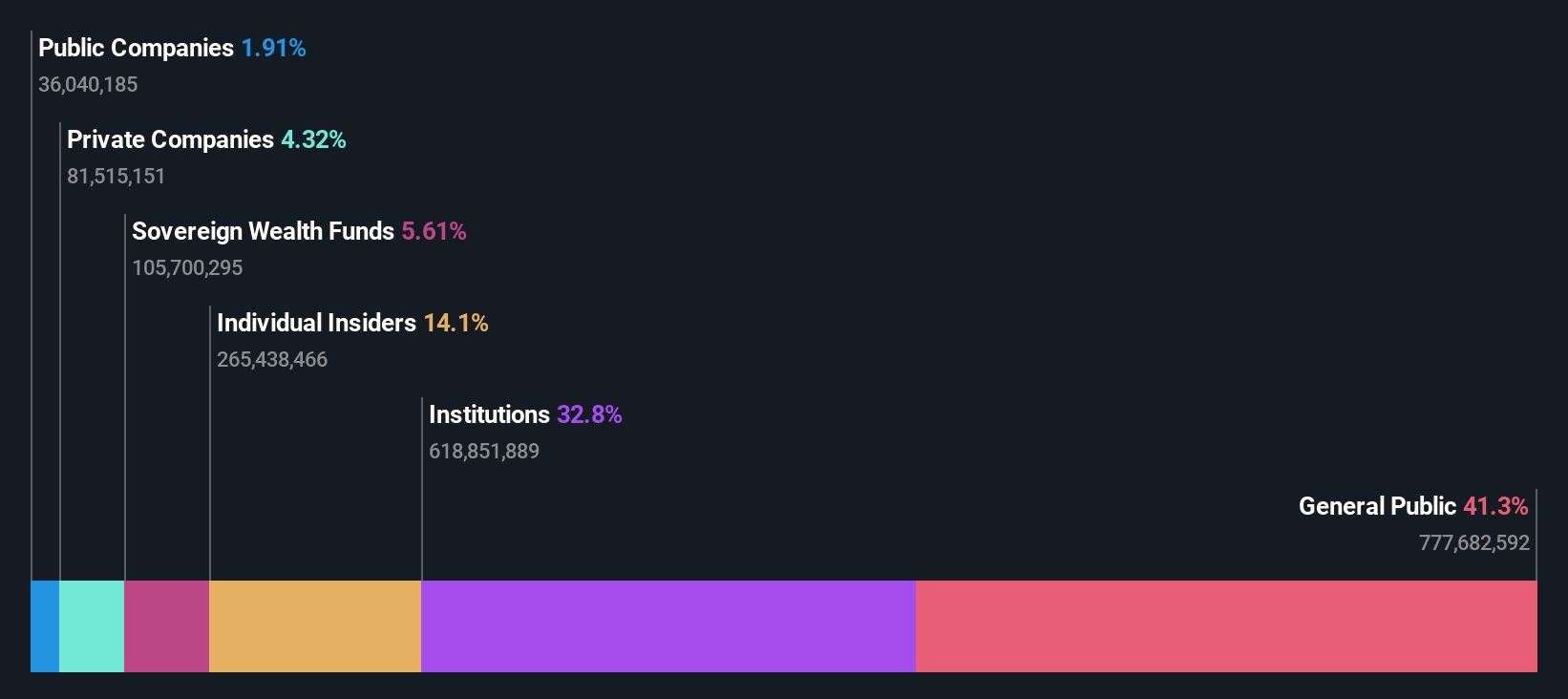

Insider Ownership: 16.1%

Chifeng Jilong Gold Mining Ltd. demonstrates strong growth potential with earnings growing by 141.7% over the past year and revenue reaching CNY 6.22 billion for the first nine months of 2024, up from CNY 5.06 billion a year ago. The company trades at a significant discount to its estimated fair value, with analysts expecting a stock price increase of 41.1%. Although insider trading activity is not substantial recently, the company's earnings are projected to grow significantly at an annual rate of 21.86%.

- Get an in-depth perspective on Chifeng Jilong Gold MiningLtd's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Chifeng Jilong Gold MiningLtd shares in the market.

Next Steps

- Click here to access our complete index of 1519 Fast Growing Companies With High Insider Ownership.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600988

Chifeng Jilong Gold MiningLtd

Operates as a gold and non-ferrous metal mining company.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives