Exploring Hyundai Home Shopping Network And 2 Other Undiscovered Gems With Solid Foundations

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by interest rate adjustments and mixed performances across major indices, small-cap stocks have faced particular challenges, with the Russell 2000 Index underperforming against larger peers like the S&P 500. Amid this backdrop, investors are increasingly seeking companies with solid foundations that can weather economic shifts and offer potential growth opportunities. In this context, identifying stocks with strong fundamentals becomes crucial. Such companies often exhibit robust financial health, competitive positioning in their respective industries, and adaptability to changing market conditions—qualities that make them stand out as potential "undiscovered gems" in today's dynamic market environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| VICOM | NA | 3.60% | -2.15% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Bank Ganesha | NA | 25.03% | 70.72% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Komori | 9.77% | 7.35% | 59.64% | ★★★★★☆ |

| S J Logistics (India) | 34.96% | 59.89% | 51.25% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Bank MNC Internasional | 18.72% | 4.80% | 43.63% | ★★★★☆☆ |

| NCD | nan | nan | nan | ☆☆☆☆☆☆ |

We'll examine a selection from our screener results.

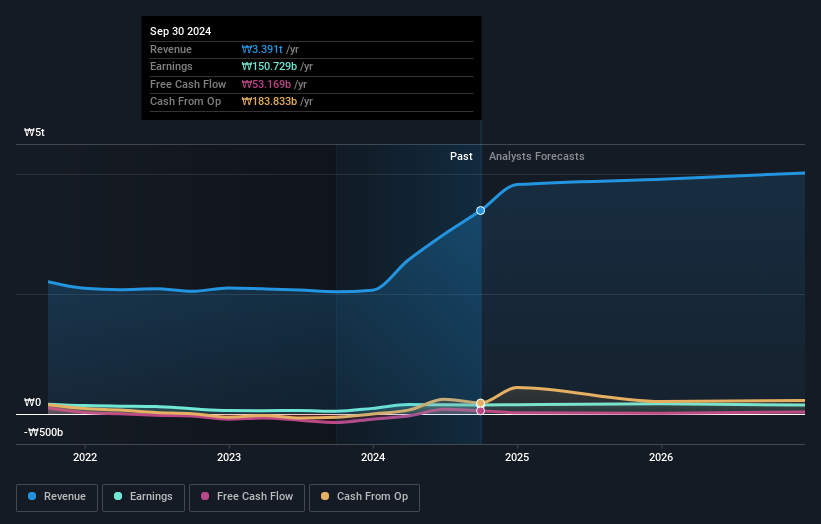

Hyundai Home Shopping Network (KOSE:A057050)

Simply Wall St Value Rating: ★★★★★★

Overview: Hyundai Home Shopping Network Corporation, along with its subsidiaries, operates an online shopping company in South Korea and has a market cap of ₩527.74 billion.

Operations: Hyundai Home Shopping Network Corporation generates revenue primarily from its home shopping and construction material segments, with the home shopping segment contributing approximately ₩1.12 trillion. The company faces a consolidation adjustment of approximately -₩9.87 million, impacting overall financial results.

Hyundai Home Shopping Network, a smaller player in the retail sector, is drawing attention with its impressive earnings growth of 231.5% over the past year, far outpacing the industry average of -19.9%. The company's price-to-earnings ratio stands at 3.5x, significantly below the KR market average of 11.4x, suggesting it trades at an attractive valuation compared to peers. Despite a substantial one-off loss of ₩789 billion impacting recent financial results, Hyundai's debt-to-equity ratio has improved from 18.4% to 9.6% over five years and it holds more cash than total debt, indicating solid financial health and potential for future stability.

- Click here to discover the nuances of Hyundai Home Shopping Network with our detailed analytical health report.

Understand Hyundai Home Shopping Network's track record by examining our Past report.

