- South Korea

- /

- General Merchandise and Department Stores

- /

- KOSE:A023530

Lotte Shopping's (KRX:023530) growing losses don't faze investors as the stock lifts 4.9% this past week

We believe investing is smart because history shows that stock markets go higher in the long term. But if when you choose to buy stocks, some of them will be below average performers. Over the last year the Lotte Shopping Co., Ltd. (KRX:023530) share price is up 28%, but that's less than the broader market return. Unfortunately the longer term returns are not so good, with the stock falling 13% in the last three years.

Since it's been a strong week for Lotte Shopping shareholders, let's have a look at trend of the longer term fundamentals.

Given that Lotte Shopping didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Lotte Shopping saw its revenue shrink by 3.2%. Given the revenue reduction the modest 28% share price rise over the year seems pretty decent. Generally we're pretty unenthusiastic about loss making stocks that are not growing revenue.

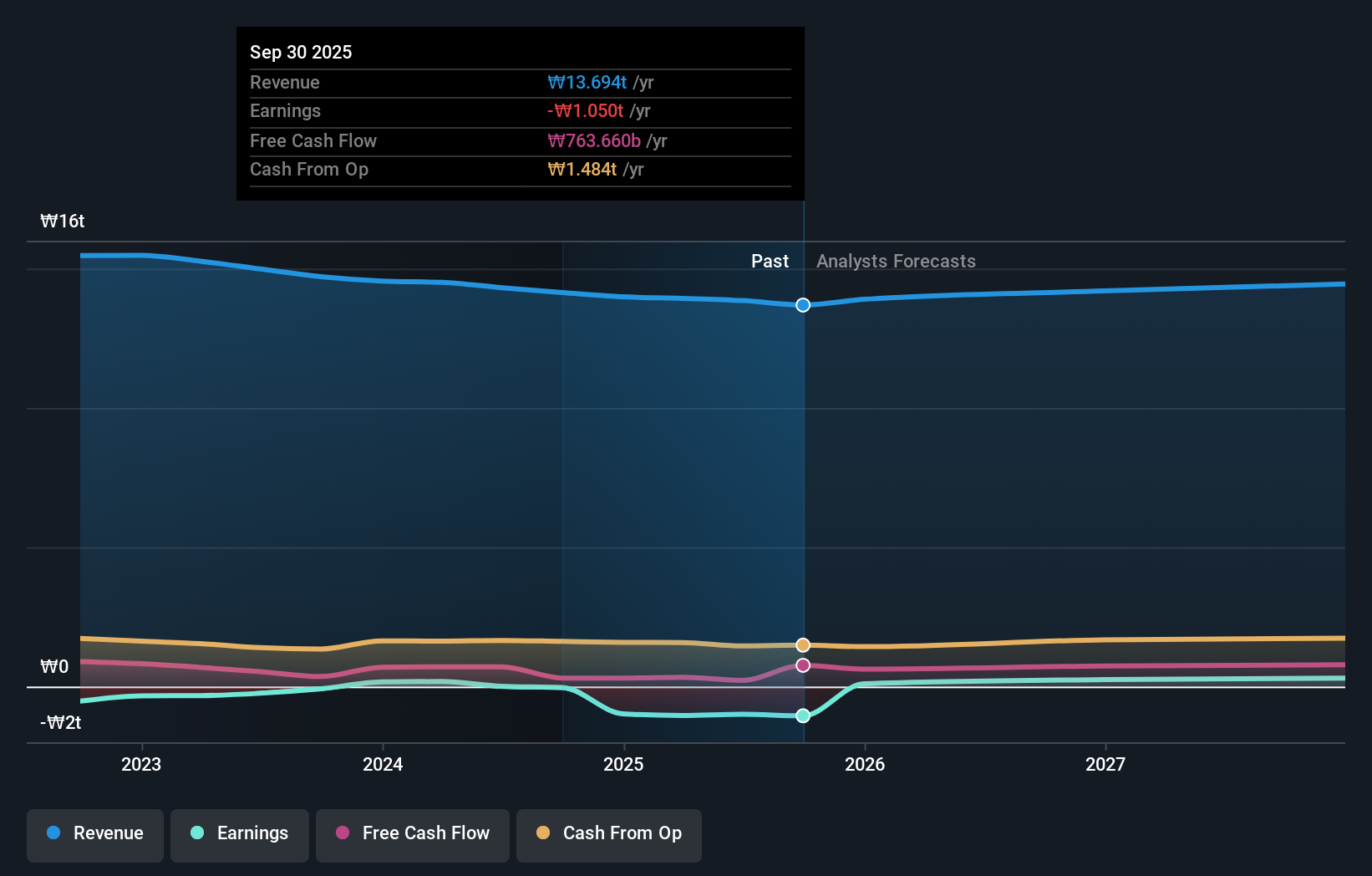

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Lotte Shopping is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Lotte Shopping stock, you should check out this free report showing analyst consensus estimates for future profits.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Lotte Shopping the TSR over the last 1 year was 38%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Lotte Shopping shareholders gained a total return of 38% during the year. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 1.3% per year, over five years. It could well be that the business is stabilizing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Lotte Shopping is showing 1 warning sign in our investment analysis , you should know about...

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A023530

Lotte Shopping

Engages in the retail operations through department stores, outlet stores, discount stores, supermarkets, electronics specialty stores, movie theaters, home shopping, and E-commerce channels.

Undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026