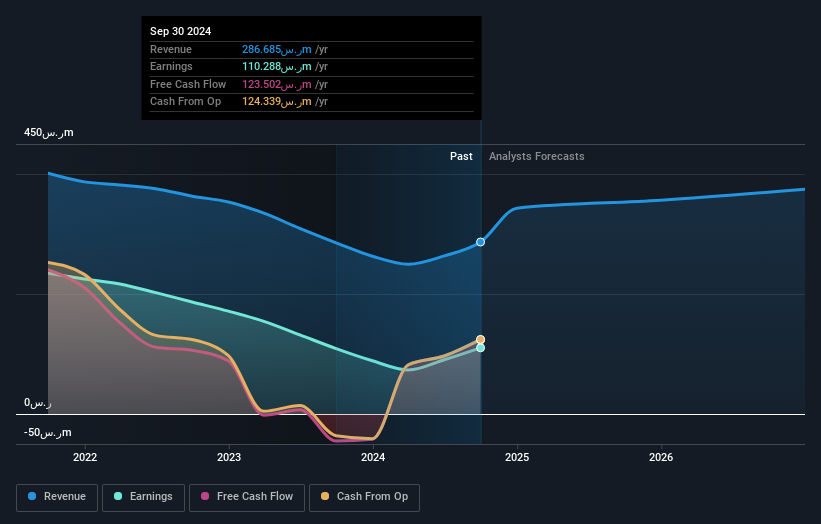

Nayifat Finance (SASE:4081)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nayifat Finance Company is a non-banking finance company offering Tawarruq cash financing solutions to consumers, SMEs, individuals, and corporates in Saudi Arabia with a market cap of SAR1.81 billion.

Operations: Nayifat Finance generates revenue primarily through personal financing, which accounts for SAR351.02 million, followed by SME financing at SAR55.88 million and Islamic credit cards at SAR12.03 million.

Nayifat Finance, a dynamic player in the financial sector, showcases high-quality earnings with a price-to-earnings ratio of 16.4x, undercutting the SA market's 23.7x. Despite an annual earnings growth of just 1.2%, which trails behind the Consumer Finance industry's 12.4%, Nayifat has managed to reduce its debt-to-equity ratio from 79.4% to a satisfactory 34.5% over five years, indicating prudent financial management. Recent results highlight an impressive net income surge to SAR 38.92 million for Q3 compared to SAR 19.14 million last year, with basic EPS doubling from SAR 0.16 to SAR 0.32, suggesting robust operational improvements and potential for future growth.

- Navigate through the intricacies of Nayifat Finance with our comprehensive health report here.

Review our historical performance report to gain insights into Nayifat Finance's's past performance.

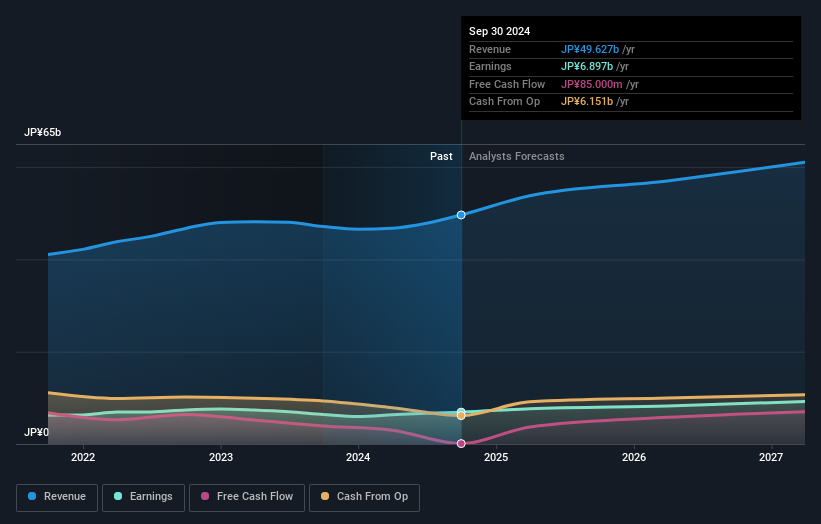

TOCALOLtd (TSE:3433)

Simply Wall St Value Rating: ★★★★★★

Overview: TOCALO Co., Ltd. specializes in developing surface modifying technologies and has a market capitalization of ¥112.79 billion, operating both in Japan and internationally.

Operations: TOCALO Co., Ltd. generates revenue through its surface modifying technologies business, with a market capitalization of ¥112.79 billion.

TOCALO Ltd., a smaller player in the machinery industry, has been making strides with earnings growth of 7.5% over the past year, outpacing the industry's 0.8%. Its debt to equity ratio improved significantly from 14.4% to 7.3% over five years, indicating better financial health. The company is trading at 58% below its estimated fair value, suggesting potential undervaluation. Recent guidance revisions show optimism with expected net sales of ¥53 billion and operating profit of ¥11.5 billion for fiscal year ending March 2025. Dividend hikes further reflect confidence in its ongoing performance and future prospects.

- Unlock comprehensive insights into our analysis of TOCALOLtd stock in this health report.

Evaluate TOCALOLtd's historical performance by accessing our past performance report.

Summing It All Up

- Click through to start exploring the rest of the 4622 Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TOCALOLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3433

TOCALOLtd

Develops surface modifying technologies in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives